Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Analisis EUR/USD: Ucapan Lagarde Penentu Arah Pasaran

Ogos 21, 2023 at 7:48 am

Analisis EUR/USD: Ucapan Lagarde Penentu Arah Pasaran

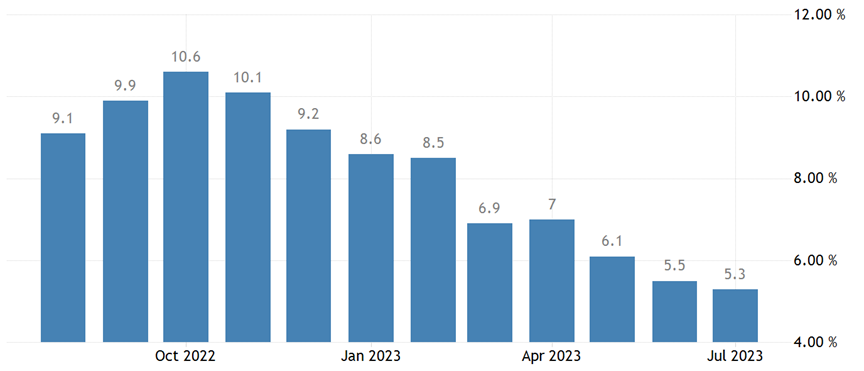

Akhirnya, euro mula menunjukkan ketahanan walaupun berdepan data ekonomi yang lemah, manakala tekanan inflasi pula dilihat semakin terkawal. Keadaan ini membuka ruang untuk European Central Bank (ECB) menilai semula dasar pengetatan monetari mereka. Tumpuan pelabur kini terarah kepada persoalan sama ada ECB akan menghentikan sementara kenaikan kadar faedah pada mesyuarat September seperti yang dijangkakan.

(Kadar inflasi zon euro sepanjang setahun lalu)

Laporan PMI bagi bulan Ogos yang akan diterbitkan pada hari Rabu dijangka menjadi fokus utama pasaran. Unjuran menunjukkan sektor pembuatan terus mengalami kemerosotan, dan kelembapan ini mula memberi kesan kepada sektor perkhidmatan, sekali gus meningkatkan risiko terhadap pertumbuhan ekonomi zon euro.

Dalam keadaan data yang lemah, ECB berkemungkinan memilih untuk berehat seketika daripada menaikkan kadar faedah pada September. Namun begitu, langkah ini boleh memberi tekanan ke atas nilai euro. Kebanyakan ahli ekonomi menjangkakan ECB akan membuat keputusan ‘pause’ pada September, tetapi masih melihat kemungkinan satu lagi kenaikan kadar faedah sebelum penghujung 2023, selari dengan kebimbangan terhadap inflasi yang masih tinggi.

Selain itu, ucapan Presiden ECB, Christine Lagarde, sempena Jackson Hole Global Central Bank Economic Symposium pada hari Sabtu bakal menjadi perhatian utama pasaran. Pelabur akan meneliti kenyataan beliau untuk mendapatkan petunjuk mengenai hala tuju dasar monetari ECB selepas ini.

Berdasarkan data yang dikeluarkan sepanjang minggu lalu, ekonomi Amerika Syarikat terus menunjukkan momentum yang kukuh. Jualan runcit dan aktiviti pembuatan mencatatkan peningkatan di luar jangkaan, manakala data sektor perumahan turut menunjukkan pemulihan. Kekuatan US dollar ini menyebabkan euro kekal berada dalam aliran menurun.

(Carta harian EUR/USD, Ultima Markets MT4)

Paras harga pada 4 Julai kini dilihat sebagai titik penting. Jika paras ini ditembusi, momentum kenaikan euro dijangka melemah dengan ketara, sekaligus mengurangkan peluang untuk pasangan EUR/USD mencatatkan lantunan semula yang kukuh.

Perlu juga diperhatikan bahawa volatiliti keseluruhan EUR/USD semakin menurun. Sama ada dari sudut pergerakan harga pada carta atau purata indikator 200-period ATR, kedua-duanya menunjukkan penyusutan. Oleh itu, kenyataan Lagarde berpotensi menjadi pemangkin utama yang mengubah tahap volatiliti pasaran dalam tempoh terdekat.

Penafian: Maklumat yang disediakan di sini adalah semata-mata untuk tujuan penyampaian maklumat dan tidak merupakan, serta tidak boleh ditafsirkan sebagai, nasihat kewangan, pelaburan, undang-undang, atau nasihat profesional lain dalam apa jua bentuk. Sebarang kenyataan atau pandangan yang terkandung dalam dokumen ini tidak boleh dianggap sebagai cadangan atau saranan oleh Ultima Markets atau mana-mana pihak yang berkaitan terhadap sebarang produk pelaburan, strategi, atau transaksi tertentu. Para pembaca dinasihatkan agar tidak bergantung sepenuhnya kepada kandungan ini dalam membuat sebarang keputusan pelaburan dan digalakkan untuk mendapatkan nasihat bebas yang sewajarnya daripada penasihat kewangan bertauliah.

Mengapa Berdagang Logam & Komoditi dengan Ultima Markets?

Ultima Markets menyediakan persekitaran kos dan pertukaran yang paling kompetitif untuk komoditi lazim di seluruh dunia.

Mohon sekarangMemantau pasaran secara terus

Pasaran terdedah kepada perubahan dalam penawaran dan permintaan

Menarik kepada pelabur yang hanya berminat dalam spekulasi harga

Kecairan mendalam dan pelbagai tanpa yuran tersembunyi

Tiada dealing desk dan tiada sebut harga semula

Pelaksanaan pantas melalui pelayan Equinix NY4

Sertai ekosistem perdagangan terbaik

Ultima Markets merupakan ahli The Financial Commission, sebuah badan bebas antarabangsa yang bertanggungjawab untuk menyelesaikan konflik dalam pasaran Forex dan CFD.

Semua pelanggan Ultima Markets dilindungi dibawah perlindungan insuran daripada Willis Towers Watson (WTW), syarikat insuran antarabangsa yang ditubuhkan pada 1828, layak untuk tuntutan sehingga US$1,000,000 setiap akaun.

Ultima Markets ialah broker CFD pertama yang menjadi sebahagian daripada United Nations Global Compact.

Pendedahan Risiko

Amaran Risiko:

Perdagangan instrumen kewangan berleveraj, termasuk Kontrak bagi Perbezaan (CFD), melibatkan risiko yang tinggi dan boleh mengakibatkan kerugian yang melebihi jumlah pelaburan asal anda. Instrumen ini tidak sesuai untuk semua pelabur dan hanya patut didagangkan menggunakan dana yang sanggup anda tanggung sekiranya berlaku kerugian. Anda tidak memiliki atau memperoleh sebarang hak terhadap aset asas bagi derivatif ini (seperti hak kepada dividen).Adalah menjadi tanggungjawab anda untuk memastikan pemahaman sepenuhnya terhadap risiko-risiko yang berkaitan. Sebelum memulakan aktiviti perdagangan, pertimbangkan tahap pengalaman anda, objektif pelaburan, dan sekiranya perlu, dapatkan nasihat kewangan bebas daripada pihak yang berkelayakan. Sila rujuk kepada dokumen undang-undang dan pendedahan rasmi kami sebelum membuat sebarang keputusan perdagangan.

Pernyataan Amaran Nasihat Am:

Maklumat yang disediakan di laman web ini adalah bersifat umum dan tidak mengambil kira objektif pelaburan, keadaan kewangan, atau keperluan peribadi anda. Sebelum bertindak berdasarkan sebarang nasihat yang diberikan, anda dinasihatkan untuk menilai kesesuaian maklumat tersebut dengan mengambil kira keadaan peribadi anda sendiri serta merujuk kepada dokumentasi undang-undang kami.

Sekatan Wilayah:

Maklumat dan perkhidmatan yang disediakan di laman web ini tidak ditujukan kepada penduduk di beberapa bidang kuasa tertentu, termasuk tetapi tidak terhad kepada Amerika Syarikat, United Kingdom, Singapura, dan mana-mana bidang kuasa yang tertakluk kepada sekatan antarabangsa. Untuk maklumat lanjut, sila hubungi khidmat pelanggan kami.

Maklumat Pengawalseliaan:

Ultima Markets merupakan nama dagangan yang dikongsi oleh beberapa entiti yang menjalankan operasi di pelbagai bidang kuasa. Entiti-entiti yang disenaraikan berikut telah diberi kuasa secara sah untuk menjalankan aktiviti di bawah jenama dan tanda dagangan Ultima Markets.

-

Ultima Markets UK Limited, nombor rujukan 470325, telah diberi kuasa dan dikawal selia oleh Financial Conduct Authority (FCA). Alamat berdaftar: 1 Blossom Yard, Tingkat Empat, London, E1 6RS, United Kingdom.

-

Ultima Markets Ltd diberi kuasa dan dikawal selia oleh Suruhanjaya Perkhidmatan Kewangan (FSC) Mauritius sebagai Peniaga Pelaburan Perkhidmatan Penuh (tidak termasuk Penjaminan), di bawah nombor lesen GB 23201593.

Alamat berdaftar: Tingkat 2, The Catalyst, 40 Silicon Avenue, Ebene Cybercity, 72201, Mauritius.

-

Ultima Markets EU OÜ, diperbadankan di Estonia dengan kod pendaftaran 17134727. Alamat berdaftar: Harju maakond, Tallinn, Kristiine linnaosa, Seebi tn 1-1501, 11316. Entiti ini tidak menawarkan produk kewangan yang dikawal selia atau menyediakan perkhidmatan dagangan.

hak cipta © 2026 Ultima Markets Ltd. Semua hak terpelihara.

-

Messenger

Continue on Messenger

Take the conversation to your Messenger account. You can return anytime.

Scan the QR code and then send the message that appears in your Messenger.

Open Messenger on this device. -

Instagram

Continue on Instagram

Take the conversation to your Instagram account. You can return anytime.

Scan the QR code to open Instagram. Follow @ultima_markets to send a DM.

Open Instagram on this device. -

Live Chat

-