OPEC+ Supply Talk Weighs on Oil Prices

TOPICSTags: Brent, Energy Outlook, Oil, Oil Market, OPEC, OPEC+, Production Increase, Trade Uncertainty, WTI

Global oil prices have been consolidating near four-year lows, with Brent crude trading around $64 per barrel and WTI at approximately $61 per barrel. The recent weakness comes amid concerns over global trade uncertainty and speculation around a potential increase in oil production by OPEC+ at its upcoming policy meeting later this week.

Trade Tensions and Supply Outlook Pressure Prices

Oil prices have been under pressure since earlier this year, primarily due to growing fears that U.S. trade policies—particularly under the Trump administration’s “reciprocal tariff” approach—could dampen global trade activity. This, in turn, raises the risk of a slowdown in global oil demand.

Adding to the cautious tone, markets are now focused on the upcoming May 31 OPEC+ meeting, where the alliance is reportedly considering an increase in production by approximately 411,000 barrels per day, starting in July. This anticipated move has contributed to further consolidation in prices, as traders assess the risk of oversupply.

“The potential production hike, coming at a time when demand growth is already slowing, is creating downside pressure on oil prices,” said Shawn, Senior Analyst at Ultima Markets.

Demand Growth Slows Amid Economic Headwinds

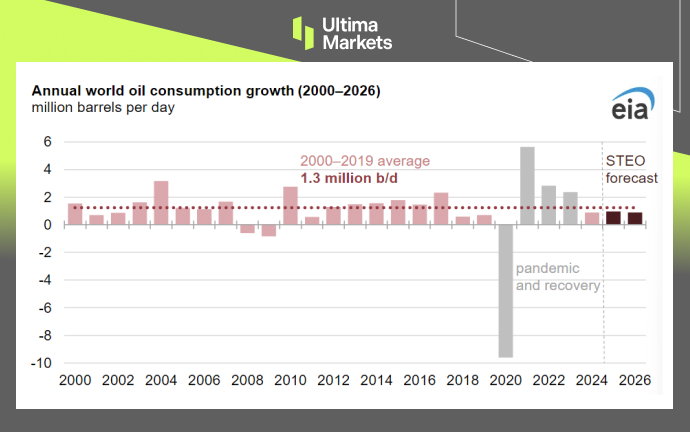

According to the International Energy Agency (IEA), global oil demand growth is expected to rise by less than 1 million barrels per day in both 2025 and 2026. If realized, this would mark the third consecutive year of sub-1 million bpd growth—an unprecedented trend since the COVID-19 pandemic.

Annual Oil Consumption Growth Forecast | Source: US EIA

“Considerable uncertainty over world trade, manufacturing, and investment continues to pose downside risks to economic growth, which directly impacts oil consumption,” the U.S. Energy Information Administration (EIA) noted in its latest report.

Key Risks to Monitor

Looking ahead, the oil market faces several critical risks:

- OPEC+ Production Policy: If the OPEC+ proceeds with its proposed output increase while demand remains weak, the market may face an oversupply scenario, pushing prices lower.

- Global Trade Uncertainty: Ongoing trade tensions between the U.S. and major economies such as China and the EU could further dampen manufacturing activity and oil consumption.

- Economic Growth Slowdown: Weakness in key economies such as China and Europe under trade tension could exacerbate demand-side challenges and keep oil under pressure.

“Unless we see a clear resolution in global trade disputes, particularly between the U.S. and its key partners, oil prices may remain capped. Markets will be closely watching any policy shifts from OPEC+ this week,” Shawn added.

Outlook for Oil Prices

While recent easing in global trade tensions has offered temporary relief to the oil market, structural risks remain. Traders and investors will closely monitor the May 31 OPEC+ meeting for clearer signals on supply policy.

Until then, oil prices are likely to remain range-bound with a bearish bias, as supply-side risks and sluggish demand dynamics continue to weigh on market sentiment.

UKOUSD (Brent), Day Chart Analysis | Source: Ultima Market MT5

USOUSD (WTI), Day Chart Analysis | Source: Ultima Market MT5

Both Brent and WTI crude oil are now trading at four-year lows, falling below their post-pandemic recovery levels. Brent has dropped below the key $69 level, while WTI is trading under $65—both breaching critical structural support zones.

From a technical perspective, this breakdown suggests that oil prices may have re-entered the pre-pandemic trading range, where crude largely remained below these levels. Technically, oil price would remain a bearish structure.

This shift could imply a return to a structurally lower pricing environment, unless new supply or demand dynamics emerge to shift sentiment.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server