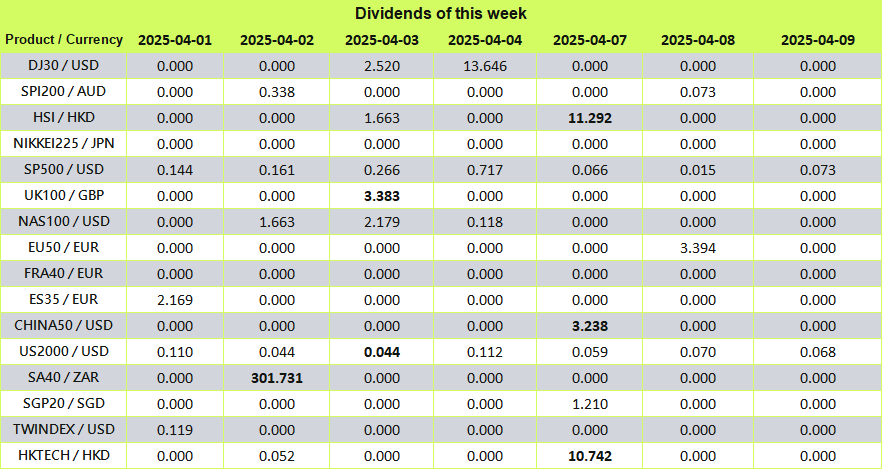

• The above data are expressed in the base currency of each index.

• According to market practice, the actual execution data may change, please refer to MT4 software for details.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact [email protected]

Unisciti all'ecosistema di trading definitivo

Ultima Markets è membro di The Financial Commission,un organismo internazionale indipendente responsabile della risoluzione delle controversie nei mercati Forex e CFD.

Tutti i clienti di Ultima Markets sono protetti da copertura assicurativa fornita da Willis Towers Watson (WTW), un broker assicurativo globale fondato nel 1828, con eleggibilità dei reclami fino a 1.000.000 dollari per conto.

INFORMATIVA SUI RISCHI

Avvertenza sui rischi: il trading su Forex e CFD comporta il rischio di perdere sostanzialmente più dell'investimento iniziale e dovrebbe essere negoziato solamente con denaro che puoi permetterti di perdere. Non possiedi né hai alcun diritto sulle attività sottostanti i derivati (come il diritto a ricevere il pagamento dei dividendi). Assicurati di comprendere appieno i rischi connessi. Il trading di prodotti con leva finanziaria potrebbe non essere adatto a tutti gli investitori. Prima di fare trading, prendi in considerazione il tuo livello di esperienza, i tuoi obiettivi di investimento e, se necessario, chiedi una consulenza finanziaria indipendente. Ti invitiamo a considerare i nostri documenti legali e ad assicurarti di comprendere appieno i rischi prima di prendere qualsiasi decisione commerciale.

Avvertenza sui consigli generali: le informazioni contenute in questo sito Web sono solo di natura generale e qualsiasi consiglio è stato preparato senza tenere conto dei tuoi obiettivi, della tua situazione finanziaria o delle tue esigenze. Di conseguenza, prima di agire in base alla consulenza, dovreste considerare l’adeguatezza di qualsiasi consulenza tenendo conto dei vostri obiettivi, situazione finanziaria ed esigenze, e dopo aver considerato i documenti legali.

Restrizioni regionali:queste informazioni o dispositivi su questo sito Web non sono diretti o offerti ai residenti di determinate giurisdizioni come Stati Uniti, Corea del Nord ecc. Per ulteriori informazioni, contattare il nostro team di assistenza clienti.

Ultima Markets, un nome commerciale di Ultima Markets Ltd, è autorizzato e regolamentato dalla Financial Services Commission "FSC" di Mauritius come intermediario di investimenti (intermediario a servizio completo, esclusa la sottoscrizione) (licenza n. GB 23201593). L'indirizzo della sede legale: 2nd Floor, The Catalyst, 40 Silicon Avenue, Ebene Cybercity, 72201, Mauritius.

Huaprime EU Ltd, registered number HE423188, and, with a business address at Georgiou Griva Digeni 122A, Kallinicos Court, Shop 1—Upper level, Neapolis, 3101 Limassol, Cyprus, is regulated by the Cyprus Securities and Exchange Commission, which has CIF license number 426/23.

Copyright © 2025 Ultima Markets Ltd. Tutti i diritti riservati.

-

Messenger

Continue on Messenger

Take the conversation to your Messenger account. You can return anytime.

Scan the QR code and then send the message that appears in your Messenger.

Open Messenger on this device.

-

Instagram

Continue on Instagram

Take the conversation to your Instagram account. You can return anytime.

Scan the QR code to open Instagram. Follow @ultima_markets to send a DM.

Open Instagram on this device.

-

Live Chat

-