You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Timing the Federal Reserve’s Next Interest Rate Cut in 2024

TOPICSTags: CPI, Federal Reserve, PCE, PPI, United States

The Federal Reserve, being a central bank with a dual mandate, is significantly tasked with ensuring equilibrium between inflation and employment market scenarios. Each consumer gets impacted by price fluctuations of goods and services, whether they are buying everyday commodities like milk and eggs or renting houses that are elastic to interest rates.

In the economic domain, three measures of inflation exist – the Consumer Price Index (CPI) and the Producer Price Index (PPI). The CPI evaluates the total value of goods and services bought by consumers over a specific period. On the other hand, the PPI offers a producer’s view on inflation, tracking costs associated with producing consumer goods.

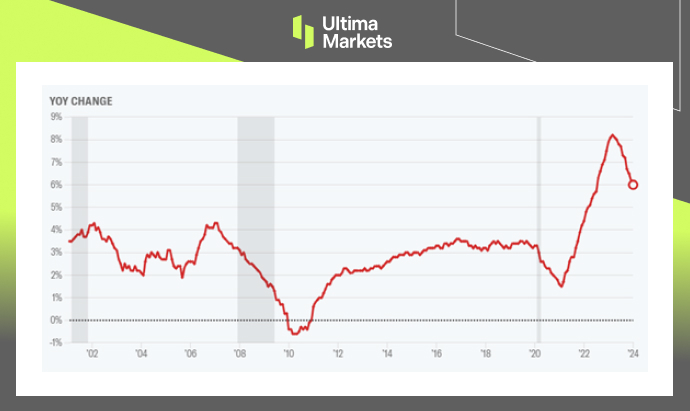

The direct impact of commodity and food prices on retail pricing makes the PPI an effective early indicator of inflationary trends. The Personal Consumption Expenditure Price Index (PCE), akin to the CPI, primarily mirrors “changes in prices.” Given its vast scope of investigation compared to the CPI, the Fed prefers the PCE for tracking inflation data since 2000.

Now let’s delve into these vital economic statistics that shape the Federal Reserve’s monetary policy:

PPI:

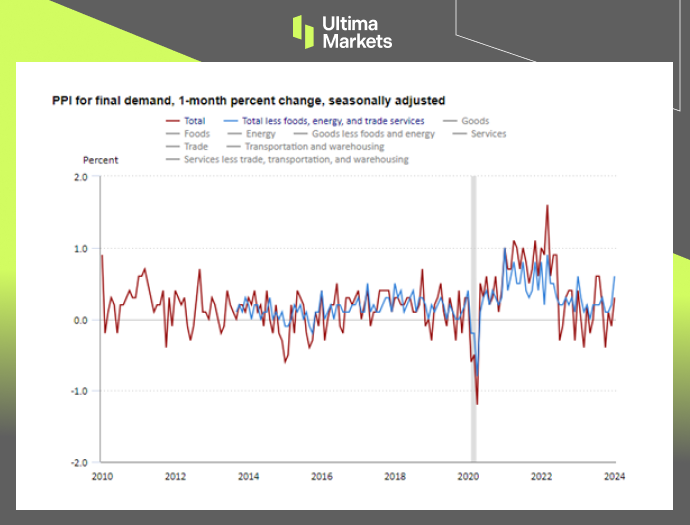

In January 2024, there was a month-over-month increase of 0.3% in producer prices for final demand in the US. This is the largest spike seen in five months, following a 0.1% decline in December. It exceeds the forecasted growth of 0.1%. Service costs went up by 0.6%, the highest surge since July, driven by a 2.2% price increase for outpatient hospital care.

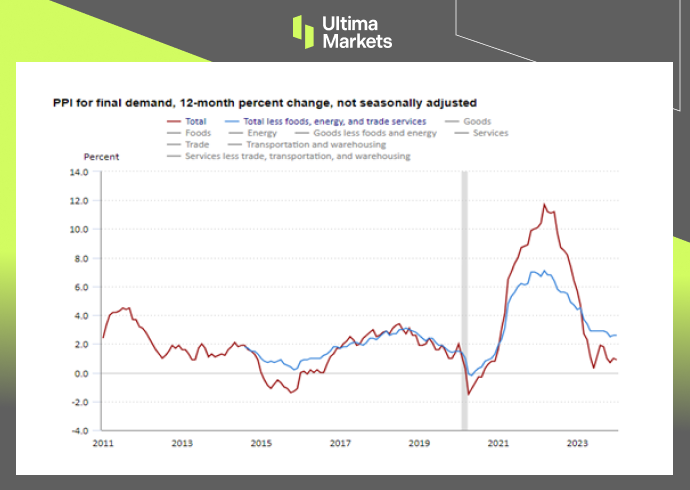

Meanwhile, goods’ prices fell by 0.2%, marking the fourth consecutive drop led by a 3.6% drop in gasoline prices. Yearly, producer prices rose by 0.9%, slightly less than December’s 1% increase, but higher than the predicted 0.6%. The core PPI, which excludes food and energy, rose by 0.5% monthly, resulting in an annual rate of 2%, both readings were above the forecast.

(Red: US PPI MoM, Blue: Core PPI MoM)

(Red: US PPI YoY,Blue: Core PPI YoY)

CPI:

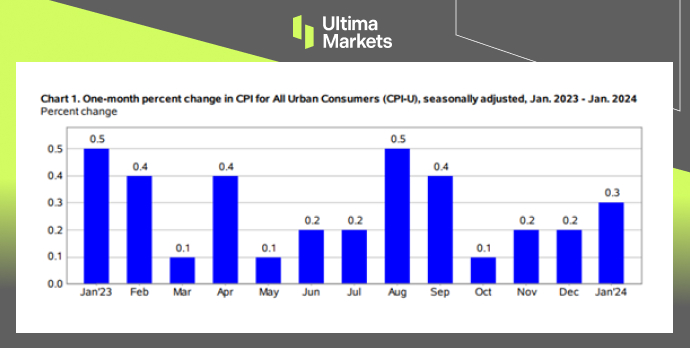

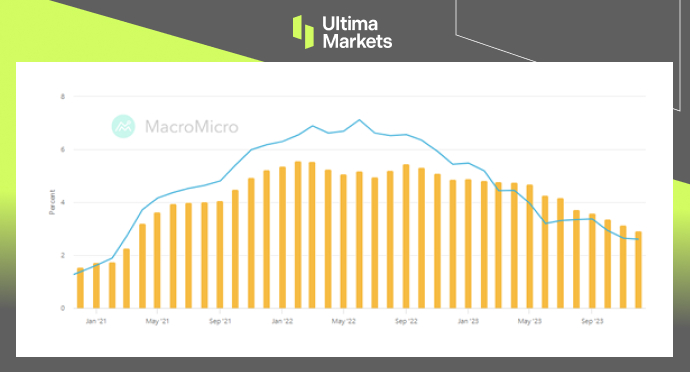

US consumer prices rose by 0.3% in January 2024 compared to the previous month. This figure was the highest in four months, surpassing December’s 0.2% increase and exceeding market expectations of 0.2%. The shelter index continued to rise, contributing to more than two-thirds of the monthly increase in overall prices.

However, the energy index decreased by 0.9%, primarily due to a reduction in gasoline prices. Monthly core consumer prices, which exclude volatile items like food and energy, grew by 0.4% in January, the highest rate since April 2023. This marked an increase from 0.3% in the previous month and was slightly above market estimates of 0.3%.

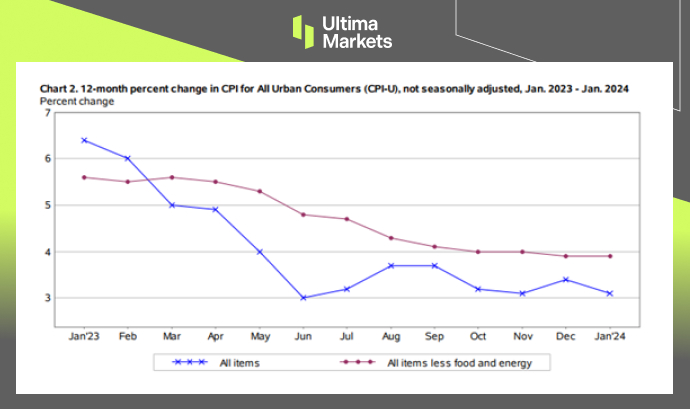

The US consumer price index rose by 3.1% year-over-year in January 2024, showing a slower growth rate compared to December’s 3.4% but still higher than the market consensus of a 2.9% increase. The annual core consumer price inflation rate in the US, excluding food and energy, reached a 2.5 year low of 3.9% in January 2024, unchanged from the previous month but higher than market forecasts of 3.7%. The shelter index increased by 6.0% over the past year, accounting for more than two-thirds of the total 12-month increase in all items, excluding food and energy.

(US CPI MoM)

(Blue: US CPI YoY,Red: US Core CPI YoY)

(Shelter Index YoY)

PCE:

In December 2023, the US personal consumption expenditure price index increased by 0.2% month-over-month, in line with market expectations and rebounding from a 0.1% decrease in November. Prices for services rose by 0.3%, while prices for goods declined by 0.2%. The annual rate remained steady at 2.6%, matching the forecast.

Concurrently, the monthly core PCE inflation, the Fed’s preferred inflation measure excluding food and energy, rose slightly to 0.2% from 0.1%, consistent with forecasts. Additionally, food prices increased by 0.1%, and energy prices showed a 0.3% rise. Finally, the yearly core inflation rate declined for the 11th consecutive month, dropping to 2.9% from 3.2%, marking the lowest level since March 2021 and coming in below the forecasted 3%.

(Blue: US PCE YoY, Yellow: Core PCE YoY)

Unemployment Rate:

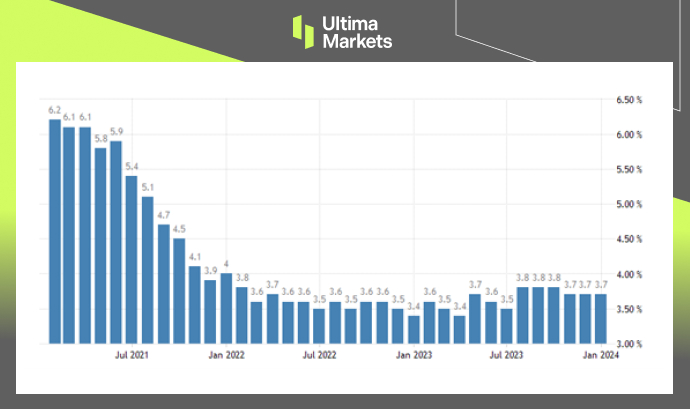

The US unemployment rate held steady at 3.7% in January 2024, unchanged from the previous month and slightly lower than the market consensus of 3.8%. The labor force participation rate also remained at 62.5%, the lowest level since February 2023. Despite the economic slowdown brought about by the pandemic, the US has been able to sustain low unemployment rates.

(US Unemployment Rate)

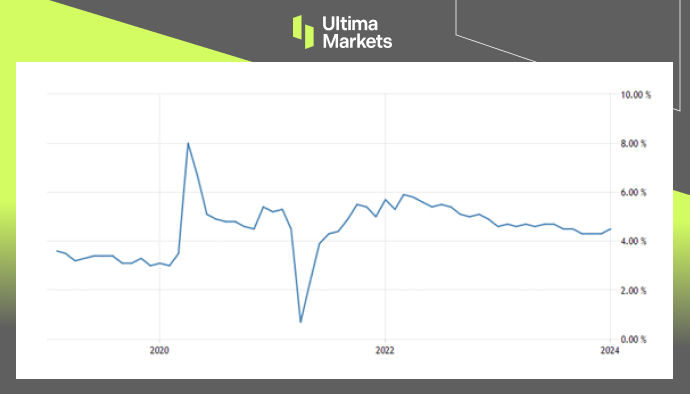

A stalwart labor market supports wage levels. Year-on-year in January 2024, the average hourly earnings for all employees on US private nonfarm payrolls saw an increase of 4.5%, higher than the prediction of a 4.1% increase. This was the largest increment in annual average hourly earnings since September 2023, leading to sustained high service costs.

(US Average Hourly Earnings YoY)

The current state of the economy could actually put upward pressure on prices for Americans. When unemployment is low, it means more people have jobs and income to spend, giving businesses more pricing power to raise their prices higher.

Conclusion:

Galvanized by domestic demand, the economy of the US maintains a monetary policy favoring high interest rates as long as feasible. However, analyzing prices and employment, which are the Federal Reserve’s prime concerns, the ongoing trend of relevant data doesn’t necessitate interest rate cuts.

Furthermore, the Fed continues to emphasize its 2% inflation target in combating stubborn inflation. The latest FOMC meeting minutes reinforced the Fed’s stance that future moves will be contingent on data, implying that tangible proof of inflation cooling must materialize before any further action is taken.

Our observations indicate that declining energy prices have majorly contributed to the moderation of inflation from its peak levels. However, factors such as rent and labor costs play a crucial role in maintaining current inflation rates, which tend to be more persistent over an extended period.

While there is widespread market speculation that the Federal Reserve may cut interest rates in June, we believe it is premature to confirm such a move as a significant deterioration in price, employment, and other economic data in the short term is unlikely.

The Federal Reserve won’t take action until the unemployment rate exceeds 4% for a consecutive few month, indicating the onset of a recession. A hasty move by the Fed may reignite future inflation pressure; an outcome they want to avoid considering the damage to their credibility in 2021 and 2022.

With the United States approaching a general election in November, it is expected that the Federal Reserve will refrain from lowering interest rates until the fall.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.