U.S. Services PMI Contracts as Tariff Impact Deepens

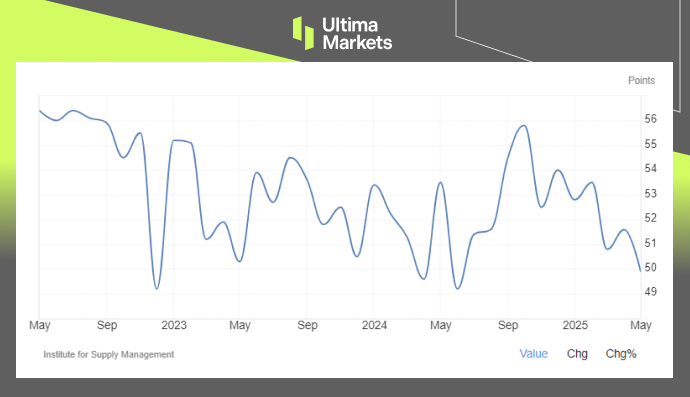

Following the earlier release of the ISM Manufacturing PMI, the latest ISM Services PMI data for May 2025 also showed a surprise contraction in the U.S. services sector. The index fell to 49.9 from April’s 51.6, missing market expectations of 52 and marking the first contraction in services activity since June 2024.

US Service PMI | Source: ISM, Trading Economics

New Orders Drop, Prices Rise Sharply

A deeper look into the report shows significant weakness in new demand. The ISM Services New Orders Index plunged to 46.4—well below the 50-point mark—suggesting that businesses are experiencing a sharp decline in incoming orders.

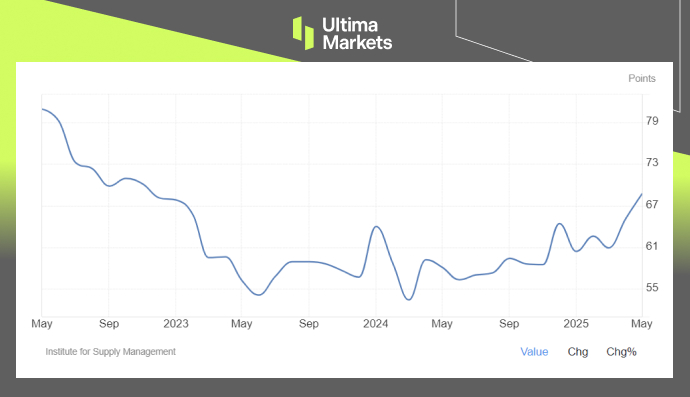

At the same time, inflationary pressures in the service sector remain strong. The ISM Services Prices Index surged to 68.7 in May, the highest level since November 2022. This increase reflects rising input costs across the services industry, with many businesses citing higher expenses linked to the latest round of tariffs and supply disruptions.

ISM Services Prices | Source: ISM, Trading Economics

Is the Tariff Impact Taking Hold?

The unexpected contraction in both manufacturing and now services PMI suggests that the economic impact of recent tariff hikes is starting to materialize. Despite a partial rollback of China tariffs in the initial May trade deal, businesses remain under pressure from broader policy uncertainty and increased costs on imported materials.

With both the manufacturing and services sectors showing signs of weakness, concerns are rising that the U.S. economy could face a broader slowdown if trade tensions persist. Investors and policymakers alike will now be watching upcoming data closely to gauge whether this soft patch deepens or stabilizes.

Markets Eye U.S. Labor Data

All eyes are on Friday’s upcoming U.S. Non-Farm Payrolls (NFP) report, a key indicator of the country’s economic health. The labor market remains a critical focus for investors, especially amid growing concerns over slowing economic activity.

According to market consensus, economists expect the U.S. economy to have added just 130,000 jobs in May—a significant slowdown compared to previous months. This cautious outlook aligns with Wednesday’s ADP Employment Change report, which showed only 37,000 new private-sector jobs added in May, far below expectations of 115,000.

While the ADP data covers only a portion of the labor market and is based on ADP’s own payrolls, it is often seen as a leading indicator or early signal for the official NFP report. If Friday’s numbers confirm a significant slowdown, it could heighten concerns about the labor market’s resilience under current economic and trade pressures.

US Dollar: What’s Next?

The U.S. dollar continued to weaken on Wednesday, extending its slide following the disappointing ISM PMI reports. The Dollar Index (USDX) dropped below the key 99.00 level once again, reflecting investor caution toward the U.S. economic outlook.

USDX, Day-Chart Analysis | Source: Ultima Market MT5

Price action suggests that while the dollar remains under pressure, it is still holding above its key technical support around the 99.00–100.00 zone. Despite recent declines, the index has yet to break down decisively, indicating that investors are waiting for a stronger catalyst.

“The U.S. dollar is currently under pressure but remains supported by a key level. If more negative economic signals emerge, the downside pressure on the dollar could intensify,” said Ultima Market analyst Shawn.

All eyes are now on the upcoming Non-Farm Payrolls (NFP) report this Friday, which could provide the next major directional cue. A strong jobs report may revive dollar strength, while a disappointing print could open the door to a deeper pullback.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server