90-Day Buffer Period for U.S. Treasuries? Ultima Markets: Awaits Another Signal

The U.S. and China have suspended tariff escalations and entered a 90-day consultation period, offering a reprieve to global markets. Ultima Markets believes that U.S. Treasuries, as a benchmark for global asset pricing, will see their trajectory driven by four major factors: progress in U.S.-China trade talks, Federal Reserve monetary policy, the U.S. fiscal situation, and demand for stablecoins.

On May 12, the U.S. and China reached a consensus on trade and economic issues, suspending tariff escalations and other trade restriction measures, and agreeing to intensify consultations over the next 90 days. This development has provided global markets with some breathing room but has also introduced considerable uncertainty about the future.

Against this backdrop, the trajectory of U.S. Treasuries, the anchor for global asset pricing, is under close scrutiny. Ultima Markets believes that U.S. Treasury prices currently remain in a downtrend. From a technical perspective, investors should wait for a breakout above the downtrend line before considering potential trend-following trading opportunities.

Current State of the U.S. Treasury Market

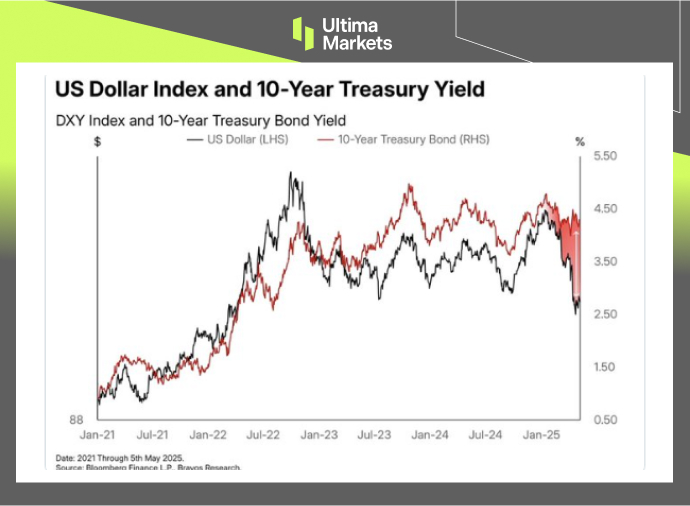

The U.S. Treasury market has recently shown complex signals. On one hand, market expectations of future Federal Reserve rate cuts are putting downward pressure on short-term Treasury yields. On the other hand, long-term Treasury yields have occasionally risen, a divergence that could weaken the effectiveness of Fed rate cuts as economic stimulus. Furthermore, the market has previously witnessed a scenario of soaring tech stocks, Treasury yields nearing highs, and a weakening U.S. dollar. This contradicts conventional logic and may point to concerns about the U.S. fiscal situation.

(When yields rise, the dollar should also strengthen, but this correlation is currently breaking down)

Elon, a senior analyst at Ultima Markets, points out that after U.S. Treasury yields broke through specific levels, an attractive “contrarian trading” buying window emerged. However, the market currently shows a relatively high degree of “coolness” towards bonds.

From a technical perspective, since the Trump administration implemented so-called reciprocal tariffs, short-term safe-haven sentiment initially pushed up 10-year U.S. Treasury prices. However, they subsequently fell sharply, and a downtrend line has now formed. The purple 13-day moving average has crossed below the green 200-day moving average, and the black 65-day moving average is also tangling with the 200-day moving average.

This implies that U.S. Treasury prices remain under short-term pressure, with no immediate signs of bullish hope. Caution is warranted as prices may continue to probe lower, potentially towards the 78.6% Fibonacci retracement level.

(US10Y, Daily Chart, Source: Ultima Markets MT5)

Potential U.S. Treasury Trends and Ripple Effects on Other Major Asset Classes

US. Treasuries, as the “cornerstone of global assets,” influence major asset classes worldwide:

Global Equities: If trade tensions ease and a dovish Federal Reserve stance prevails, driving U.S. Treasury yields lower, this would reduce the discount rate for stocks, benefiting growth stocks and boosting overall market risk appetite. Conversely, if falling Treasury yields are driven by expectations of a deep recession, or if rising yields are coupled with a weakening U.S. dollar, equity markets would face pressure.

US. Dollar Index: If the Federal Reserve’s dovishness exceeds expectations, the relative attractiveness of U.S. Treasuries would decline, potentially putting pressure on the U.S. dollar. However, if a “dollar shortage” is triggered by global risk aversion or U.S. fiscal issues (though the probability is low), the dollar could also experience a phase of strength. The traditional positive correlation between the U.S. dollar and Treasury yields has recently shown signs of cracking, requiring close attention.

Emerging Market Assets: Falling U.S. Treasury yields and a weaker U.S. dollar are generally favorable for emerging market currency appreciation, capital inflows, and equity market performance, alleviating their debt burdens. Easing trade tensions are also directly beneficial for export-reliant emerging markets. Notably, recent appreciations in the New Taiwan dollar, South Korean won, and previously the Hong Kong dollar suggest the market is now paying closer attention to Asian currencies.

Commodities: An easing of trade friction helps improve global demand expectations, supporting industrial metals, crude oil, and other commodities. During the negotiation period, if China commits to increasing purchases of U.S. agricultural products (such as soybeans) and energy products, this will directly impact the prices of these related commodities.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server