TSMC’s Bullish stance on AI Chip Market Points to 20% Growth

TSMC Sees Promising AI Chip Market, Expects 20% Revenue Jump This Year

Taiwan Semiconductor Manufacturing Company (TSM.US), a key player in the semiconductor industry, is poised for substantial growth, projecting a 20% revenue increase this year. Let’s delve into the recent developments and insights shaping TSMC’s optimistic outlook.

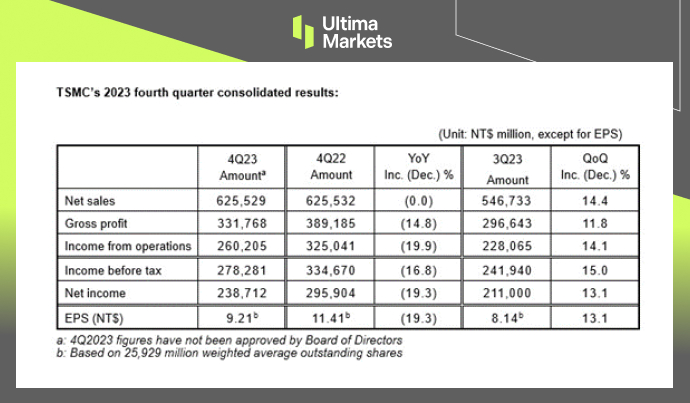

TSMC’s Strong Financial Performance in Q4 2023

In the fourth quarter, TSMC reported robust financials, with NT$625.53 billion in revenue, marking a 14.4% increase from the previous quarter. Impressively, the gross profit margin stood at 53%, exceeding financial forecasts.

Operating profit margin also outperformed expectations at 41.6%. Despite a 19.3% YoY net profit fall, the company remains optimistic about future prospects.

(TSMC Q4Y23 Earnings)

Projections for 2024 and Industry Growth

CEO C. C. Wei anticipates a healthy industry growth as the destocking of IC design customers concludes. The semiconductor industry, excluding memory, is expected to witness over 10% growth in 2024, with wafer foundry industry revenue projected to surge by 20%.

TSMC, due to its technological prowess, aims to outpace industry growth, targeting a remarkable 21-26% increase in revenue quarter by quarter.

Technological Leadership Driving Revenue Growth

With a strong focus on technological leadership, TSMC is well-positioned to capitalize on the rising demand for high-end chips, especially in the artificial intelligence (AI) sector. The company’s optimistic projections align with its consistent commitment to innovation and cutting-edge chip manufacturing.

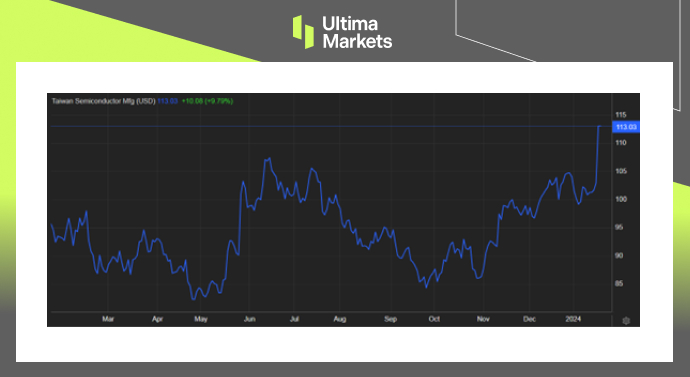

Market Response and ADR Performance

Following the earnings release, TSMC ADR (TSM.US) experienced a notable uptick, surging by 9.79% to reach 113.03. This positive market response underscores investor confidence in TSMC’s strategic direction and growth potential.

(TSMC ADR Performance Yearly Chart)

Industry Impact: TSMC’s Influence on Taiwan Stocks and Government

TSMC’s bullish outlook is reverberating beyond financial markets. Taiwan-listed shares of TSMC soared on Friday, eliciting a positive response from the government. The company’s optimistic outlook is not only shaping its market standing but also influencing broader economic sentiments in Taiwan.

TSMC’s Strategic Investments: Advanced Packaging Plant for AI Chips

A notable move in TSMC’s strategy involves a substantial investment of $2.9 billion in an advanced packaging plant for AI chips.

This forward-looking initiative aligns with the company’s commitment to staying at the forefront of AI chip manufacturing, capitalizing on the anticipated growth in this segment.

Key Takeaways and FAQ

Q: What contributed to TSMC’s strong Q4 financial performance?

A: TSMC’s Q4 success can be attributed to a 14.4% increase in revenue, with a gross profit margin of 53%, exceeding expectations

Q: Why is TSMC optimistic about the semiconductor industry’s growth in 2024?

A: TSMC’s CEO, C. C. Wei, foresees healthy industry growth as the destocking of IC design customers concludes, with an estimated 10%+ growth in the semiconductor industry.

Q: How is TSMC positioning itself in the AI chip market?

A: TSMC’s strategic investments, including a $2.9 billion advanced packaging plant for AI chips, showcase its commitment to staying ahead in the AI chip market.

Read more on TSMC’s outlook:

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server