1 December 2023

Ultima Markets Notification of Server Upgrade

|

Date |

Trading sessions (GMT+2) |

Trade status |

Maintenance sessions (GMT+2) |

|---|---|---|---|

2023/12/02 (Sat.) |

05:00-23:59 |

05:00 Late Open |

00:00-05:00 |

2023/12/03 (Sun.) |

00:00-23:59 |

Normal |

– |

• Any client portal and UM App functions that contain account data adjustments might be temporarily unavailable.

• During the upgrade process, the features of MetaTrader software & application, including but not limited to logging in, quoting and opening/closing positions, will be temporarily unavailable.

• There might be a gap between the original price and the price after maintenance. The gap between Pending Orders, Stop Loss and Take Profit will be filled at the market price once the maintenance is completed.

• Please refer to MT4 for the latest update on the completion and market opening time.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

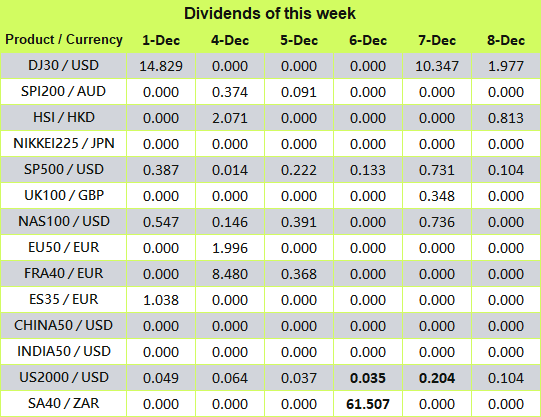

1 December 2023

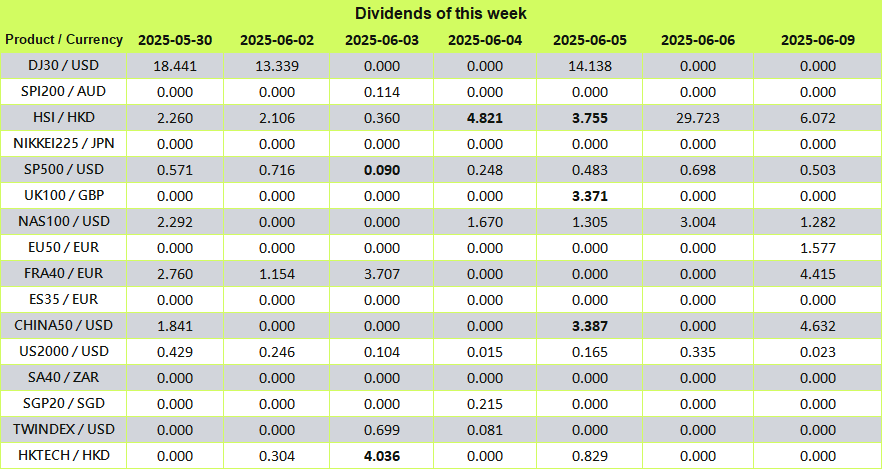

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

• According to market practice, the actual execution data may change, please refer to MT4 software for details.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact [email protected]

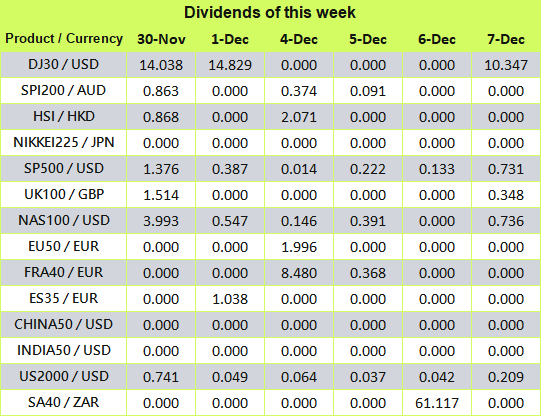

30 November 2023

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

• According to market practice, the actual execution data may change, please refer to MT4 software for details.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact [email protected]

30 November 2023

Ultima Markets – The Adjustments of Leverage for US Share

From 4th , Dec 2023

|

Product |

Previous Leverage |

Leverage after updating |

|---|---|---|

|

US share CFDs |

20:1 |

33:1 |

• The margin requirements for the above products will decrease with the leverage adjustment. The margin level may be affected; please pay attention to your trading strategy and account risk.

• Due to the inherent uncertainty in the market, please refer to the MT4 software as the primary source for executing trades and monitoring market conditions.

• The holding positions can be kept after the adjustment.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

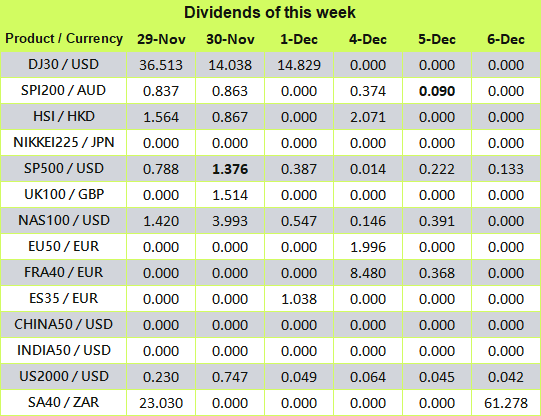

29 November 2023

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

• According to market practice, the actual execution data may change, please refer to MT4 software for details.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact [email protected]

Ultima Markets Index Dividend Adjustment Notice

Filters:

No Results

Please try a different search term.

• The above data are expressed in the base currency of each index.

• According to market practice, the actual execution data may change, please refer to MT4 software for details.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact [email protected]