Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWhat Is a Premium Wick ICT?

A premium wick in ICT (Inner Circle Trader) methodology refers to the upper part of a candlestick that extends into the premium pricing zone, typically above the 50% equilibrium level of a defined price range. These wicks represent failed bullish attempts, suggesting that institutional traders stepped in to sell, creating strong signals for potential price reversals.

Key Takeaways

- Premium wicks form above the 50% equilibrium, signaling rejection from overvalued price zones.

- They indicate smart money activity and potential reversals.

- Often form at swing highs, order blocks, or liquidity zones.

- Used with other ICT tools like Fair Value Gaps (FVGs) and market structure.

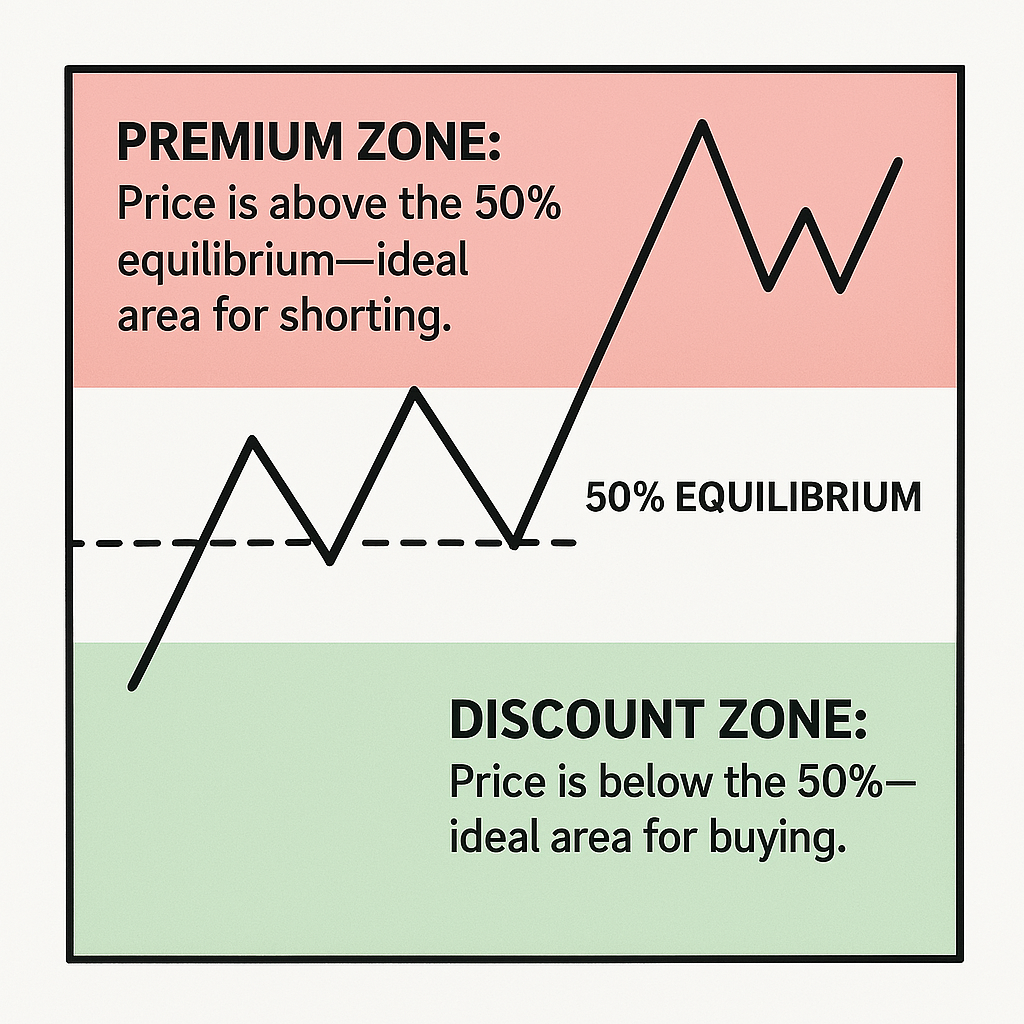

Discount vs Premium Trading Zone in ICT

In ICT:

- Premium Zone: Price is above the 50% equilibrium—ideal area for shorting.

- Discount Zone: Price is below the 50%—ideal area for buying.

A premium wick is the candlestick formation that happens inside that zone, showing that price was rejected. Premium wicks happen when the price moves into an expensive area but can’t stay there. Instead, it drops back down, leaving a long upper wick. This often tricks retail traders into buying too high, while big institutions are actually selling.

Why Do Premium Wicks Work

Institutions prefer to trade where there’s plenty of liquidity, usually in overvalued areas known as premium zones. When price reaches these zones, retail traders often start buying, thinking price will keep rising.

This is where smart money steps in.

Institutional traders sell into that retail buying pressure, creating a long upper wick as price gets rejected and closes lower. This wick is a clear sign that institutions are offloading positions or entering shorts.

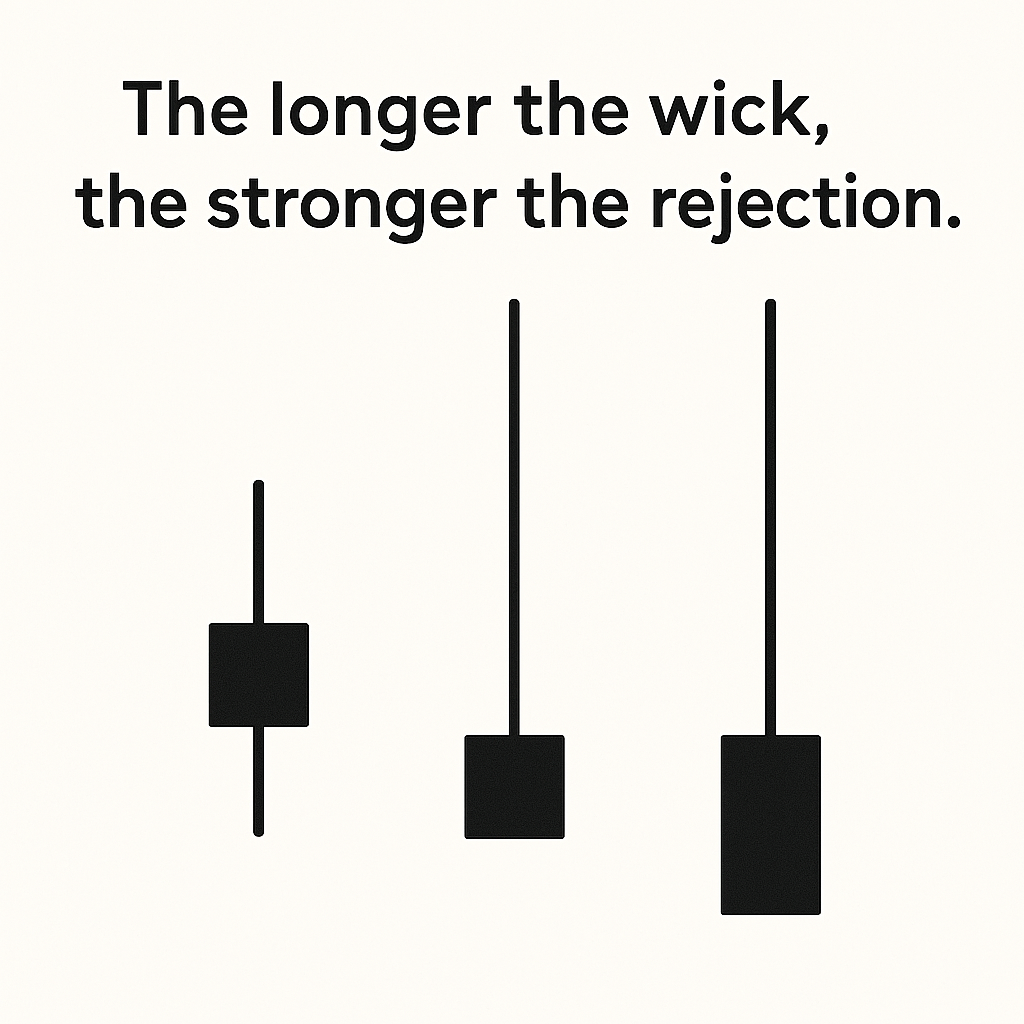

- The longer the wick, the stronger the rejection.

- Premium wicks often appear during high-liquidity times like the London or New York Killzones.

How to Identify Premium Wick in ICT

To identify a valid premium wick in ICT trading, focus on candles where the upper wick clearly extends into the premium zone above the 50% equilibrium level of a defined price range. These wicks should appear near key liquidity levels like previous highs or order blocks and must show signs of strong rejection, such as a bearish follow-up candle or break of structure. Always confirm the setup aligns with the higher timeframe bearish bias to increase the probability of success.

- Wick extends well above the body of the candlestick.

- Occurs in a clear premium zone between 62%–88% using Fibonacci retracement.

- Confirmed by bearish follow-through, such as Fair Value Gaps (FVGs) or Break of Structure (BOS).

- Appears near key levels like previous swing highs, liquidity pools, or order blocks.

- Matches the higher timeframe bearish bias.

How to Identify Premium Zones

To find a premium zone in ICT trading, follow these simple steps:

- Use a Fibonacci retracement tool – draw it from the recent swing low to swing high on your chart.

- Mark the 50% level – this is called the equilibrium, the halfway point of the move.

- Everything above 50% is the premium zone – price is considered overvalued here. Focus especially on the 62% to 100% range for high-probability rejection.

- Use higher timeframes like the 4-hour or daily charts – these give stronger and more reliable zones for premium wick setups.

This helps you spot where institutional traders are likely to step in and reject overpriced levels.

Premium Wicks vs Other ICT Patterns

| Feature | Premium Wick | Order Block | Rejection Block |

| Focus Area | Wick above 50% | Zone of interest | Zone of rejection |

| Entry Precision | High | Medium | Medium |

| Works Best With | FVG, BOS | FVG, Liquidity | Structure shifts |

Premium wicks provide precision, while other patterns provide context. Used together, they increase trade probability.

Which Time Frame is Best for Premium Wick Forex?

While premium wicks appear on all timeframes, the most reliable ones form on the H1, H4, and Daily charts. These show true institutional activity and reduce noise seen on lower timeframes.

- H1 (1-hour): Offers a balance between precision and confirmation. Many ICT traders use this timeframe for entries once premium wick setups align with structure and liquidity zones.

- H4 (4-hour): Helps confirm premium wick validity by revealing stronger institutional rejection and providing broader market context.

- Daily: Ideal for identifying major swing points, premium zones, and bias direction. Wicks formed here often indicate significant distribution by smart money.

Conclusion

Premium wicks aren’t just random spikes. They’re institutional footprints showing where smart money is likely entering. By learning to spot and trade these formations using ICT tools like FVGs, order blocks, and market structure, you align with institutional order flow and increase your trading edge.

For consistent results, always combine premium wick analysis with context, confirmation, and higher timeframe bias.

Ready to sharpen your trading strategy with ICT? Visit Ultima Markets for expert tools and real-time insights.

FAQ

What is a premium wick in ICT trading?

It’s the upper shadow of a candle that extends into premium price territory, signaling potential reversal due to smart money selling.

How do I know it’s valid?

Wick forms above 50%, aligns with higher timeframe bias, and is confirmed by bearish follow-through.

Can I use premium wicks in crypto or indices?

Yes. ICT principles apply across markets.

Are they always bearish signals?

In premium zones, yes. But confirmation is critical.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.