Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhen Does a Bearish Market Become Bullish in Forex

A bearish forex market becomes bullish when the price starts forming higher highs and higher lows, breaking out of a downward trend with confirmation from technical indicators like RSI moving above 30, MACD crossovers, and bullish chart patterns such as double bottoms or trendline breaks. This shift is often reinforced by fundamental catalysts, including central bank policy tightening, improving economic data (e.g. GDP, employment), or resolution of geopolitical risks.

How to Identify Bullish Signals

What does a bullish signal look like? In forex trading, a bullish signal often appears when price action forms higher highs and higher lows, breaking above key resistance levels. A commonly used technical indicator considered to be bullish is the Relative Strength Index (RSI) rising above 30 from oversold territory. Other bullish indicators include MACD crossovers, moving average breakouts, and bullish chart patterns like double bottoms or ascending triangles, all signaling potential upward momentum.

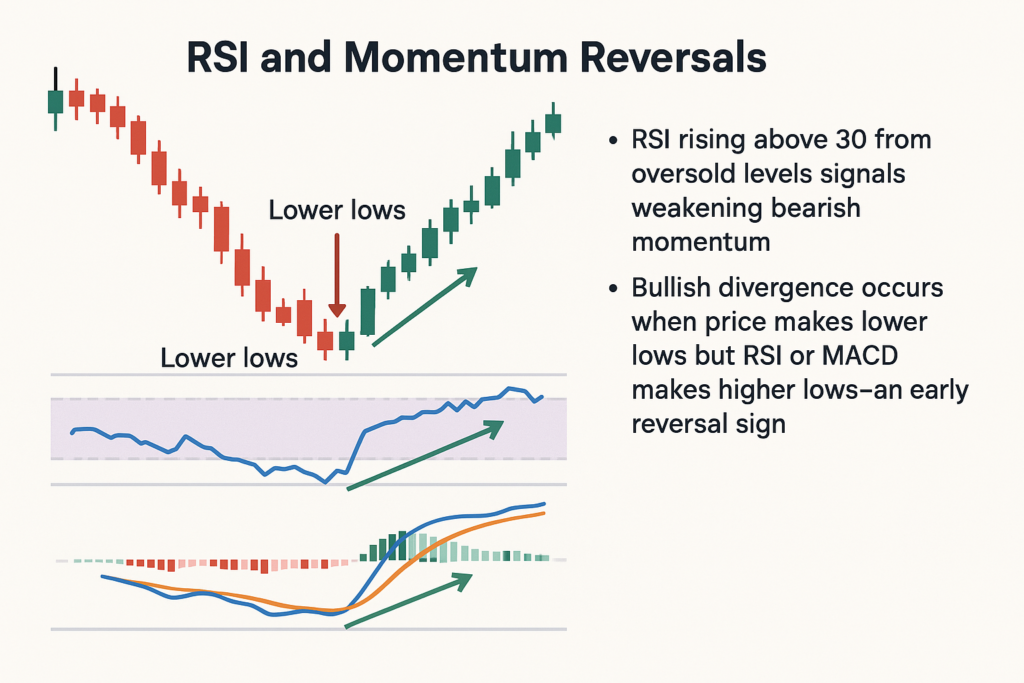

RSI and Momentum Reversals

- RSI rising above 30 from oversold levels signals weakening bearish momentum.

- Bullish divergence occurs when price makes lower lows but RSI or MACD makes higher lows—an early reversal sign.

Trendline Breakouts

- A break above a descending trendline indicates institutional buying and the end of bearish control.

- Confirm with increased tick volume or futures volume and bullish candlestick follow-through (e.g., engulfing patterns).

Moving Averages and Structure Shifts

- A break above the 200-day moving average, with price forming higher highs and higher lows, signals a shift to bullish structure.

- Use multiple timeframes (daily and weekly) to confirm trend change durability.

Spotting the Shift: From Bearish to Bullish in Forex

The transition from a bearish to bullish forex market is one of the most profitable but riskiest opportunities for traders. However, technical signals alone aren’t enough. To confirm and sustain a bullish reversal, traders must understand the fundamental events that fuel currency strength.

What Fundamental Events Trigger Forex Trend Reversals?

Forex market reversals don’t happen in isolation. They are often driven by macroeconomic shifts that impact currency valuations globally. Understanding these fundamental catalysts helps traders identify when a bearish market is not just bouncing but turning bullish with conviction.

How Central Bank Policy Changes Affect Forex

Central bank decisions are among the most powerful drivers of currency reversals. When a central bank shifts from a dovish (rate-cutting) stance to a hawkish (rate-hiking) stance, the associated currency often strengthens sharply.

Examples:

- The Federal Reserve’s rate hikes in 2022 reversed USD weakness and triggered a strong dollar rally.

- The European Central Bank’s hawkish pivot in late 2022 supported a reversal in EUR/USD.

- The Bank of England’s emergency bond purchases helped stabilize the British pound after its steep crash in September 2022.

Even changes in forward guidance how central banks communicate future intentions can lead to significant market repositioning, as traders adjust their expectations for interest rates and liquidity.

How Economic News Affects Currency Prices

What economic indicators move forex? Stronger-than-expected data releases can shift sentiment quickly and trigger bullish reversals, especially when they surprise markets:

- GDP growth above forecasts indicates stronger economic health.

- Employment reports with falling jobless rates suggest economic momentum.

- Moderating inflation signals price stability, which may lead to more hawkish policy.

Currency values often reprice immediately after such surprises, especially in high-liquidity pairs like EUR/USD or USD/JPY.

Can Geopolitical Events Reverse Forex Trends?

Yes, geopolitical developments frequently lead to sharp, sentiment-driven reversals in currency markets. Risk-sensitive currencies like the Australian dollar (AUD) and New Zealand dollar (NZD) often react to global uncertainty.

Examples include:

- The global risk-on rally after COVID-19 lockdowns eased, which helped commodity-linked currencies rebound.

- Resolutions to trade tensions or military conflicts that restore investor confidence and reverse safe-haven flows.

These changes create fertile ground for trend shifts as investors rebalance exposure across regions and asset classes.

Real-World Examples of Bearish to Bullish Forex Reversals

EUR/USD Recovery in 2022

- Bottomed at 0.9535 in Sept 2022

- Reversal driven by ECB tightening, falling energy prices, and declining recession risks

- Confirmed by double bottom, RSI divergence, and 200-day MA breakout

GBP/USD Flash Crash & Recovery

- Hit 1.0350 in Sept 2022 amid fiscal panic

- Reversed after BoE emergency bond market support

- RSI rebounded from below 20; bullish engulfing pattern and policy stability followed

USD/JPY Reversal After BOJ Intervention

- Peaked at 151.95 in Oct 2022

- Reversed sharply after Bank of Japan’s rare FX intervention

- Bearish engulfing on daily chart and break of short-term support signaled trend shift

Best Scale-In Strategies for Forex Market Reversals

Entering gradually allows you to manage risk during volatile trend shifts:

- Start with small positions during the early signs of a bullish reversal

- Add positions at major technical confirmation points, such as resistance breakouts or moving average crossovers

Risk Management Tips for Trading Forex Reversals

Risk control is critical when volatility is high:

- Use low leverage in early phases of trend transition

- Set dynamic stop-losses just below recent support zones

- Diversify across uncorrelated pairs to reduce directional risk (e.g., EUR/JPY vs AUD/USD)

Conclusion

Catching a bullish reversal in forex isn’t about guessing the bottom. It’s about recognizing the shift when the clues start to line up. From RSI breakouts to central bank moves, the signs are there if you know where to look. The key is patience, confirmation, and having the right tools to act with confidence.

That’s where Ultima Markets comes in. Whether you’re watching price action unfold or planning your next entry, Ultima gives you powerful analysis tools and insights that help you stay ahead of the trend.

Markets are always changing but with the right approach and support, you don’t just react to reversals, you capitalize on them. Ready to trade the next bullish turn with confidence? Ultima Markets is here to help you every step of the way.

FAQ

How long does it take for a bearish forex market to become bullish?

It usually takes weeks to months, depending on macro conditions and confirmation signals across timeframes.

Does a 20% rally confirm a bull market in forex?

Unlike stocks, forex doesn’t rely on fixed percentages. Instead, traders look for higher highs/lows, volume, and macro support.

Can a bullish reversal happen without economic improvement?

Yes, but it’s often short-lived. Sustainable bullish trends usually need support from GDP growth, inflation control, or central bank policy.

What forex pairs show the clearest reversal signals?

Pairs like EUR/USD, GBP/USD, and USD/JPY are more liquid, better structured, and respond well to fundamentals—making reversals clearer.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.