Fed Holds Fuels Dollar Rebound, but Uncertainty Remain

The Federal Reserve kept interest rates unchanged on Wednesday, as widely expected. However, policymakers signaled that rate cuts are still likely in 2025—though Fed Chair Jerome Powell cautioned against placing too much confidence in that outlook, citing ongoing uncertainties around tariffs and inflation.

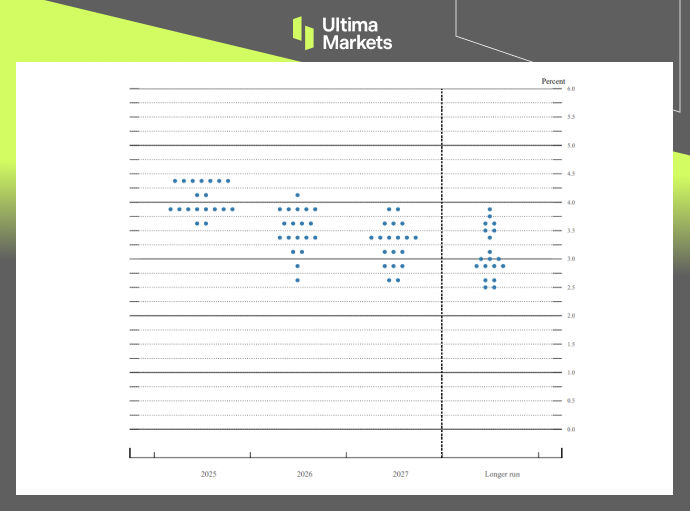

Summary of Economic Projection

With the decision to hold rates largely priced in, market attention turned to the June Summary of Economic Projections (SEP). The updated dot plot shows that the Fed still anticipates two 25-basis-point cuts by the end of 2025. However, views remain divided—some Fed officials foresee no cuts at all, underscoring the uncertainty around the rate path.

June’s SEP Fed Dot Plot | Source: Federal Reserve

While a majority of officials still expect two or more rate cuts in 2025, the split in opinions reflects the cautious stance the Fed is maintaining in light of mixed economic signals.

Powell’s Press Conference: Data-Driven and Tariff-Wary

During the press conference, Powell reiterated that the dot plot projections are not commitments, but rather “weak signals” subject to change. He emphasized that future policy moves will remain data-dependent and flexible.

Importantly, Powell flagged the rising inflation risks, citing two key concerns:

- Tariff-related uncertainties, which could push prices higher.

- Geopolitical tensions, including elevated oil prices driven by Middle East instability.

He noted that any easing would likely depend on clear signs of cooling inflation in the coming months.

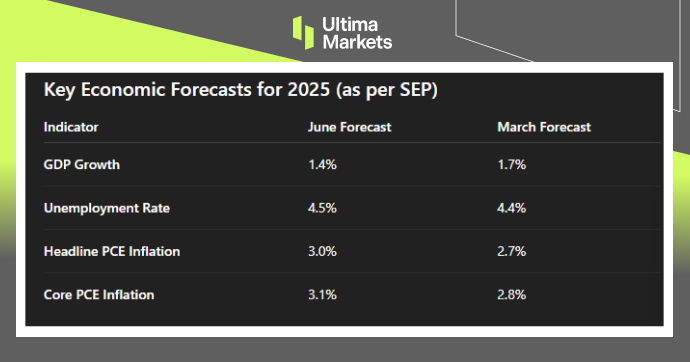

Fed Economic Projection | Source: Federal Reserve, Chart: Ultima Market

The Fed’s economic outlook signals slower growth and elevated inflation in 2025, reinforcing its cautious approach toward future rate cuts.

“The Fed’s stance hasn’t changed—it remains firmly data-driven, especially with inflation still clouded by tariff-related uncertainties,” said Shawn, Senior Analyst at Ultima Market.

He added, “Markets are likely to increase bets on rate cuts if inflation shows clear signs of cooling in the coming months, particularly ahead of the September meeting.”

Market Shows Mixed Reaction

U.S. equity markets closed slightly lower on Wednesday, reflecting a mixed reaction to the Federal Reserve’s cautious stance. While the Fed held rates steady as expected, its tone signaled patience and uncertainty, prompting a modest retreat in stocks.

At the same time, the U.S. Dollar remained supported, with investors interpreting the Fed’s guidance as a sign that rates could stay higher for longer—especially in light of persistent inflation and slower growth.

Key Takeaways:

- The Fed maintained a steady rate policy, emphasizing a data-dependent approach moving forward.

- The latest dot plot projects two rate cuts in 2025, but the timing remains unclear due to elevated inflation and weaker growth forecasts.

- Geopolitical risks, tariff-related inflation pressures, and concerns over data quality have become central to the Fed’s policy outlook.

U.S. Dollar Outlook: Limited Rebound, Uncertainty Remains

USDX—Dollar Index, Day Chart Analysis | Source: Ultima Market MT5

Despite a modest rebound in the U.S. Dollar following the FOMC meeting, the broader outlook remains clouded as the Fed’s overall stance showed little change.

The U.S. Dollar Index (USDX) continues to trend lower, struggling to reclaim the key 99–100 level. Without a sustained move above this range, it suggests that investor confidence in a stronger dollar remains limited, particularly given ongoing concerns over U.S. fiscal stability and tariff-related uncertainties.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server