RUT 2000 Surges, Outshining SP 500 in Small-Cap Rally

RUT 2000 Outperforms SP 500 in December 2023

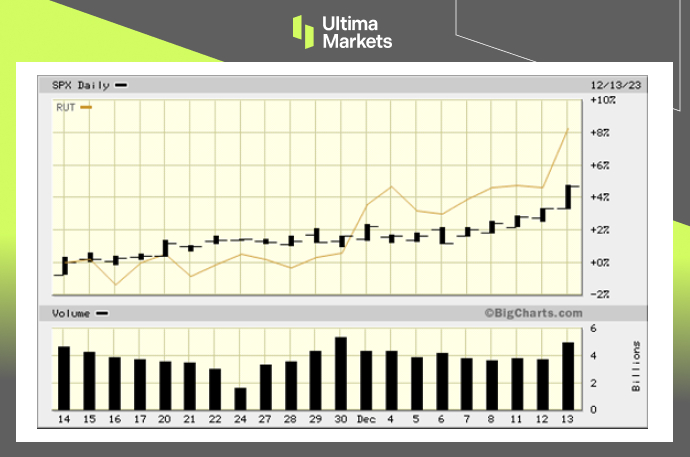

In the financial landscape, December has witnessed a remarkable surge in the Russell 2000 small-cap stock index, surpassing its large-cap counterpart, the S&P 500, by a substantial margin.

With a robust 7.7% rally, the Russell 2000 has outpaced the S&P 500 by 4.6%, marking its most significant relative outperformance since January 2021.

(SPX vs RUT One-month Chart)

What Sets the Russell 2000 Apart?

The Russell 2000 index, a measure of small-cap US stocks in the Russell 3000, has historically demonstrated strength during times of economic turbulence. Its focus on the universe of U.S. small capitalization stocks positions it uniquely in the market.

Performance Analysis

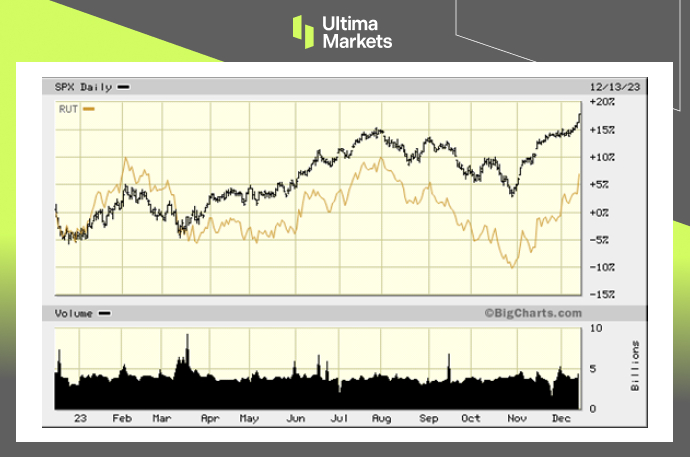

Analyzing the performance of the S&P 500 versus the Russell 2000 ETF reveals interesting dynamics. While the S&P 500 typically includes larger, well-established companies, the Russell 2000 Index follows the performance of around 2,000 U.S. small-cap stocks. This diversity can be a key factor in its recent outperformance.

Comparing Differences

The differences between the Russell 2000 and S&P 500 are noteworthy. The Russell 2000 serves as a useful tool for tracking and profiting from the universe of U.S. small capitalization stocks, whereas the S&P 500 leans towards more tech and growth-focused companies.

Market Outlook

According to analysts, the small-caps index is expected to rise by 14% in the next 12 months, outpacing the projected 9% climb for the S&P 500. This forecast aligns with the recent trend of the Russell 2000 outperforming the largest-cap U.S. index.

(SPX vs RUT One-year Chart)

Economic Impact

The Russell 2000’s recent outperformance during times of economic turbulence, as discussed in Investopedia, suggests that small-caps may present an attractive option for investors seeking resilience in varying market conditions.

Frequently Asked Questions

Q: What is the main difference between the S&P 500 and Russell 2000?

A: The primary distinction lies in the size and focus of the companies each index comprises. The S&P 500 includes larger, well-established companies, while the Russell 2000 focuses on around 2,000 U.S. small-cap stocks.

Q: How does the Russell 2000 perform during economic turbulence?

A: Historically, the Russell 2000 has shown resilience during economic turbulence, often outperforming larger indices like the S&P 500.

Q: What is the market outlook for small-caps versus the S&P 500?

A: Analysts anticipate a 14% rise in the small-caps index compared to a projected 9% climb for the S&P 500 in the next 12 months.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server