Australian CPI Holds—What’s Next for the RBA?

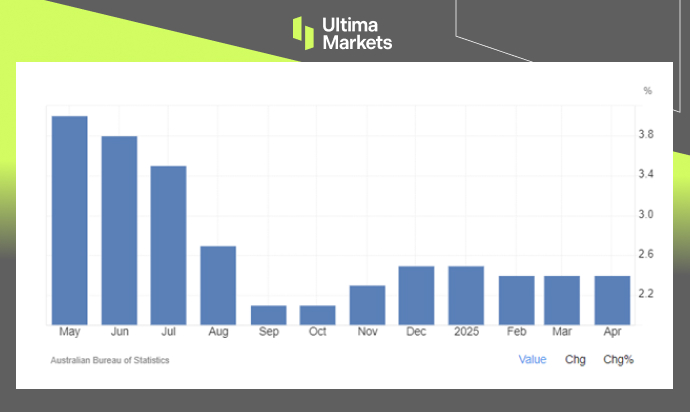

TOPICSAustralia’s annual inflation rate remained steady at 2.4% in April 2025, aligning with the Reserve Bank of Australia’s (RBA) target range of 2–3%. However, a slight uptick in core inflation to 2.8% has introduced uncertainty on the central bank’s future rate cuts.

Australia Key Inflation Metrics

- Headline CPI: Unchanged at 2.4% year-on-year, matching March’s figure and slightly above expectations of 2.3%.

- Trimmed Mean Inflation: Rose to 2.8% from 2.7% in March, indicating modest underlying inflation pressures.

- Excluding Volatile Items & Holiday Travel: Also increased to 2.8%, up from 2.6% in March.

Primary contributors and offsetting to inflation included:

- Food and Non-Alcoholic Beverages: +3.1%, with egg prices surging by 18.6% due to avian flu outbreaks.

- Housing: +2.2%, with rents increasing by 5.0% over the year.

- Recreation and Culture: +3.6%.

- Fuel Prices: Decreased by 12%.

- Electricity Costs: Fell by 6.5%, aided by government rebates.

Australia’s Monthly CPI YoY | Source: AU Bureau of Statistic | Charting: Trading Economics

Monetary Policy Outlook

The RBA recently reduced the cash rate by 25 basis points to 3.85%, marking its second cut this year. While inflation remains within the target range, the slight rise in core inflation suggests that the central bank may adopt a cautious approach to further easing.

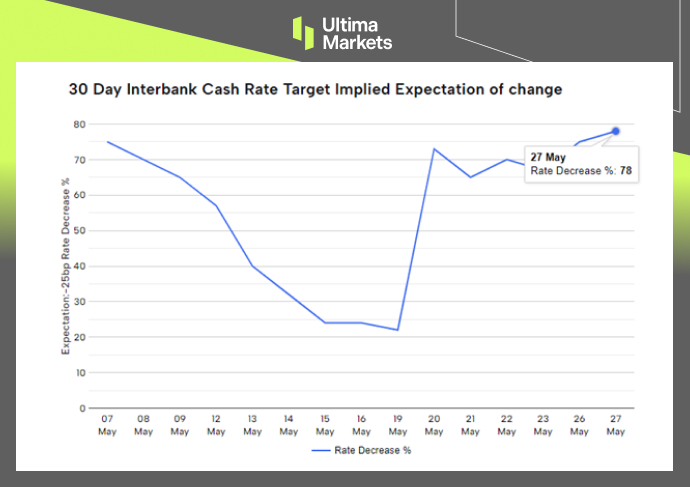

RBA Rate Trackers | Source: ASX.com.au

According to RBA rate trackers (Source: ASX.com.au), market expectations for the next RBA board meeting—prior to the CPI announcement—show a 78% probability of another 25-basis-point cut to 3.60% in July.

However, some investors are beginning to anticipate a pause at the July meeting, awaiting more comprehensive data. Note that the rate trackers currently reflect probabilities only up to May 28, so market sentiment could shift after tomorrow’s updates.

Additionally, the RBA’s May 2025 Statement on Monetary Policy projects that headline inflation may temporarily exceed 3% in the second half of the year due to the expiration of cost-of-living measures, before easing back towards the midpoint of the target range.

Market Implications

- Australian Dollar (AUD): The currency experienced a modest uptick following the inflation data, reflecting tempered expectations for immediate rate cuts.

- ASX 200 Index: The index rose to a three-month high, buoyed by the RBA’s recent rate cut and investor optimism.

While Australia’s inflation remains within the RBA’s target range, the slight increase in core inflation underscores the need for careful monitoring. The central bank’s future policy decisions will likely hinge on forthcoming economic data, particularly the next quarterly CPI report.

Outlook for AUDUSD

AUDUSD, 4-H Chart Analysis | Source: Ultima Market MT5

The AUDUSD remains largely unmoved despite shifts in implied rate expectations, continuing to trade within a consolidation range. While a minor uptrend channel has formed, the pair remains broadly contained between the 0.6500 and 0.6400 levels.

Market reaction has been limited, reflecting the current low-volatility environment. Although the RBA’s policy outlook could eventually influence the Aussie dollar, the currency appears to be in a wait-and-see mode. Without a clear catalyst, AUDUSD is likely to remain range-bound in the near term.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server