MT4 vs MT5: A Comprehensive Comparison of the Leading Forex Trading Platforms – Which One is Right for You?

Since MetaQuotes launched the MetaTrader (MT) platform in 2005, over 80% of global forex transactions have been conducted through either MT4 or MT5, making them the go-to choices for both beginner and experienced traders. As MT5 gains wider adoption, many traders find themselves wondering about the key differences between MT4 and MT5. How do they compare, and which platform is the best fit for your trading needs? In this article, we will provide a comprehensive comparison, analyzing differences in functionality, usability, and real-world trading applications. This guide will help you quickly determine which platform aligns better with your trading style.

Differences in Positioning Between MT4 and MT5: Traditional Forex vs. Multi-Asset Integration

MT4: The Classic Leader in Forex Trading

MT4 is primarily designed for professional forex and contract for difference (CFD) trading, excelling in real-time price quotes and high-frequency trading strategies. It remains one of the most widely used platforms in the industry.

Key Features of MT4:

Launched in 2005, the MT4 trading platform set the industry standard. Its longevity and widespread adoption make it a reliable and familiar choice for many traders. Stability is a crucial factor—especially during market volatility—since no trader wants their trading software to fail at critical moments.

MT5: The Evolution Toward Multi-Asset Trading

MetaQuotes introduced MT5 in 2010 with the goal of creating a multi-asset trading platform. Unlike MT4, which focuses solely on forex and CFDs, MT5 supports additional markets such as stocks, futures, and cryptocurrencies. It enhances technical analysis tools, introduces more advanced strategy testing, and incorporates an exchange-trading mode to adapt to complex market structures.

Key Features of MT5:

MT5 was developed to address limitations in MT4, particularly by enabling trading in asset classes beyond forex, such as stocks and commodities. Unlike MT4, MT5 is better equipped to integrate with regulated exchanges, making it a preferred choice for those looking to trade across multiple markets.

In summary, here are the key differences between MT4 and MT5:

| MT4 | MT5 |

| Launched in 2005 | Launched in 2010 |

| Set the industry standard for forex trading platforms | A more updated platform with additional trading features and advantages |

| Widely available and easily accessible | Not as widely offered by forex brokers |

| Supported language: MQL4 | Supported language: MQL5 |

Forex Trading in Practice: Key Operational Differences Between MT4 and MT5

1. Interface Differences Between MT4 and MT5

What are the differences between the MT4 and MT5 interfaces? It is difficult to visually distinguish between MetaTrader 4 and MetaTrader 5 at first glance. In the newer version, developers have focused on expanding platform functionalities while keeping the interface nearly unchanged.

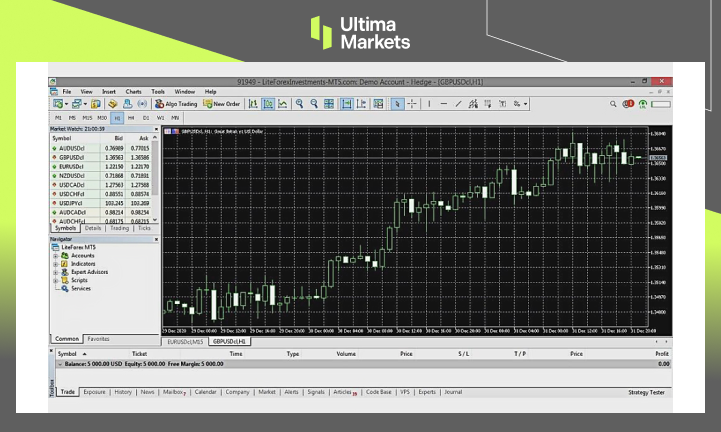

Here is what the MT4 interface looks like when all main windows and panels are open:

Here is what the MT5 interface looks like:

If you compare MetaTrader 5 with MetaTrader 4, you will notice some subtle differences. In MT5, toolbar icons are larger, and additional tabs have been added to the “Terminal” window.

Changes in the main menu of MetaTrader 5 compared to MetaTrader 4:

- In the “File” menu, users can now directly deposit or transfer funds within the platform.

- “Depth of Market” has been added to the “View” menu.

- The “Insert” menu includes two additional options—”Expert” and “Scripts.” Built-in software is available for algorithmic traders, and custom Expert Advisors (EAs) can also be added in MetaTrader 5.

- The “Charts” menu now contains more charting tools.

- The “Terminal” window includes an “Economic Calendar” and VPS (Virtual Private Server) services.

Conclusion: If you have already mastered all the functions of MT4, it will only take a few hours to get familiar with MetaTrader 5. Conversely, if you are proficient in MT5, you will quickly adapt to using MT4.

2. Order Execution Policies

MT4 has three types of order execution policies:

- Instant Execution – When a trader sends an order request, the platform automatically inserts the current price into the order. If the price is accepted, the order is executed. If the price is not accepted, the order is rejected and returned with a new price; this is known as a requote.

- Request Execution – The order is executed at a previously received price. Traders can either accept the quoted price or reject the execution.

- Market Execution – The forex broker decides to execute the order without prior price confirmation from the trader. If the trader places an order, it means they have already agreed to execute it at the available market price, even if it differs from the price displayed in the terminal.

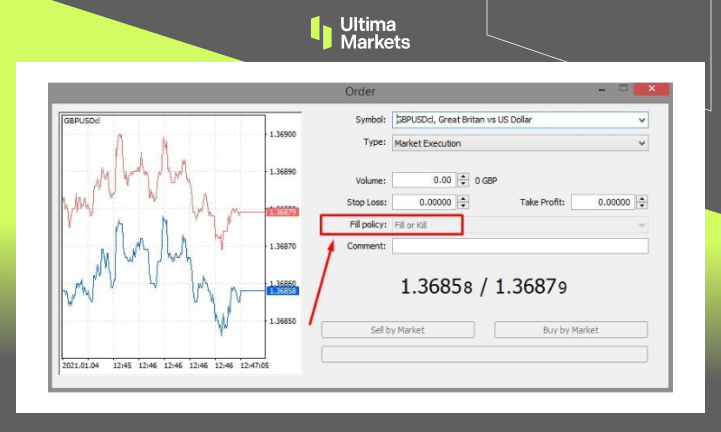

MT5 offers more types of order execution policies, allowing traders to specify their preferences in the order window:

- Fill or Kill (FOK) – The entire order volume must be executed at the specified price. For example, a trader wants to buy 1 lot of EUR/USD at a price of 1.22543, but the market only has 0.6 lots available at that price, with the remaining lots at higher prices. In this case, the order will not be executed. This is the only additional order execution policy in MetaTrader 5 compared to MetaTrader 4.

- Immediate or Cancel (IOC) – The trade is executed only for the available volume at the specified price, while the remaining volume is canceled. In the previous example, 0.6 lots would be bought, while the remaining 0.4 lots would be canceled.

- Return – If an order is partially executed, the remaining volume remains open in the market instead of being canceled.

In terms of order execution, beginner traders are advised to choose MT4—fewer options make it easier to understand the platform’s fundamental concepts.

3. Comparison of Pending Orders in MT4 and MT5

The number of pending order types differs between MT4 and MT5.

MT4 offers four types of pending orders:

- Buy Stop / Sell Stop

- Buy Limit / Sell Limit

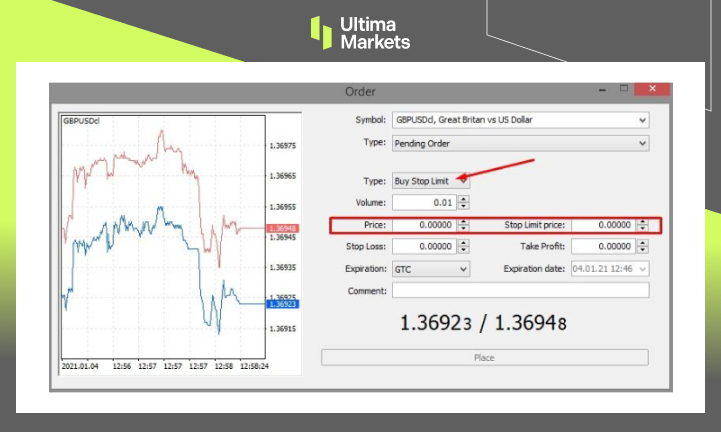

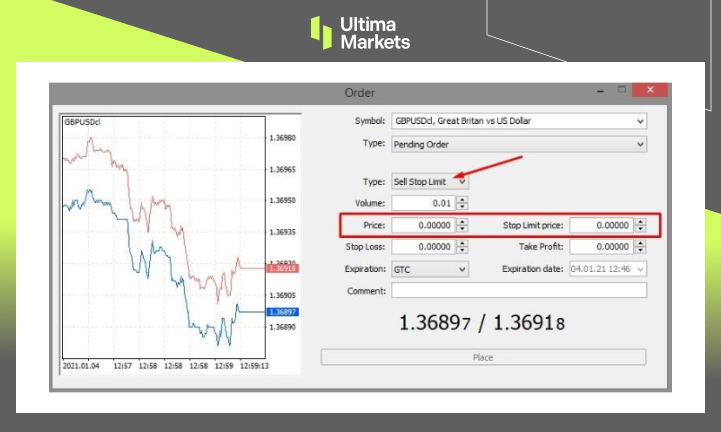

Meanwhile, MT5 introduces six types of pending orders.

A Buy Stop Limit order is a combination of a Buy Stop and a Buy Limit order. Once the Ask price reaches the value specified in the “Price” field, the platform will automatically place a Buy Limit order at the price set in the “Stop Limit” field.

A Sell Stop Limit order is a combination of a Sell Stop and a Sell Limit order. Once the Bid price reaches the value specified in the “Price” field, the platform will automatically place a Sell Limit order at the price set in the “Stop Limit” field.

Conclusion. For professional traders, the additional pending order types provided by MT5 may be highly useful. However, for beginner traders, the pending order types available in MT4 are already sufficient.

4. Comparison of Algorithmic Trading in MT4 and MT5

Compared to MT4, algorithmic trading in MT5 has not changed significantly. However, there are a few subtle differences: The “Insert” menu now includes two additional tabs, “Scripts” and “Experts.” Currently, there are no specific reviews on these tabs. If traders can add their own custom Expert Advisors (EAs) and scripts written in MQL5, the purpose of these additional tabs may seem unclear.

One of the most significant improvements in MT5 is the Strategy Tester. Developers have fundamentally upgraded the MT5 Strategy Tester, making it a unique tool that allows optimization of even the most complex manual and algorithmic trading strategies. Its capabilities surpass those of the MT4 Strategy Tester and other built-in testers like Fx Blue and Forex Simulator.

Summary: MT4 vs MT5 – How to Choose? A Key Decision-Making Guide

If you’re selecting the most suitable forex trading platform, the choice between MT4 and MT5 should be based on your specific trading needs.

MT4 is ideal for traders who:

- Focus exclusively on the forex market.

- Are accustomed to using MT4 Expert Advisors (EAs) and prefer not to learn a new platform.

- Primarily engage in short-term trading, such as day trading.

MT5 is ideal for traders who:

- Need to trade across multiple asset classes, including stocks, futures, and cryptocurrencies.

- Require enhanced trading features like Depth of Market (DOM) and economic calendar integration.

- Seek faster execution speeds and access to advanced analytical tools.

Ultima Markets provides a specially optimized MT4 platform, allowing traders to easily access a wide range of asset classes, including forex, precious metals, commodities, indices, stock CFDs, and cryptocurrencies. Whether you’re a beginner or an experienced trader, the platform ensures a smooth and intuitive trading experience.

Final Thoughts

In summary, MT4 and MT5 each have their own advantages—MT4 remains a popular choice for forex traders, while MT5 is ideal for investors looking to diversify across multiple asset classes. Regardless of which platform you choose, be sure to test your strategies with an Ultima Markets demo account to find the trading tool that best suits your needs!

![[MetaTrader 5 Mobile Trading Complete Guide] 7 Key Advantages for Real-Time Market Access](https://www.ultimamarkets.com/wp-content/uploads/2025/04/mt5_mobile_trading_card.jpg)