Pound Sinks, Gilt Yields Surge on UK Fiscal Jitters

The British Pound tumbled nearly 1% on Wednesday, hitting a six-day low against the U.S. Dollar, as investors grew increasingly concerned about the UK government’s fiscal discipline following an unexpected policy reversal and a politically charged session in Parliament.

Pound Sinks, Gilt Yields Surge

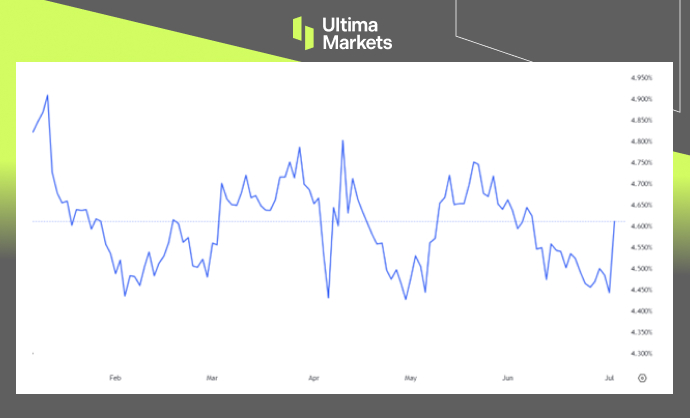

Sterling slid to 1.3600 against the US Dollar, its lowest level in two weeks, while the 10-year gilt yield briefly spiked to 4.68% before easing to 4.613% by the close. The selloff marked the steepest one-day move in UK bond markets since April 2025.

The volatility was triggered by the government’s abrupt decision to reverse £5 billion in welfare spending cuts—a core pillar of Chancellor Rachel Reeves’ fiscal strategy. The reversal has now cast doubt over the government’s commitment to its self-imposed debt reduction plan, unsettling both FX and the bond market in UK.

UK Gilt 10-Year Yields | Chart: Trading View

Reeves’ Emotional Moment Fuels Uncertainty

Chancellor Reeves’ visibly emotional appearance during Prime Minister’s Questions added to the market unease. Her reaction quickly went viral, sparking speculation about her stability in the role and the broader direction of the UK Treasury.

While Prime Minister Keir Starmer offered a firm public show of support, stating that Reeves has his “full backing,” the incident left lingering doubts among investors about internal competence within the government’s economic and fiscal credibility.

Potential Bank of England Intervention

In response to the turmoil, the Bank of England is widely expected to reassessing its recent monetary policy, amid signs that renewed bond market volatility could complicate the financial conditions.

The central bank’s next moves will be critical, especially as inflation expectations and growth concerns remain delicately balanced heading into Q3. Whereas in recent ECB central bank forum, the BoE’s Bailey delivered a more cautious tone on further easing.

“Cautious on any further Policy path changes, if Gilt volatility continues, the BoE may step in and this could lead to further volatility in the Pound.”, said Shawn, Ultima Senior Market Analyst.

Market Implication: Market Confidence Shaken, But Not Broken

GBP/USD broke below the psychological 1.3700 level and losses toward the 1.3600, while EUR/GBP spiked toward 0.8600, reflecting pound’s weakness across majors.

The developments also highlight rising risks heading into the next fiscal statement, where the Treasury will need to reassure markets that its fiscal strategy remains intact—even as it faces political pressure to ease.

“Despite this setback, the UK macro-outlook remains relatively stable—provided the government can swiftly restore policy coherence,” said Shawn, Senior Analyst at Ultima Market.

“But it’s a warning shot for UK fiscal credibility, especially with the BoE still on a cautious easing trajectory. Any misstep now could easily dent market confidence.” Shawn added.

GBP/USD Outlook: 1.3600 Key Level in Focus

Sterling extended losses against the U.S. Dollar, retreating from recent highs near 1.3790 and breaking below the key 1.3700 psychological level. However, price action continues to find support above 1.3600, marking this as a critical zone to watch.

GBPUSD, 4-H Chart Analysis | Source: Ultima Market MT5

From a technical perspective, the move reflects deteriorating investor sentiment toward the pound amid rising fiscal uncertainty. A sustained break below 1.3600 could open the door to deeper downside pressure—especially notable given the broader weakness in the U.S. dollar, which normally supports GBP strength.

Unless confidence is swiftly restored, the pair may struggle to recover, and traders will likely treat 1.3600 as the near-term make-or-break level.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server