U.S. Credit Rating Downgraded, US Dollar Opens Lower

TOPICSMoody’s Investors Service has downgraded the U.S. credit rating from AAA to AA1, citing rising government debt and growing budget deficits. The downgrade unsettled financial markets, leading to declines in U.S. stock futures and a weaker U.S. Dollar at Monday’s open.

Market Overview

Following the downgrade, U.S. stock futures slipped, with all three major indices opening lower on Monday as investors weighed concerns over fiscal policy and future economic growth.

Asian and European equity markets showed mixed performances. Japanese stocks came under pressure due to weak domestic data, while Chinese markets displayed resilience amid ongoing trade discussions.

In the currency markets, the Japanese Yen—seen as a safe-haven—strengthened against the U.S. Dollar at the open, sending USDJPY lower. However, the U.S. Dollar quickly recovered some of its losses after the initial gap down.

US Dollar Outlook: Uncertainties Across Key Drivers

Despite the recent credit rating downgrade, the US Dollar has not shown significant downside momentum. While the downgrade is fundamentally negative, there appears to be a lack of strong bearish catalysts to drive the dollar much lower for now.

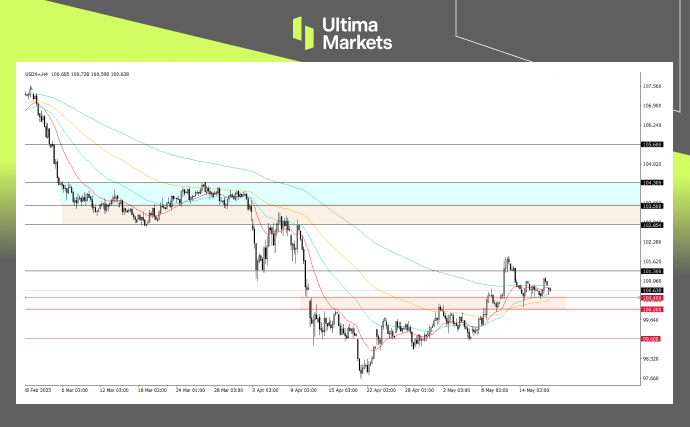

US Dollar Index, 4H Chart | Source: Ultima Markets MT5

From a technical standpoint, the US Dollar remains supported as long as it holds above the 100.40 level. A break below this level could trigger further downside, but as long as it holds, bearish pressure may stay limited.

The US Dollar is currently navigating a mixed landscape—pressured by Moody’s downgrade due to rising debt concerns, but supported by renewed optimism in US-China trade negotiations and the potential for a higher-for-longer monetary policy stance.

Upcoming Economic Events

While the recent credit rating downgrade and ongoing trade tensions may weigh on the US Dollar over the longer term, near-term volatility is likely to be influenced by key economic releases this week.

On Thursday, May 22, the S&P Global Flash PMI will offer an early snapshot of economic activity following April’s trade policy shifts—potentially triggering USD movement.

Additionally, several important data releases from the UK and Eurozone are expected. Any downside surprises that weaken the euro or pound could lead to renewed strength in the US Dollar.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server