US-China Manufacturing PMI Contracts Amid Tariff Policy

The latest manufacturing activity data from both the United States and China shows clear signs of strain, with Purchasing Managers’ Index (PMI) readings for May showing contractions on both sides amid ongoing tariffs, despite both countries significantly reduced tariffs after reaching an initial trade agreement in Switzerland in May.

US-China Manufacturing Activity in Contraction

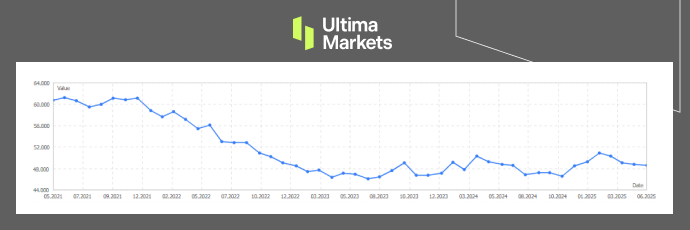

According to the latest PMI releases, both economies are seeing manufacturing weakness. In the US, manufacturing contracted for a third straight month in May, slipping to 48.5 from April’s 48.7, based on the Institute for Supply Management (ISM) survey published on Monday.

The ISM noted that suppliers faced the longest delivery times in nearly three years due to tariffs, which may be contributing to goods shortages.

ISM U.S. Manufacturing PMI | Source: Ultima Market

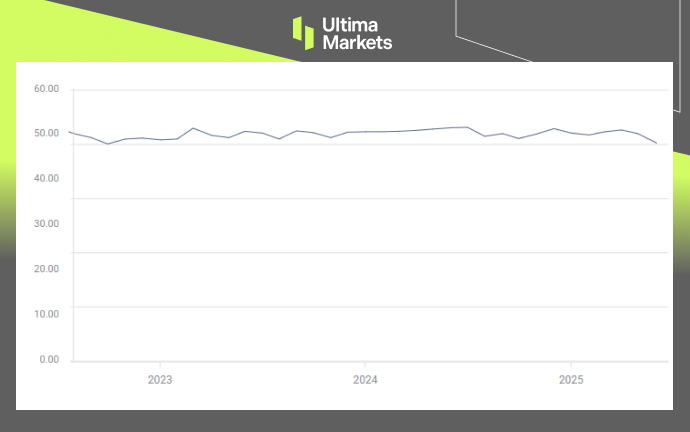

In China, the Caixin Manufacturing PMI dropped to 48.3 in May 2025, marking its first contraction in eight months and the lowest reading since September 2022. The drop was driven by a sharp decline in new export orders due to renewed U.S. tariffs, with weakening demand both domestically and internationally.

China Caixin Manufacturing PMI | Source: Ultima Market

What Does This Mean for the US?

The manufacturing contraction in both nations is clearly tied to the US-China trade war.

In the US, even though the broader economy remains on a modest growth path, the manufacturing sector—which accounts for about 10.2% of GDP—is showing signs of pressure due to policy uncertainty and rising costs.

Although the Trump administration continues to claim that foreign countries are bearing the tariff costs, industry feedback suggests otherwise. U.S. businesses and consumers appear to be absorbing most of the burden. The ISM survey noted that manufacturers reported import duties—especially on Chinese goods and raw materials—have “wreaked havoc” on profitability and supply chains.

The report also showed a steep drop in imports, with the ISM index falling to 39.9—the lowest since early 2009. Export activity declined as well, and customer inventories hit a 15-month low, raising concerns about future shortages and possible inflation pressures.

What About China?

In China, factory output and employment also shrank, while manufacturers continued facing pricing pressures and supply chain disruptions.

Even though China is transitioning toward a services-driven economy, manufacturing still accounts for roughly 27%–30% of GDP, making it a key driver of growth.

The drop in manufacturing PMI could indicate a slowdown in China’s broader economic momentum. If the contraction persists, it may further weigh on overall performance.

That said, business sentiment surveys show that companies remain cautiously optimistic, with some hope for trade stabilization in the months ahead.

Implications for USDCNH

The contraction in manufacturing activity in both the U.S. and China has potential implications for the USDCNH exchange rate.

From a fundamental perspective, weaker Chinese manufacturing data could signal a decline in exports and raise concerns about China’s economic momentum. This may weigh on the Chinese Yuan, especially if markets expect the PBoC to respond with further easing or currency devaluation.

However, the U.S. Dollar has also come under pressure recently, amid rising fiscal and trade uncertainties, which has contributed to its broader weakness.

USDCNH, Day Chart Analysis | Source: Ultima Market MT5

From a technical standpoint, USDCNH is currently hovering below the 7.220 level, a 7-month low, suggesting continued pressure on the U.S. Dollar against the Yuan.

A sustained struggle below 7.220 may signal further downside for the Dollar, potentially driven by ongoing concerns over U.S. fiscal policy and trade outlook.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server