US CPI Softens, Geopolitical Tensions Drive Safe-Haven Demand

Financial markets saw mixed sentiment on Wednesday as U.S. inflation data came in cooler than expected, while rising geopolitical risks in the Middle East rattled investor confidence.

The combination of softening consumer price inflation and escalating U.S.–Iran tensions created a tug-of-war across asset classes, notably in safe-haven flows, energy markets, and bond yields.

U.S. CPI Cools Slightly in May

The U.S. Consumer Price Index (CPI) rose by 2.4% YoY in May, slightly above April’s 2.3%, but in line with market expectations. Meanwhile, Core CPI remained steady at 2.8% YoY, with monthly growth at just 0.1%, both coming in softer than expected.

Despite inflation staying slightly elevated, the persistent disinflationary momentum is viewed positively by investors—especially since the anticipated impact of tariffs has not materialized as harshly as feared.

“With both headline and core inflation remaining steady despite the tariff landscape, this allows the Fed some breathing room and opens the door for potential rate cuts later this year,” said Shawn, Senior Analyst at Ultima Markets.

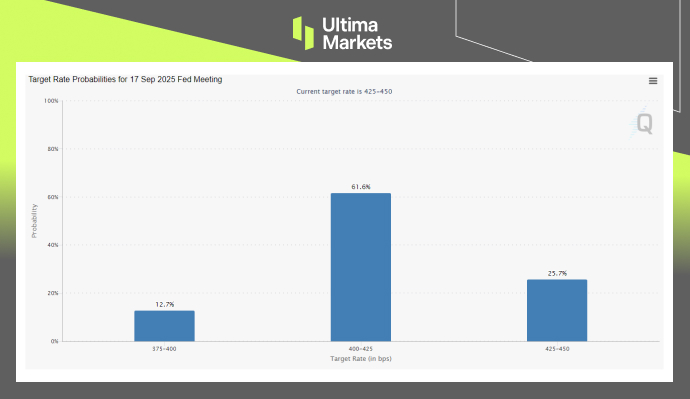

Target Rate Probabilities for September Meeting; Source: CME Fedwatch

According to CME FedWatch, markets are now pricing in a 61.6% probability of a rate cut in the September FOMC meeting—up sharply from just 41% a month ago.

US-Iran Tensions Reignite Middle East Risk

Adding to the volatility, tensions between the United States and Iran intensified on Wednesday. The U.S. ordered a partial evacuation of personnel from its embassies in Iraq, Bahrain, and Kuwait, citing increased threats from Iranian-linked forces.

Meanwhile, Iran’s Defense Ministry warned that any further provocation from the U.S. could lead to retaliatory strikes on American bases across the Gulf region.

This marks the most serious flare-up since late 2023, triggering fresh fears over geopolitical instability, oil production disruptions and potential threats to global shipping lanes.

Safe-Haven & Oil Surges

Commodity prices surged as gold rallied on rising safe-haven demand, while concerns over potential oil supply disruptions drove a strong rebound in crude prices from their multi-year lows. Crude oil jumped sharply and traded at its highest levels in more than two months.

Technical Outlook: UKOUSD

UKOUSD (Brent), Day-Chart Analysis | Source: Ultima Market MT5

Brent crude oil surged to a two-month high, regaining ground above the $69 mark and approaching the $70 level. Any further escalation in geopolitical risk could disrupt oil production and trigger another spike in energy prices.

Technically, the key levels to watch now lie in the $69–$70 per barrel range. A confirmed breakout above this zone could pave the way for further upside in oil prices.

Technical Outlook: XAUUSD

XAUUSD (Gold), 4-H Chart Analysis | Source: Ultima Market MT5

As for gold, despite briefly attempting to break lower, the $3,300 level held firm, with buyers eventually overpowering the sellers. Gold continued to see upside momentum as geopolitical tensions acted as a fresh catalyst for renewed safe-haven buying.

For now, gold may retest the $3,400 level or move even higher, especially if the geopolitical situation escalates into a broader regional conflict.

Outlook: Cautious Optimism, But Risks Loom

While markets welcomed the soft inflation print, rising geopolitical tensions and persistent fiscal risks in the U.S. are keeping investors on edge. The U.S.–Iran standoff has added a fresh layer of uncertainty just as U.S.–China trade negotiations appeared to make tentative progress.

Investors will now turn their attention to upcoming Producer Price Index (PPI) data, weekly jobless claims, and the Fed’s June policy meeting, which could shape expectations for interest rates and risk sentiment heading into the summer.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server