Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomGold vs S&P 500, Which is Better?

When it comes to long-term investing, one of the most common debates is gold vs S&P 500. Investors often ask which asset offers better returns, more stability, and greater protection against inflation. This article dives deep into a gold vs. S&P 500 investment comparison, analyzing performance over the last 10 and 20 years to help you make smarter financial decisions.

Key Takeaways :

- Gold outperformed the S&P 500 over the last 20 years (433% vs. 358%), driven by crisis periods and inflation spikes.

- S&P 500 outperformed gold over the last 10 years (175% vs. 100%), showing stronger returns in growth cycles.

- Gold is a safe-haven asset, offering stability during economic uncertainty and inflationary periods.

- The S&P 500 provides higher long-term growth, but comes with higher volatility and market risk.

- Diversification matters: combining both assets in a portfolio can improve risk-adjusted performance.

- Gold performs better during inflation, while stocks thrive in expanding economies.

What Is Better Investment: Gold or S&P 500?

Choosing between gold and the S&P 500 depends on your financial goals and risk tolerance. Gold offers stability, inflation protection, and portfolio diversification, making it ideal for conservative investors or uncertain markets. The S&P 500, on the other hand, provides higher long-term returns through capital growth but carries more volatility. Most experts recommend a mix of both to balance risk and reward.

Nature of the Asset

- Gold is a tangible commodity, valued for its scarcity and use as a store of value.

- S&P 500 is a stock market index that tracks 500 of the largest U.S. companies. It represents the equity market and corporate profitability.

Investment Purpose

- Gold is often seen as a safe-haven asset, especially during market volatility.

- The S&P 500 is growth-focused, aiming to generate returns through economic and corporate expansion.

Volatility and Risk

- Gold tends to be less volatile but can underperform during economic booms.

- The S&P 500 is more volatile but historically delivers strong long-term gains.

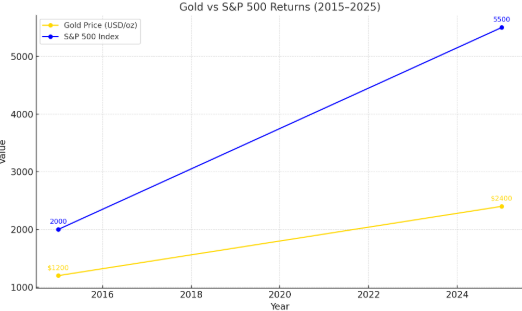

Gold vs S&P 500 Returns Last 10 Years

Over the past decade, the S&P 500 delivered stronger returns compared to gold, driven by a prolonged bull market and corporate earnings growth. While gold doubled in value due to inflation and global uncertainty, the S&P 500 saw nearly 175% gains, excluding dividends, highlighting its strength as a growth asset.

From 2015 to 2025:

- Gold rose from around $1,200 per ounce to about $2,400, delivering a 100% return.

- S&P 500 climbed from approximately 2,000 points to over 5,500, a 175% return, excluding dividends.

Over the past decade, the S&P 500 outperformed gold in pure returns. However, gold showed resilience during inflationary spikes and geopolitical crises.

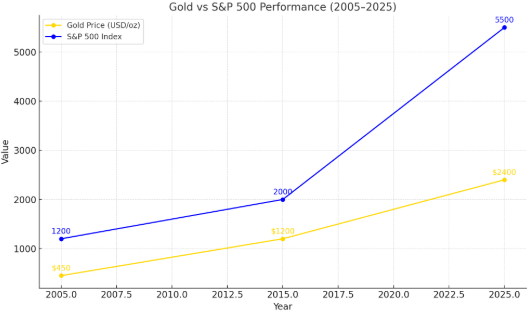

Gold vs S&P 500 Returns Last 20 Years

Over the last 20 years, gold slightly outpaced the S&P 500 in total returns, mainly due to strong gains during financial crises and inflationary cycles. While the S&P 500 rebounded strongly post-2008 and during tech-driven bull markets, gold’s performance during periods of economic stress helped it maintain a competitive edge.

From 2005 to 2025:

- Gold surged from around $450 to $2,400, a 433% increase.

- S&P 500 moved from roughly 1,200 to 5,500, about a 358% increase.

Over 20 years, gold outpaced the S&P 500, especially due to gains during the 2008 financial crisis and recent inflation-driven rallies.

Is Gold Safer Than the Stock Market?

While the S&P 500 offers higher average returns, gold provides strong risk-adjusted returns due to its lower volatility. Many financial advisors recommend holding 5% to 15% of a portfolio in gold to balance equity risk.

- Gold typically rises during crises and acts as a hedge against currency devaluation.

- The S&P 500, while offering growth, is vulnerable during recessions or bear markets.

Historically, gold has outperformed stocks during crises like 2008 and the COVID-19 crash, but underperformed during extended bull markets.

Gold vs S&P 500 During Inflation

Gold is known as one of the best inflation hedges. During high inflation periods, such as the 1970s or 2020–2022, gold significantly outperformed equities.

- Example: From 2020 to 2022, during U.S. inflation spikes, gold rose ~20%, while the S&P 500 experienced increased volatility.

- In the 1970s, gold increased over 1,000% while equities lagged behind due to stagflation.

Should You Buy Gold or Invest in the S&P 500?

It depends on your investment objectives.

- If you’re seeking long-term capital growth, the S&P 500 may be more suitable.

- If your focus is wealth preservation and inflation protection, gold remains a solid choice.

- Ideally, a diversified portfolio including both assets offers the best of both worlds.

Portfolio Diversification: Gold and Stocks Together

Combining both assets enhances diversification and reduces overall portfolio risk.

- Historical studies show that portfolios with 10%–15% gold allocation tend to have better risk-adjusted performance during volatile markets.

- Gold’s negative correlation to equities makes it a strategic hedge.

Conclusion

The debate of gold vs S&P 500 isn’t about picking one over the other. It’s about understanding your investment goals. Over the last 10 years, the S&P 500 has led in growth. But over 20 years, gold has proven to be a reliable store of value. In a well-balanced portfolio, both assets have their place.

To explore diversified strategies and professional tools for managing your portfolio, visit Ultima Markets, your trusted partner in navigating global markets.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.