BOJ Holds Rates, Signals Caution with Gradual Tapering

The Bank of Japan (BOJ) kept its benchmark interest rate unchanged at 0.5% on Tuesday, maintaining its highest level in 17 years while signaling a cautious approach toward policy normalization. The decision was unanimous, extending the pause in rate hikes since the 25-basis point increase in January.

In its June meeting, the BOJ also outlined a clear tapering plan for its Japanese Government Bond (JGB) purchases—a move seen as the central bank’s next step in unwinding years of ultra-loose policy without unsettling markets.

BOJ’s Gradual Tapering

Under the new plan, the BOJ will reduce JGB purchases by ¥400 billion per quarter through March 2026, then taper more slowly at ¥200 billion per quarter until March 2027. The central bank aims to shrink its JGB holdings by about 17% by that time, including natural maturities. The plan was approved by an 8-1 vote.

This gradual approach signals the BOJ’s intent to normalize monetary policy while minimizing the risk of market disruption, particularly in the bond and foreign exchange markets.

Ueda’s Cautious Tone

In the post-meeting press conference, Governor Kazuo Ueda struck a cautious tone, highlighting external risks such as U.S. tariff policies and geopolitical tensions in the Middle East. He emphasized that future rate decisions will be data-dependent, hinging on whether inflation can sustainably exceed the 2% target.

While Japan’s economy is recovering moderately, some weakness remains, particularly in consumption. Ueda noted that inflation expectations have risen moderately, but the BOJ still sees underlying inflation expectation below target.

Ueda also warned that the latest U.S. trade tariffs could weigh on Japan’s wage growth and corporate bonus outlook, potentially stalling the momentum needed for policy tightening. Meanwhile, ongoing instability in the Middle East could keep oil and food prices elevated, feeding into broader inflation expectations.

In response to questions about bond market stability, Ueda reaffirmed that the BOJ stands ready to intervene with fixed-rate bond operations or liquidity tools if long-term yields spike abruptly.

Outlook: Normalization Pace Slows

With its cautious guidance and tapering plan, the Bank of Japan is clearly signaling that monetary policy normalization will remain gradual and data-dependent. While the central bank continues to leave the door open for future tightening, the slightly more cautious tone—particularly on global risks—has tempered market expectations for another rate hike in the near term.

“Given the BOJ’s growing caution around external uncertainties, the normalization timeline may now be pushed further out,” said Shawn, Senior Analyst at Ultima Markets.

“If inflation evolves in line with BOJ projections, the next rate hike is likely to come no earlier than Q4 2025.”, Shawn added.

This shift in tone suggests that the BOJ may prioritize market stability and global risk management over aggressive tightening, especially amid renewed trade tensions and geopolitical volatility.

Market Reaction: JGB Yields Slight Uptick

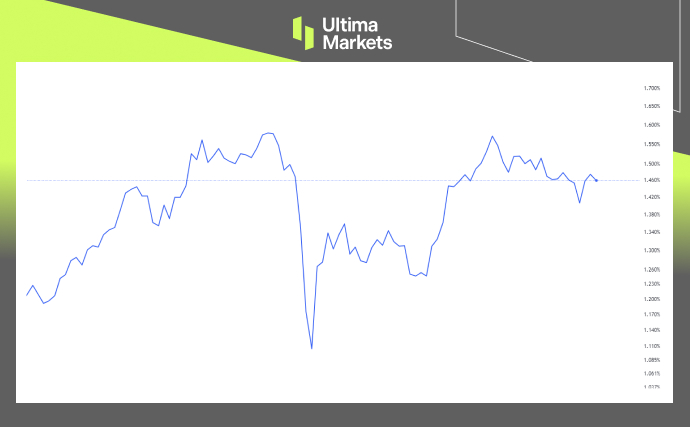

JGB 10-Year Bond Yields; Source: Ultima Market

The 10-year Japanese Government Bond (JGB) yield saw a slight uptick following the BoJ press conference, as markets interpreted the announced tapering of bond purchases as a potential step toward future policy tightening.

Investors are beginning to price in the possibility of higher interest rates ahead, which pushed long-term yields modestly higher. Over the longer term, sustained yield increases could also lend support to the Japanese Yen.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server