Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomGBP Trading Guide: Trends & Strategies in 3 Mins!

In the global forex market, GBP (British Pound) has long been one of the most prominent major currencies. Entering 2025, with shifts in the UK’s economic landscape, easing inflation, and adjustments in interest rate policies, GBP trends have drawn significant attention from investors. This article will take you through the current status of GBP, trading opportunities, and risk management, and explain how to trade the Pound efficiently via Ultima Markets, helping you seize every opportunity in the GBP market.

Introduction to GBP: Overview of the British Pound

What is GBP?

GBP (Great British Pound) is the currency code for the British Pound, with the symbol “£”. It is the official currency of the United Kingdom and is also widely used in Gibraltar, Saint Helena, and the Falkland Islands. As one of the oldest currencies still in use today, GBP ranks as the fourth most traded currency in the forex market—following the USD, EUR, and JPY.

GBP’s Global Standing

With London being the world’s largest forex trading hub, GBP holds a pivotal position in the international financial system. According to the Bank for International Settlements, the average daily trading volume of GBP is approximately $325 billion. The UK’s economic scale, openness of its financial markets, and stable political environment all contribute to strengthening GBP’s global influence.

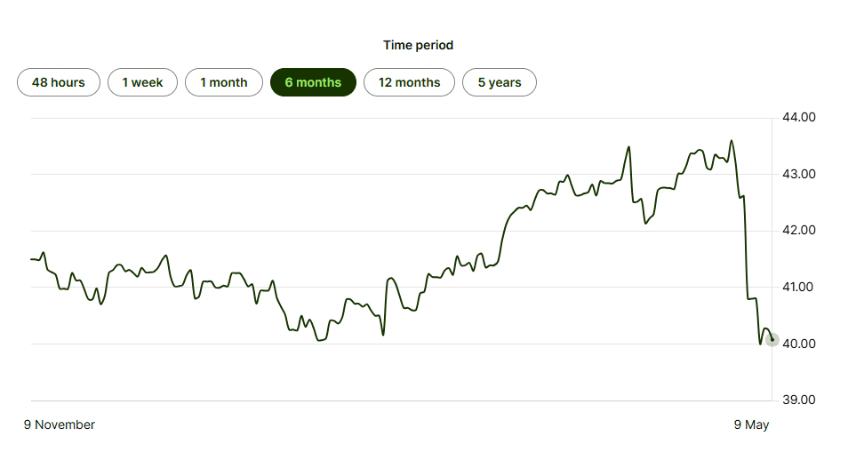

GBP to TWD: Exchange Rate Overview

While GBP/TWD is not considered a major currency pair, it still draws attention in Taiwan. As of April 29, 2025, the GBP/TWD exchange rate hovers around 1 GBP to 43.3 TWD. Though direct trading of this pair is limited, investors can flexibly engage through professional forex platforms like Ultima Markets, using cross-rates between GBP/USD and USD/TWD.

The main factors influencing GBP/TWD fluctuations include the interest rate differential between the UK and Taiwan, movements in the US Dollar Index, policies of Taiwan’s central bank, and key economic data from the UK.

Key Factors Influencing GBP Trends

UK Economic Data

Indicators such as GDP growth, unemployment rate, retail sales, and CPI inflation are vital in assessing the health of the UK economy. Monthly data releases often trigger short-term volatility in GBP and influence overall market confidence and valuation of the currency.

Bank of England (BoE) Interest Rate Decisions

The BoE’s benchmark interest rate is a major driver of GBP performance. In Q1 2025, the Bank of England maintained its rate at 4.5%, with market expectations pointing to a possible slight cut in the second half of the year to stimulate economic growth. Such policy expectations directly impact GBP’s short-term movement against other currencies.

Political Risks and Geopolitical Events

In 2025, close attention should be paid to domestic policy adjustments in the UK, as well as geopolitical developments in Europe, including the situation in Ukraine and UK-EU trade negotiations. These factors may lead to significant GBP volatility. Political stability in 2025 will be a crucial condition for GBP’s continued strength.

Global Risk Sentiment and US Dollar Trends

As the world’s primary reserve currency, the strength of the US dollar plays a key role in GBP/USD performance. When market risk appetite increases, capital may flow into higher-yield currencies such as GBP; conversely, during risk-off periods, funds tend to move toward safe-haven assets like the USD.

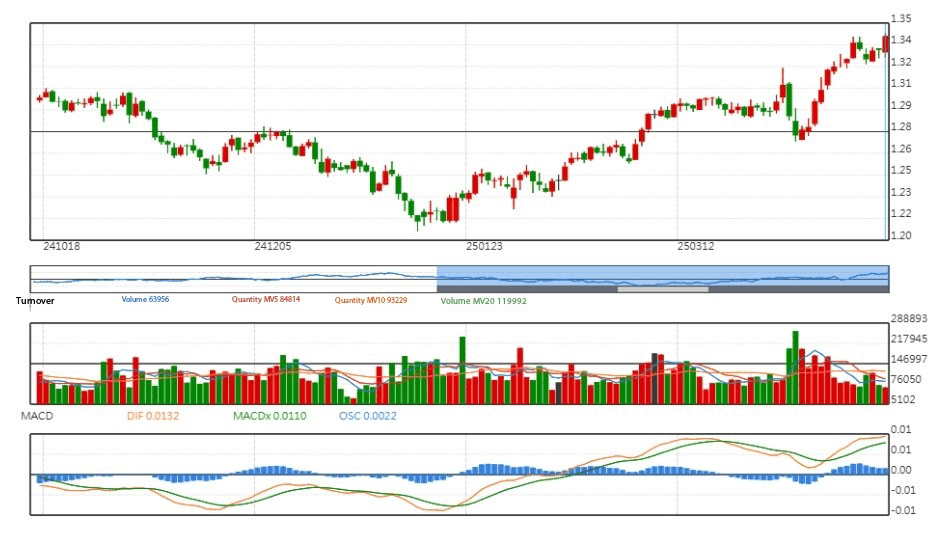

▲Recent GBP/USD Technical Chart

Major GBP Currency Pairs and Their Characteristics

GBP/USD: British Pound vs. US Dollar

GBP/USD is one of the most popular GBP currency pairs, known for its strong liquidity, accounting for over 60% of GBP trading volume in the global forex market. It is suitable for swing trading.

- Characteristics: High liquidity, low spreads, ideal for intraday trading and long-term positioning.

- Influencing Factors: Interest rate differentials between the UK and US, US economic data, global political risks.

EUR/GBP: Euro vs. British Pound

The EUR/GBP pair primarily reflects the relative strength between the UK and the Eurozone economies, making it a top choice for range trading.

- Characteristics: Lower volatility, suitable for medium- to long-term trend trading.

- Influencing Factors: Eurozone economic data, UK economic performance, post-Brexit developments.

GBP/JPY: British Pound vs. Japanese Yen

GBP/JPY is driven by carry trades and is known for its high volatility, with daily swings often exceeding 150 pips, making it a favorite among short-term traders.

- Characteristics: Large price fluctuations, ideal for high-frequency or swing trading.

- Influencing Factors: Changes in global risk sentiment, demand for the yen as a safe-haven asset.

Opportunities and Risks in GBP Trading

Potential Opportunities in GBP Trading

- Carry Trade Opportunities: If UK interest rates remain higher than those of other major economies, GBP will gain appeal.

- Economic Recovery Momentum: Recovery in the UK’s services and real estate sectors could support GBP appreciation.

- Swing Trading During Increased Risk Aversion.

Major Risks in Trading GBP

- Political uncertainty: such as UK parliamentary elections and Brexit developments.

- Risk of UK economic downturn, with sharp volatility before and after economic data releases; failure to set proper stop-loss orders may lead to amplified losses

- Global tightening of US dollar liquidity may suppress non-USD currencies, including GBP.

Main Channels for Trading GBP in the Forex Market

- Forex brokers (e.g., Ultima Markets): professional platforms with low trading costs.

- Bank forex platforms: suitable for large trades but with higher costs and slower execution.

- Fintech apps (e.g., Revolut, Wise): convenient for currency exchange but best for small amounts.

- Forex ETFs or futures markets: ideal for institutional investors and experienced traders.

Strategies for Trading GBP

The British Pound (GBP), as one of the major currencies in the forex market, offers moderate volatility and ample opportunities, attracting long-term investor attention. The following trading strategies can help you approach GBP trades with clearer direction and stronger risk control.

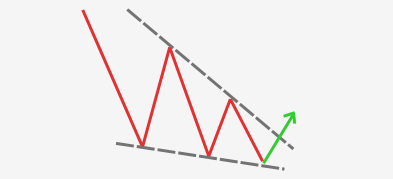

1. Technical Strategy: Accurately Identify Overbought and Oversold Points

Technical analysis is a key method of making trading decisions based on charts and indicators. In GBP trading, the following three technical indicators are particularly common:

- RSI (Relative Strength Index): When RSI exceeds 70, the market may be overbought and at risk of a price pullback; when it drops below 30, it may indicate an oversold condition with potential for a rebound.

- MACD (Moving Average Convergence Divergence): Crossovers in the MACD histogram and signal lines can serve as entry signals, especially effective for highly liquid pairs like GBP/USD.

- Bollinger Bands: These help monitor whether the price is touching the upper or lower band, signaling potential reversal points. When combined with trendlines, they can improve success rates.

These tools should not be used in isolation, but rather in combination for cross-validation to improve entry and exit accuracy.

2. Support and Resistance Strategy: Positioning at Key Price Levels

GBP exchange rates have accumulated notable technical levels over the years. Common trading methods include:

- Buying near historical support levels, when the price tests these levels without breaking below, it may signal buying interest entering the market.

- Selling near resistance zones, when the price approaches previous highs or levels preceding major news, a pullback may occur.

In GBP/USD trading, round numbers such as 1.2000, 1.2500, and 1.3000 are often key psychological levels and tend to serve as significant support or resistance zones closely watched by the market.

3. Fundamental-Combined Strategy: Event-Driven Trading

GBP exchange rates are heavily influenced by UK economic data and political events. Key indicators include:

- Bank of England (BoE) interest rate decisions and statements: Tightening monetary policy typically supports GBP, while easing may lead to depreciation.

- CPI (Consumer Price Index) and PPI (Producer Price Index): Strong inflation figures usually indicate upcoming rate hikes by the BoE.

- GDP and employment data: Robust economic growth in the UK generally strengthens the GBP, while weak data can have the opposite effect.

- Post-Brexit policies and geopolitical risks: Political uncertainty remains a major driver of GBP volatility.

Traders are advised to assess market expectations before data releases, enter positions accordingly, and set stop-loss orders to manage potential volatility.

4. Risk Management Strategies: Avoiding Large Losses on Single Trades

Regardless of whether GBP is in a bull or bear market, risk control remains the cornerstone of successful trading. Effective risk management strategies include:

- Setting stop-loss and trailing stop orders (Trailing Stop): This helps protect profits while limiting potential losses.

- Limiting exposure to no more than 2% of account capital per trade: Prevents significant capital drawdowns from a single error.

- Scaling into positions and exiting in stages: Enables more stable average pricing and returns in volatile market conditions.

- Testing strategies with a Demo Account: Using the simulated environment provided by Ultima Markets enhances confidence before live trading.

How Ultima Markets Supports Your GBP Trading

Diverse Trading Platforms

Supports MT4, MT5, WebTrader, and the proprietary Ultima Markets App, allowing you to flexibly capture GBP volatility.

Ultra-Low Trading Costs

ECN account spreads start from as low as 0.0, with average GBP/USD trading costs under USD 7 per lot.

Flexible High Leverage

Leverage up to 1:2000 enables small capital to pursue larger gains—though proper risk management is essential.

Fund Security & Compensation Protection

Client funds are held with Westpac Bank in Australia and covered by up to EUR 20,000 compensation under The Financial Commission.

Professional Market Analysis Tools

Integrated with Trading Central signals to help you capture GBP trading opportunities more accurately.

2025 GBP Market Outlook and Analysis

In 2025, the British Pound (GBP) presents a generally bullish trend amidst volatility. Benefiting from a weakening US dollar, uncertainty in US-China trade relations, and market confidence in UK policy stability, GBP/USD recently hit a seven-month high. However, structural challenges such as slowing economic growth, inflationary pressures, and a widening fiscal deficit continue to cap GBP’s upside potential. Overall, GBP’s trajectory will depend on the Bank of England’s rate decisions, inflation data, and global geopolitical developments. Traders are advised to adopt flexible strategies in response to changing conditions.

On the technical side, GBP/USD has formed a mid-term consolidation range in early 2025, with support around 1.3200 and resistance near 1.3424. Investors can use technical indicators such as RSI and MACD to time their entry and exit points.

Conclusion

As one of the world’s major currencies, GBP remains full of trading potential in 2025. With the UK economy gradually stabilizing and ongoing policy adjustments, the pound’s movements are expected to stay in the spotlight. Through a professional platform, traders can enjoy highly competitive trading conditions and precisely seize every opportunity that GBP volatility brings. Start your GBP trading journey today with Ultima Markets!

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.