Japan Inflation Persists Amid Growth Concerns and Market Volatility

TOPICSJapan’s National Consumer Price Index (CPI) data for April 2025 continues to highlight persistent inflationary pressure, adding complexity to the Bank of Japan’s (BoJ) policy outlook.

Key Inflation Metrics:

- Headline CPI held steady at 3.6% YoY, unchanged from March and well above the BoJ’s 2% target.

- Core CPI (ex. fresh food) rose to 3.5%, the highest in over two years, beating expectations of 3.4%.

- Core-core CPI (ex. fresh food and energy) increased to 3.0%, indicating broad-based price pressures.

These figures point to more entrenched inflation, extending beyond volatile components like food and energy.

Growth Concerns Complicate BoJ Policy

Despite high inflation, Japan’s economic momentum has weakened. Q1 2025 GDP contracted by 0.2%, with the annualized rate falling to -0.7%, signaling growing concerns over stagflation.

The economic weakness is largely attributed to cost-push inflation, driven by:

- Higher import costs from global tensions and U.S. tariffs

- Rising domestic wages after recent “Shunto” spring wage negotiations

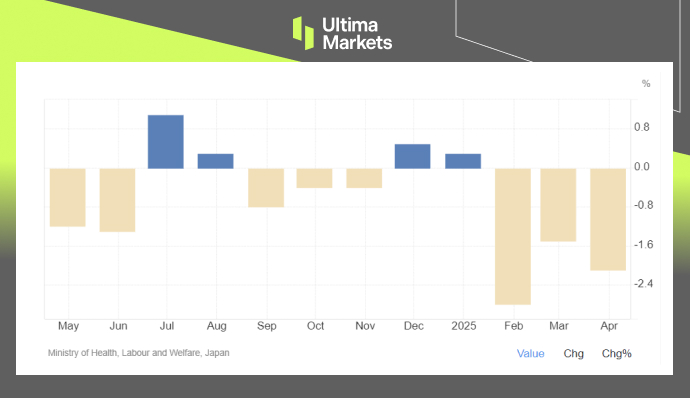

However, inflation-adjusted (real) wages have contracted over the past three months, limiting household purchasing power and complicating the BoJ’s policy decisions. Reflecting this uncertainty, the BoJ recently downgraded its economic outlook.

Japan Inflation-Adjusted Wage (Real Wages); Source: Japan Ministry

Rising Yields on Inflation and Fiscal Concerns

The Japanese Government Bond (JGB) market has seen increased volatility amid persistent inflation and growth worries:

- 10-year JGB yield: Nearing 1.65%, retesting decade highs.

- 40-year JGB yield: Surged to around 3.7%, up 100 bps since April.

These rising yields reflect investor concerns over inflation risk and fiscal sustainability, along with growing expectations of BoJ policy tightening, possibly as early as September.

Japanese Yen and Policy Outlook: Balancing Act

The Japanese Yen has found moderate support from rising domestic yields and a softer U.S. Dollar amid global yield volatility. However, the Yen’s movement remains sensitive to both domestic policy signals and global interest rate trends.

The BoJ faces a critical challenge: tightening monetary policy enough to anchor inflation expectations without triggering a deeper economic slowdown. With inflation above target but real wages and GDP growth weakening, market attention is on the BoJ’s tone in upcoming meetings.

Market Implications:

- JGBs: Expect higher yields, especially on long-dated bonds, as markets price in potential policy normalization.

- JPY: Could strengthen moderately if the BoJ maintains a hawkish stance and global yields stabilize.

- Equities: Caution advised as tighter policy and a stronger yen may pressure earnings, particularly for exporters and domestic consumption sectors.

In summary, the BoJ walks a fine line between fighting inflation and supporting growth. The coming policy meetings will be pivotal in shaping the outlook for the Yen, bonds, and Japanese markets.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server