Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteHow to Trade TWD Currency Pairs? Master Forex Strategies

In 2025, Taiwan’s forex market remained active, with TWD trading volume surging to nearly USD 40 billion in April, ranking it among Asia’s top ten currencies by volume. Against the backdrop of heightened global economic volatility, TWD attracts international investors due to Taiwan’s robust economic structure and the strategic importance of its semiconductor industry.

This article provides an in-depth analysis of the factors driving TWD exchange rates, the latest trading strategies, and market dynamics in 2025 to help investors seize key opportunities.

What Is TWD?

TWD (New Taiwan Dollar) has been Taiwan’s legal currency since the 1949 reform. Issued and managed by the Central Bank of Taiwan, it uses a “monetary targeting system” to control inflation and support economic growth. Although Taiwan is not a G7 or major economy member, its export-driven economy and the global influence of its semiconductor industry make TWD one of Asia’s safe-haven currencies.

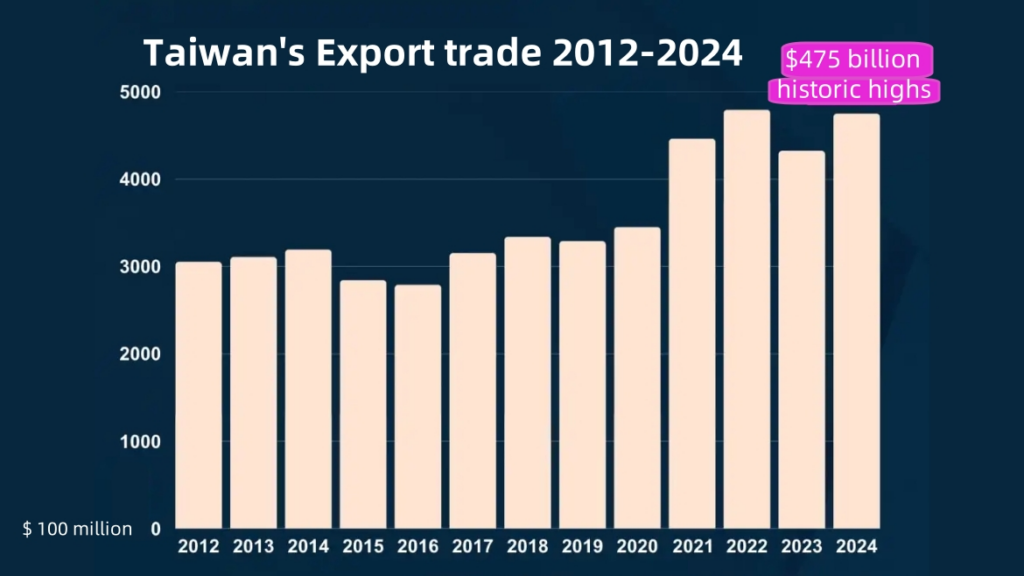

Statistics show that Taiwan’s export volume reached USD 475 billion in 2024, ranking it as the world’s 16th largest exporter, with semiconductor output continuing to grow. Against this economic backdrop, TWD is not only a key currency for trade settlement but also a closely watched asset among international forex traders.

*Data Source: Ministry of Finance

Key Factors Affecting the TWD Exchange Rate

1. Taiwan’s Economic Fundamental

Taiwan has a sound economic system. According to data from Taiwan’s Directorate-General of Budget, Accounting and Statistics, GDP growth is projected at 3.2% in 2025, mainly supported by technology exports and stable domestic demand. This growth provides strong support for the TWD exchange rate.

2. Central Bank Monetary Policy

Taiwan’s central bank generally maintains a relatively stable interest rate policy, keeping the benchmark rate steady at 1.875% as of May 2025. However, it uses foreign exchange reserves (over USD 600 billion) to regulate market liquidity and curb speculative trading.

Interest rate differentials directly influence capital inflows and outflows, driving TWD’s appreciation or depreciation trends.

3. US Dollar Trends and International Environment

TWD/USD is one of the primary trading currency pairs. When the US dollar index strengthens, TWD often faces depreciation pressure; conversely, it may appreciate when the dollar weakens.

After the US imposed tariffs on China, Taiwan’s business shift increased demand for TWD, but if the US expands tariffs on Taiwan (e.g., semiconductors), it could trigger foreign capital outflows. Additionally, cross-strait relations and other geopolitical issues can disrupt TWD’s short-term trends.

4. Foreign Capital Movements and Market Sentiment

In 2024, foreign net capital inflows reached USD 37.196 billion, a historical high, putting upward pressure on TWD. However, Federal Reserve interest rate hikes could reverse capital flows.

Popular TWD Currency Pairs and Their Characteristics

USD/TWD

The most liquid currency pair with the most stable spreads, suitable for intraday and mid-term traders. Due to its high sensitivity to US economic conditions and policies, it is recommended to analyze it in conjunction with US economic data and local Taiwan news.

TWD/CNH

An excellent tool for monitoring cross-strait capital flows and trade changes. Especially in 2025, with continued international focus on the Taiwan Strait situation, this pair’s volatility offers opportunities for arbitrage strategies.

TWD/JPY, TWD/EUR

Although trading volumes are lower compared to USD pairs, these currency pairs can be used to hedge Asian market risks or for mid- to long-term investment positioning.

�� Note: Trading TWD pairs through Ultima Markets offers spreads starting from 0 pips, significantly reducing trading costs and enhancing profit potential.

Three Major Advantages of Trading TWD Forex

1. Strong Economic Fundamentals

Taiwan’s average annual economic growth rate is 3.2%. Last year, the unemployment rate averaged 3.38%, the lowest in 24 years, while the trade surplus expanded to USD 80.6 billion due to semiconductor export growth.

2. High Policy Transparency

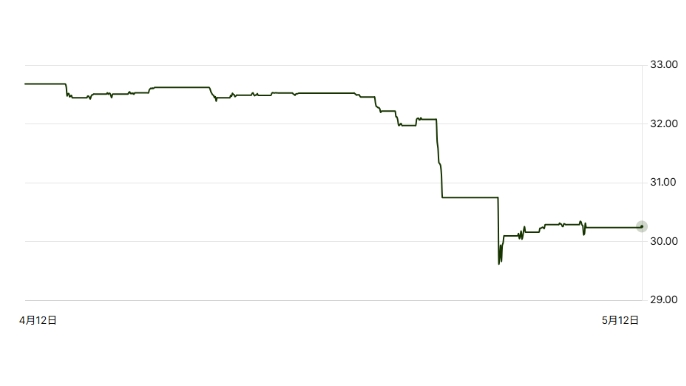

In May 2025, Taiwan’s central bank governor Yang Chin-long emphasized that there is “no currency manipulation” and stabilizes the market through timely interventions. For example, after TWD/USD surged nearly 8% within two days, the central bank released dollar reserves to curb excessive volatility.

3. Ample Liquidity

TWD’s daily trading volume has risen significantly, suitable for short-term and swing trading. For instance, the 1-month implied volatility of USD/TWD spiked to 16.0 in May 2025, creating high-yield opportunities for technical traders.

TWD Trading Techniques and Practical Strategies

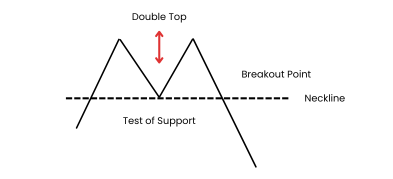

Technical Analysis-Based TWD Strategies

- Use moving averages (MA) to determine mid-term trends

- Use RSI indicators to identify overbought and oversold conditions

- Use Bollinger Bands to observe breakout signal

For example, in May 2025, TWD/USD fluctuated between 30.25 and 31.50. Combining Bollinger Bands with RSI indicators helps identify overbought and oversold points. Designing option portfolios using the 1-month implied volatility (currently 14.0) can effectively hedge exchange rate risk.

News-Based Trading

Combine central bank policy meetings, GDP releases, export data, and other events for “event-driven trading.” If the Taiwan central bank signals a dovish stance, TWD may face short-term depreciation pressure, making it favorable to go long on USD/TWD.

For example: monitor Taiwan’s central bank quarterly meetings (next scheduled for June 2025) and US non-farm payroll data. In April 2025, non-farm payrolls increased by 177,000, strengthening the US dollar and pushing down the TWD/USD exchange rate.

Risk Management Recommendations

- Control single trade positions to no more than 5% of total capital

- Set strict stop-loss orders: Based on historical volatility, it is recommended to keep TWD trading leverage below 10x

- Diversify currency pairs: Besides USD/TWD, allocate TWD/CNY (interest rate differential approx. 1.2%) to balance risk

- Regularly adjust trading strategies to avoid blind chasing of prices

With UM’s Demo Account feature, you can test various strategies risk-free and familiarize yourself with TWD trading rhythms before entering live markets.

Why Choose Ultima Markets to Trade TWD?

When selecting a trading platform, safety, trading costs, and system stability are key factors. Ultima Markets stands out with clear advantages in these areas:

1. Secure Fund Protection

- Client funds are segregated and held at Australia’s WESTPAC Bank

- Additional insurance coverage up to 1 million USD

- Members are supervised by the Financial Commission (FinaCom), with compensation protection up to 20,000 EUR

2. Ultra-Low Trading Costs

- ECN account spreads starting from 0.0 pips, commissions as low as 3 USD per lot

- Supports various TWD currency pairs, with costs much lower than typical platforms

3. Professional Platform and Analytical Tools

- Supports MT4, MT5, WebTrader, and Ultima Markets’ proprietary app

- Built-in Trading Central analysis plugin for real-time tracking of TWD technicals and fundamentals

4. Demo Account Availability

- Offers 100,000 USD demo funds

- Practice trading TWD currency pairs without any deposit required

- Suitable for beginners to practice or advanced traders to test strategies

5. Localized Chinese Service and Educational Resources

- 24/7 Chinese customer support for timely response

- Webinars and market analysis help users grasp key points of TWD trading

2025 TWD Exchange Rate Outlook and Investment Recommendations

1. Short-term Volatility Range Forecast

- TWD/USD: Influenced by US-Taiwan interest rate differentials, expected to fluctuate between 30.00 and 32.00. If the US raises interest rates, it may test the 30.00 support level.

- TWD/CNY: With China’s economic recovery slowing and the yuan under pressure, TWD/CNY is expected to rise toward 0.2300.

2. Long-term Investment Strategies

- Carry Trade: TWD arbitrage attracts capital due to the Taiwan-US interest rate gap, but exchange rate volatility risk remains high (e.g., losses if TWD breaks above 30). If the Fed cuts rates and Taiwan maintains steady policies, the narrowing interest rate gap may reverse trade directions.

- Hedging Allocation: Allocate 10%-15% of assets into TWD-denominated bonds to hedge against global inflation risks.

Frequently Asked Questions (FAQ)

Q1: Are TWD currency pairs more suitable for short-term or long-term trading?

A: USD/TWD is well-suited for short- to mid-term trading. Combining technical analysis with news-based strategies can improve win rates. TWD/CNH and TWD/JPY, on the other hand, are better for medium- to long-term investment positioning.

Q2: What are the risks involved in trading TWD?

A: Besides exchange rate volatility, traders should watch out for cross-strait political tensions and shifts in global market sentiment that could impact capital flows.

Q3: Does Ultima Markets support TWD deposits?

A: Yes, UM supports multiple local currency deposit methods, including credit cards, bank wire transfers, and e-wallets. TWD currency conversion is also available, offering high convenience.

Conclusion

TWD trading is no longer just a tool for exporters—it has become a new profit avenue for global traders. As Asia-Pacific financial markets grow increasingly complex in 2025, mastering the rhythm of TWD currency pair movements allows you to navigate risks and seize opportunities with confidence.

By choosing a professional forex platform like Ultima Markets, you can trade TWD/USD, TWD/CNH, and other currency pairs with low costs, high efficiency, and robust fund protection, ensuring a premium trading experience every step of the way.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.