U.S. Faces Trillion-Dollar Debt; Could Stablecoins Offer Support?

TOPICSThe U.S. and China have suspended tariff escalations and entered a 90-day consultation period, offering a reprieve to global markets. Ultima Markets believes that U.S. Treasuries, as a benchmark for global asset pricing, will see their trajectory driven by four major factors: progress in U.S.-China trade talks, Federal Reserve monetary policy, the U.S. fiscal situation, and stablecoin demand.

The U.S. Treasury market is undoubtedly set for an intense battle between bullish and bearish factors in the next 90 days. Ultima Markets believes thatevery step in the U.S.-China trade negotiations, policy signals from the Federal Reserve, the U.S. fiscal situation, and the passage of the GENIUS Act will be core variables influencing the direction of U.S. Treasuries.

Core Four Driving Factors for U.S. Treasury Trends in the Next 90 Days

Over the next 90 days, four major factors will be key to understanding the direction of U.S. Treasuries:

- Progress in U.S.-China Trade Negotiations and Tariff Expectations:

Over the next 90 days, the success or failure of U.S.-China negotiations will directly impact market expectations for global economic growth and inflation prospects. If progress is positive, reduced tariff pressures could theoretically help lower inflation expectations, providing some support for the bond market. Conversely, renewed friction could lead to safe-haven demand and inflation concerns, potentially pushing yields higher.

However, repeated U.S. trade tariff actions might raise concerns that foreign countries (as holders of U.S. debt) could retaliate, including by reducing their Treasury holdings. While the impact of a single country reducing its holdings is limited, with U.S. Treasury trends still primarily driven by U.S. fundamentals (economy, inflation, monetary policy), coordinated action by major economies triggered by recurring tariffs could present a significant shock.

- Federal Reserve Monetary Policy Path and Market Communication:

Statements from Federal Reserve officials regarding the future path of interest rates will be crucial. Fed Chair Powell previously hinted that the average inflation targeting policy might no longer be appropriate, which the market initially interpreted as a dovish signal. In the coming 90 days, any signals regarding the peak in interest rates, the timing of rate cuts, and the magnitude of such cuts will significantly impact short-term and even long-term interest rates.

Furthermore, the Federal Reserve emphasizes data dependence. If inflation data shows a continued cooling trend and the labor market is not overheating, it would support a dovish stance. However, if inflation resurges due to tariffs (even if suspended, previous impacts may linger) or supply chain issues, it will make the Fed’s decision to cut rates more difficult.

President Trump’s unpredictable trade policies make inflation forecasting more challenging. Even with new tariffs suspended, the pass-through effects of previous tariffs on prices may not have fully materialized. Although headline CPI might decline due to lower energy prices, persistently high core inflation (excluding food and energy) would limit the Federal Reserve’s room for monetary easing.

- U.S. Fiscal Condition and Treasury Supply/Demand:

President Trump’s “Big Beautiful Bill” passed the House of Representatives in mid-May. Although the Senate is expected to make modifications to the bill, the market does not anticipate significant changes.

Elon Musk even stated in an interview that he was very disappointed by this, hinting that previous efforts for DOGE were all in vain.

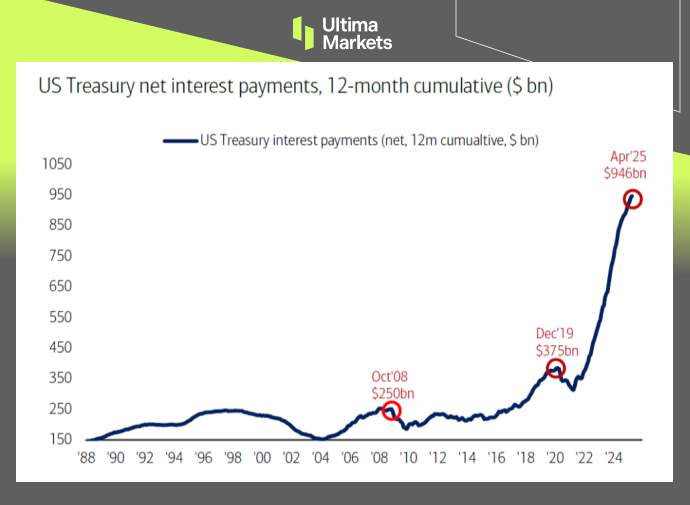

Currently, the U.S. federal budget deficit is high as a percentage of GDP, and annual net interest expense has reached a high level (nearly $1 trillion). In a high-interest-rate environment, persistent deficits and substantial interest payments themselves constitute long-term risks.

(Since 2024, annual net interest payments on U.S. debt have reached $1 trillion)

Additionally, the U.S. government is projected to issue a massive amount of Treasuries (forecasted at over $2 trillion). Against a backdrop of potentially declining purchasing appetite from major foreign buyers (such as some central banks), the question of “who will buy U.S. debt” becomes central. This could compel the Federal Reserve to intervene in some form in the future (such as restarting QE) or push up the “term premium” (where investors demand higher returns to hold long-term bonds).

Although the main conflict in the current debt ceiling issue lies in “rolling over” existing debt, if debt ceiling problems reappear in the future, it will further unsettle the market.

- Stablecoins and Other Emerging Demand:

If the U.S. stablecoin GENIUS Act is officially launched, it will clearly support U.S. Treasury prices in the future.

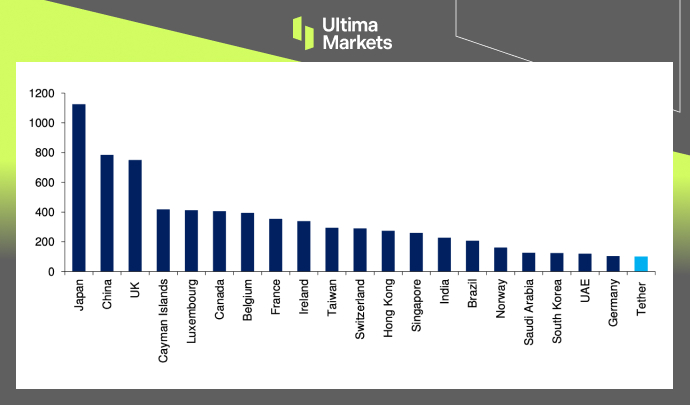

So-called “stablecoins” are a type of digital asset, with over 99% of the stablecoin market capitalization pegged to the U.S. dollar. They effectively function as money market funds supporting the U.S. short-term debt market. For example, Tether has already become a major holder of U.S. Treasuries.

The Act requires stablecoin reserves to be more heavily allocated to short-term, highly liquid U.S. dollar assets, which could create a new source of demand for short-term U.S. Treasuries.

In practice, stablecoin issuers like Tether have already become significant holders of U.S. Treasuries (especially short-term Treasuries).

As of March 2025, Tether’s holdings of U.S. Treasuries reached $98.5 billion. This figure was near zero in 2020, and Tether has now joined the ranks of major foreign holders of U.S. debt.

(As of March 2025, Tether’s holdings of U.S. Treasuries reached $98.5 billion)

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server