Middle East Conflict Stokes Inflation Fears, Threatening Wall Street Rally

The conflict between Israel and Iran has triggered a surge in oil prices, leading to increased cost-push inflationary pressures that are impacting corporate profits and stock market valuations. Rising oil prices could also prompt the Federal Reserve to delay interest rate cuts or even implement further hikes, placing additional pressure on the market. Concurrently, a downshift in consumer spending and contracting demand are expected to drag on the economy, elevating stagflation risks. While energy stocks may benefit, the broader market faces systemic risks, and investors should be cautious of potential valuation resets.

As the conflict between Israel and Iran ignites the Middle East powder keg, the market’s focus has shifted beyond short-term oil price volatility to a more profound threat: an energy-driven inflationary storm poised to suffocate Wall Street’s rally.

Historical data compiled by Ultima Markets shows that geopolitically driven oil price shocks often trigger a deadly “cost-inflation-tightening” spiral. This time, fragile market liquidity and elevated valuation levels leave U.S. stocks more vulnerable than ever.

The Specter of Resurgent Inflation

Crude oil, the lifeblood of the modern economy, sees its every price fluctuation impact corporate profitability.

When crude prices surge, manufacturing and transportation sectors bear the initial brunt, as sharply rising fuel and raw material costs directly compress corporate profit margins. This pressure quickly transmits to the market, dampening corporate earnings expectations and, consequently, share prices.

A 13% surge in crude oil due to Middle East conflict instantly inflates operating costs for core industries like manufacturing and transportation, relentlessly squeezing profit margins. This cost-push inflation is the nemesis of stock market valuations.

The most damaging aspect of rising oil prices lies in their power to reshape monetary policy expectations. As Ultima Markets previously noted in its analysis: “Oil price increases that push up interest rates will crush U.S. stock valuations.” When crude prices climb persistently, the Federal Reserve may be forced to delay interest rate cuts or even resume rate hikes to curb inflation.

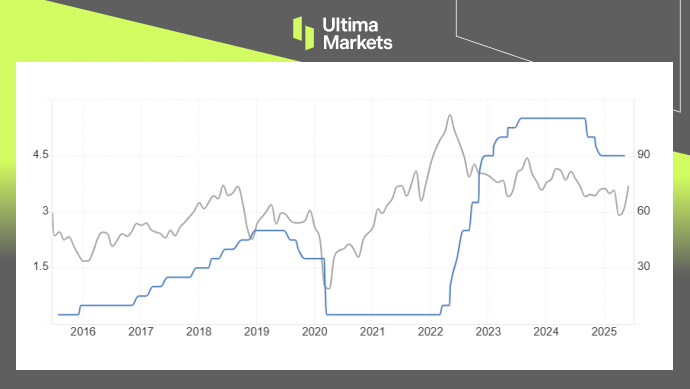

(Image: Blue line: Federal Reserve interest rate path vs. Gray line: Oil price, Chart by Ultima Markets)

Demand Destruction Under Stagflation’s Shadow

The shockwaves from rising oil prices extend beyond the corporate sector, directly hitting consumers’ wallets via prices at the pump.

Increased spending on gasoline and household energy means less disposable income, inevitably leading to consumer hesitancy in discretionary spending on items like retail goods and automobiles.

This downshift in consumption will directly drag on the performance of related companies. Just as Nike’s shares plummeted 14% due to soaring costs amid tariff shocks in early April, cost pressures eventually morph into demand contraction.

(Image: Nike 4-hourly chart, Source: Ultima Markets MT5)

If oil prices remain elevated for an extended period, the impact will escalate from shrinking consumption to a broader suppression of overall economic activity.

The market action on June 12 already offered a preview of these concerns. Crude oil prices rose over 5%, immediately sparking fears of “stagflation” (a combination of economic stagnation and inflation).

Amidst such macroeconomic gloom, market risk aversion intensifies, prompting large-scale capital flight from risk assets like equities to safe havens such as U.S. Treasuries or gold.

Geopolitics: The Deadly Catalyst

Every conflict in the Middle East typically plays out a classic “oil up, stocks down” scenario in global markets.

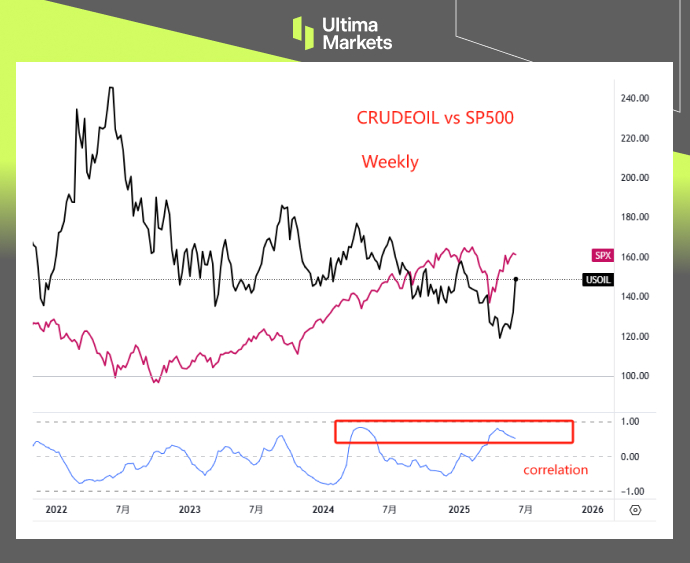

(Image: Correlation between Crude Oil and U.S. Stocks Turning Negative, Chart by Ultima Markets)

The market reaction to the Israel-Iran conflict on June 14 was a textbook example: oil prices surged as much as 13%, while the Dow Jones Industrial Average plummeted over 700 points.

Elon Gu, an analyst with Ultima Markets’ research team, stated that the damaging power of geopolitical conflict lies in its dual-impact effect: pushing up oil prices while simultaneously increasing uncertainty in global supply chains.

When tariff threats and rising oil prices resonate, there is a very high probability of U.S. Treasury yields rising, and the market faces a potential outbreak of systemic risk.

While the energy sector might benefit from rising oil prices—evidenced by the 2.69% gain in oil and gas ETFs on June 14—this localized benefit is far from sufficient to offset the systemic risk to the broader market.

The core problem currently facing the market is that high valuation levels and a fragile liquidity environment make any external shock capable of triggering a chain reaction.

Oil Up, Stocks Down: Not an Ironclad Rule

However, the “oil up, stocks down” adage is not an immutable law; investors need to discern the underlying drivers.

In the current supply shock triggered by geopolitical conflict, one sector stands out as a clear beneficiary: energy stocks. Rising oil prices directly bolster the profits of oil and gas companies, making them a “partial safe haven” amidst market turmoil. For instance, against the backdrop of a broad market decline on June 14, oil and gas ETFs rallied 2.69%.

Furthermore, it is crucial to distinguish whether rising oil prices are caused by a “supply shock” or “demand pull.”

If oil prices rise due to a strong global economic recovery and robust demand, it reflects optimism about growth and could actually benefit cyclical stocks. However, the current surge in oil prices, triggered by the Israel-Iran conflict, is a typical supply-side risk, and its impact on the market is unequivocally negative.

Ultimately, the core transmission mechanism of the current geopolitically driven rise in oil prices follows this logical chain: “cost-push inflation → monetary policy tightening → pressure on corporate earnings and valuations.” This chain becomes particularly perilous when compounded by geopolitical risks.

For investors, this is not merely a market correction but potentially the beginning of a valuation reset. As the fires of conflict reignite in the Middle East, Wall Street’s winter may just be arriving.

Disclaimer

The comments, news, research, analysis, prices, and other information contained herein are provided as general market information only, to assist readers in understanding market conditions, and do not constitute investment advice. Ultima Markets has taken reasonable measures to ensure the accuracy of this material, but cannot guarantee its precision, and it may be changed at any time without notice. Ultima Markets will not accept liability for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server