Amid Tariffs and Trade Negotiation: What’s Next for the US Dollar?

As we step into the second month since Trump announced the so-called “Reciprocal Tariff” on April 2—commonly referred to as the “Liberation Day”—the trade tension between the US and China has escalated rapidly. In the past two months, both countries have raised tariffs to as high as 145%, with some even hitting 245%.

This intensifying trade war between the world’s two largest economies has shaken global markets. Stock markets tumbled right after the tariff announcement, and the US Dollar (USD)—typically seen as a safe-haven—became one of the most underperforming major currencies.

Measured by the US Dollar Index, the dollar has depreciated nearly 10% since the first wave of Trump’s tariffs rolled out.

Why Did the US Dollar Take a Hit in the Trade War?

The US Dollar has been one of the biggest losers during the trade tension period, largely due to a key reason: the global market is losing trust in the US Dollar.

The United States, once known for its reliable economy, dominance in global trade, and economic and political stability, has always supported the US Dollar’s hegemony. However, Trump’s aggressive trade tariffs—targeting almost every major trade partner—have shaken market confidence in the currency. Around the world, many central banks and countries have significantly reduced their US Dollar reserves, further pressuring the currency.

Of course, several other reasons have also contributed to the US Dollar’s depreciation:

- Global trade slowdown hurts US Dollar demand

- Investor fears of a US growth slowdown

- Risk sentiment may favour other safe-haven currencies during a trade war

Sentiment Recovers on Trade Negotiation

After months of escalating trade tensions, some relief finally came when the US and China agreed to a truce on May 14, 2025. Global equities—including the US stock market—rebounded strongly, returning to a bullish cycle after nearly a month-long bear phase, along with the US Dollar.

Market risk sentiment further improved in June as both the US and China moved forward with a second round of negotiations. However, unlike the stock market, the US Dollar remained weak.

Why did the US Dollar fail to recover like equities? The answer: US Fiscal Risk.

U.S. Fiscal Risk: Massive Debt

While it’s not the only reason, US fiscal risk is one of the key factors contributing to the US Dollar’s ongoing depreciation.

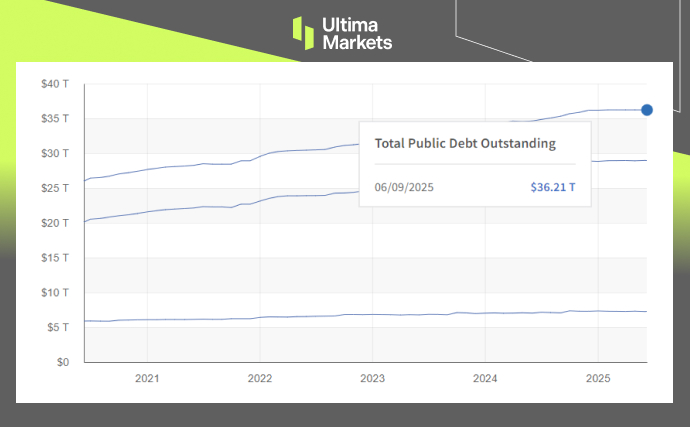

According to the US Treasury Department’s data on FiscalData.gov, total US debt stood at $36.21 trillion as of June 2025—an increase of nearly $2 trillion year-over-year. The debt-to-GDP ratio now stands at 124%.

US Total Public Debt Outstanding |Source: FiscalData.Treasury.Gov

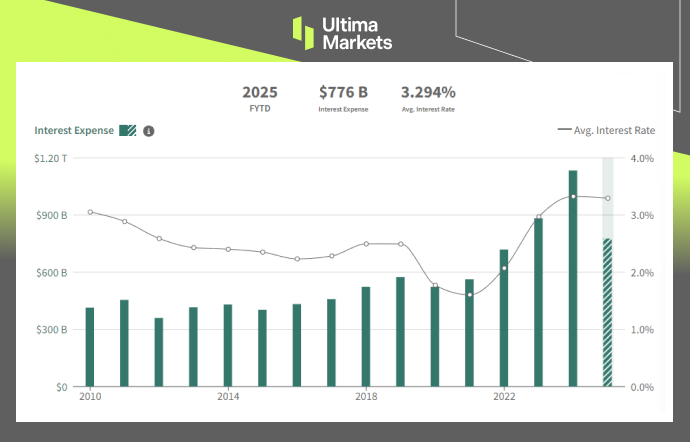

Meanwhile, according to FiscalData, the US government spent $1.13 trillion on interest expenses in 2024. For 2025, as of June, it has already spent $776 billion, and is estimated to reach $1.2 trillion for the fiscal year.

US Interest Expenses & Avg. Interest Rates on Debt | Source: FiscalData.Treasury.Gov

This growing debt is undoubtedly a major challenge for the US government. It is estimated that $9.2 trillion in US Treasury securities will mature in 2025—60% of which will mature before July.

The government will need to refinance or repay this massive sum. If interest rates remain high, the cost of rolling over this debt could significantly increase fiscal pressure.

This is one of the key reasons why US fiscal stability is under growing scrutiny by rating agencies and global investors—ultimately weighing on the US Dollar.

Trade Uncertainty and Fiscal Risk

US debt has been piling up for years. Until recently, strong investor confidence allowed the US to roll over old debt by issuing new Treasury bonds.

However, signs of strain are now emerging. Long-term bond issuance is coming under pressure, as elevated yields and rising fiscal uncertainty are dampening investor appetite.

Adding to this concern are the recent US credit rating downgrades, the ongoing tariff-driven trade war, and a ballooning national debt—all of which are eroding market confidence in the US’s fiscal stability, and in turn, the US Dollar.

Trump’s aggressive tariff policy has triggered a significant loss of confidence among investors and global markets. As a result, both US Treasury bonds and the US Dollar have taken a hit. With debt risks rising, fiscal concerns are now a key weight dragging the dollar lower.

Simply put, investors and markets are losing confidence in the US government—or more specifically, in the Trump administration.

What Does It Mean for the US Dollar?

Despite that, this doesn’t mean the US Dollar will lose its status as one of the world’s most powerful currencies overnight. Global confidence in the US Dollar still exists due to its dominant role in global trade and finance.

However, the road ahead may not be easy. The US Dollar faces significant long-term challenges, and while it won’t collapse suddenly, these issues could gradually weaken its global position.

For now, several key factors continue to weigh on the US Dollar:

- Global de-dollarization – Many governments and central banks are diversifying their reserves away from the Dollar, turning to other assets such as gold or currencies like the euro or yuan.

- US fiscal risk – The massive national debt and rising interest payments are raising concerns among investors about the sustainability of US fiscal policy.

- Waning investor appetite for US bonds – As credit risks increase and yields remain high, investor demand for US Treasuries may decline. This could push borrowing costs even higher, creating a negative feedback loop for both the bond market and the Dollar.

- Geopolitical pushback against the Dollar system – Countries facing US sanctions or tariffs are actively seeking alternatives to reduce dependence on the Dollar. This includes building bilateral trade settlements in other currencies.

Technical Outlook for the US Dollar

US Dollar Index, Day Chart Analysis | Source: Ultima Market MT5

From a technical perspective, the 100 mark has been a key support level for the US Dollar Index. With the Dollar now at risk of breaking below this crucial level, we may be witnessing the beginning of a new phase—an era where the Dollar trades consistently below the 100-mark, especially under the current fundamental and macroeconomic landscape.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server