Singapore’s Manufacturing Sector: A Resilient Recovery and Soaring Confidence

In the ever-evolving landscape of Singapore’s manufacturing sector, the latest data paints a promising picture of recovery and growth.

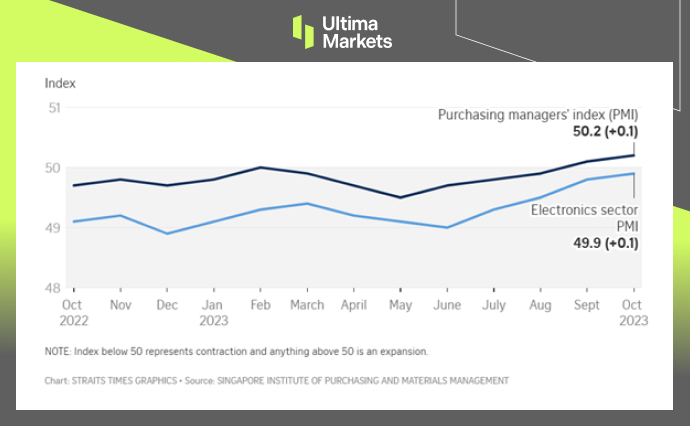

The Purchasing Managers’ Index (PMI) for October 2023 inched up slightly to 50.2, marking the second consecutive month above the pivotal 50-point threshold.

This upward trend signals a robust recovery and an expansion of factory activity, underlining the resilience of Singapore’s manufacturing landscape.

Steady Gains in Key Metrics

Crucial metrics such as factory output, new exports, and employment have witnessed positive developments, indicating a steady climb back to pre-contraction levels. This optimistic trend is particularly encouraging given the recent six-month contraction period.

Despite the challenges posed by sluggish external demand, the manufacturing sector is demonstrating its ability to adapt and thrive.

Simultaneously, the electronics sector, which accounts for approximately 40% of Singapore’s industrial output, saw its activity decline for the 15th consecutive month in October. However, the rate of decline moderated slightly, with a reading of 49.9 compared to 49.8 in September.

(Singapore Manufacturing PMI, SIPMM)

Factory Output Takes Center Stage

Factory output, a cornerstone of manufacturing vitality, has shown notable improvement. The positive momentum suggests increased production activities, reflecting not only a recovery but also a potential uptick in consumer demand.

This bodes well for the overall economic landscape, as manufacturing often serves as a barometer for broader economic health.

New Exports Signal Global Relevance

The uptick in new exports is another noteworthy aspect of Singapore’s manufacturing resurgence. Despite external challenges, the sector is positioning itself on the global stage, showcasing its resilience and adaptability.

This is a testament to the competitiveness of Singaporean products in the international market.

Employment on the Rise

A positive correlation between increased factory activity and employment growth is a pivotal marker of a thriving manufacturing sector. As the manufacturing landscape expands, job opportunities follow suit, contributing to the overall economic well-being of the nation.

Navigating Challenges: A Balanced Outlook

While the overall trajectory is positive, it’s crucial to acknowledge and address the challenges that persist. Despite improvements, input purchases and new orders continue to contract, influenced in part by the economic deceleration in China and geopolitical tensions.

Additionally, supplier deliveries have experienced deterioration, reflecting the interconnected nature of global supply chains.

Electronics Sector: A Mixed Bag

The electronics sector, a significant contributor to Singapore’s industrial output, witnessed a decline for the 15th consecutive month in October. However, the rate of decline moderated slightly, signaling potential stabilization. This nuanced perspective underscores the sector’s resilience amid external pressures.

Business Confidence: Reaching New Heights

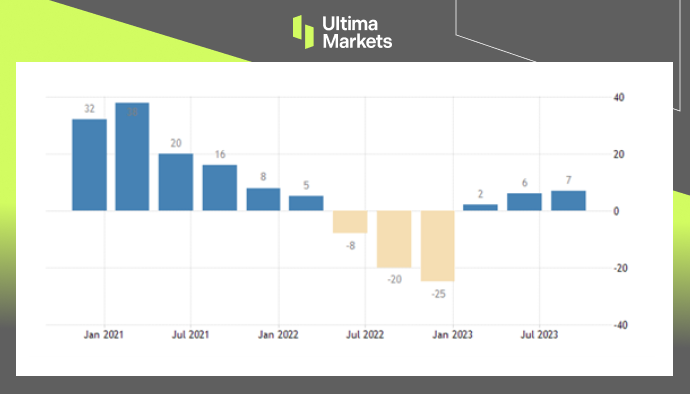

Beyond the numbers, the third quarter of 2023 brought a surge in business confidence, reaching its highest level in 18 months. This surge, from a confidence index of 6 to 7, signifies a renewed optimism within the manufacturing community.

(Business Confidence, Singapore Department of Statistics)

Electronics Industry: A Driving Force

The electronics industry, particularly the semiconductor segment, emerged as a major driver of this newfound confidence. The confidence index soared from 11 in the second quarter to an impressive 23 in the third quarter.

This surge underscores the pivotal role of semiconductors in shaping the outlook of the manufacturing sector.

General Manufacturing: Diverse Optimism

Diversification of optimism is evident in the general manufacturing sector, where an overall increase from -8 to 6 is observed. This shift is primarily attributed to positive sentiments surrounding food, beverages, and tobacco manufacturing.

The sector’s ability to adapt and pivot towards areas of demand is a testament to its resilience.

Sector-Specific Variances: A Nuanced Landscape

While overall confidence rose, specific sectors experienced divergent trends. The transport engineering sector witnessed a dip from 43 to 35, signaling a need for strategic adjustments.

Similarly, assessments for the chemicals, biomedical manufacturing, and precision engineering segments saw fluctuations, highlighting the importance of targeted strategies for sustained growth.

In conclusion, Singapore’s manufacturing sector is on a trajectory of resilience and recovery. The positive indicators across key metrics and the surge in business confidence underscore the adaptability and strength of the sector.

As challenges persist, addressing them with strategic precision will be paramount in ensuring a sustained and robust manufacturing landscape for Singapore.