Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteHow to do currency conversion: rates, tools, and tips

Amid the tides of globalization and digitalization, currency conversion has become an essential part of daily life and financial planning for people in Taiwan. Whether for overseas travel, cross-border shopping, paying foreign tuition, or engaging in forex and CFD trading, accurately tracking exchange rates and mastering currency conversion is key to reducing both costs and risks.

According to Taiwan’s Directorate-General of Budget, Accounting and Statistics, GDP growth in 2025 is forecast at 3.14%, with an annual CPI increase of approximately 1.94%, indicating stable economic growth. However, global uncertainties such as inflationary pressures continue to intensify currency fluctuations, further underscoring the importance of currency conversion in financial decision-making.

The Basic Principles and Methods of Currency Conversion

What Is Currency Value?

Currency value refers to a country’s money in terms of both “purchasing power” and its “exchangeability with other currencies,” comprising two core aspects:

- Domestic Purchasing Power: The amount of goods or services that a unit of currency can buy

- Example: If a chicken cutlet in Taiwan rises from TWD 70 to TWD 90, the TWD has lost domestic currency value (inflation erodes purchasing power).

- Foreign Exchange Value: The currency’s relative price in the global forex market

- Example: If 1 USD appreciates from TWD 30 to TWD 32, it indicates that the TWD has weakened in international currency value.

Currency Conversion Formula and Example

The basic currency conversion formula is:

Foreign Currency Amount × Exchange Rate = Local Currency Amount

Example: If 1 USD = TWD 32.5, then USD 100 converts to:

100 × 32.5 = TWD 3,250

Methods of Quoting Exchange Rates

- Direct Quotation: The price of one unit of foreign currency expressed in the local currency (e.g., 1 USD = TWD 32.5).

- Indirect Quotation: The price of one unit of local currency expressed in a foreign currency (e.g., 1 TWD = 0.0308 USD).

Bid Price, Ask Price, and Spot Rate

- Bid Price: The price at which a bank or trading platform is willing to buy foreign currency.

- Ask Price: The price at which a bank or trading platform is willing to sell foreign currency.

- Spot Rate: The current market exchange rate at which a currency can be exchanged immediately.

Key Factors Affecting Exchange Rate Fluctuations

Policy Factors

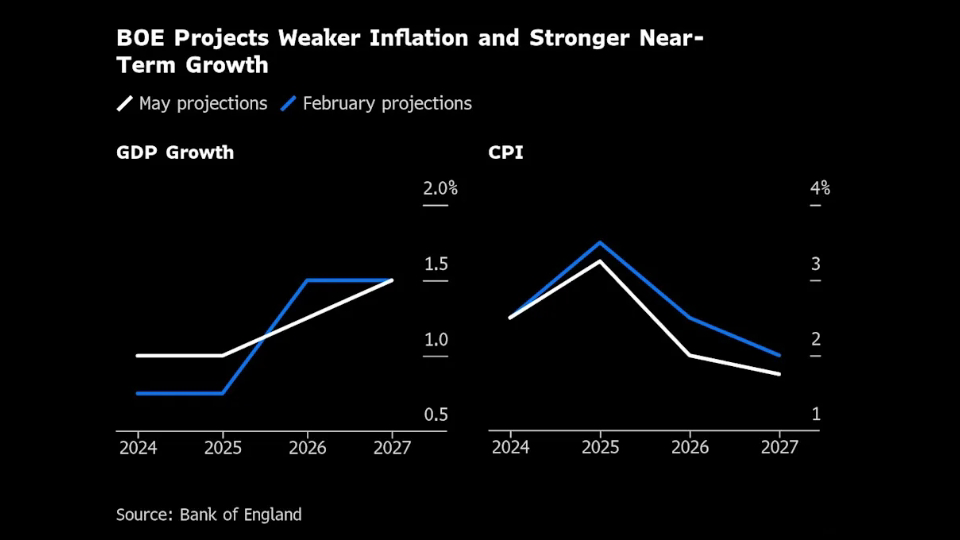

Central bank interest rate decisions and monetary policy have a direct impact on exchange rates. For example, in May 2025, the Bank of England lowered its interest rate to 4.25% in response to global trade tensions.

Economic Indicators

Economic indicators such as GDP growth rate, inflation rate, and employment data influence market confidence in a country’s economy and therefore affect its exchange rate.

Geopolitical Events and Market Sentiment

Factors like international trade policies and political stability impact investor demand for a currency, causing exchange rate volatility.

Foreign Capital Flows and Trade Structure

The inflow or outflow of foreign capital and a country’s export-import structure affect the supply and demand for its currency, thereby influencing the exchange rate.

Common Currencies and How to Check Exchange Rates

Commonly Used Currencies in Taiwan

Foreign currencies frequently used in Taiwan include:

- US Dollar (USD)

- Japanese Yen (JPY)

- Chinese Yuan (CNY)

- Hong Kong Dollar (HKD)

- Euro (EUR)

Ways to Check Real-Time Exchange Rates

- Bank Websites: Local banks like Bank of Taiwan or Mega Bank offer real-time exchange rate information.

- Online Tools: Tools like Google Currency Converter or XE.com are widely used.

- Trading Platforms: Platforms like Ultima Markets provide live rates and currency conversion tools.

Currency Conversion Scenarios in Forex Trading

Profit and Loss Calculation

In forex trading, currency conversion is used to calculate profits and losses. For example, if your account is denominated in USD and you trade EUR/JPY, the profit or loss in JPY must be converted into USD.

Margin and Leverage Calculation

When trading different currency pairs, conversion is required to calculate the necessary margin. For example, trading GBP/JPY requires converting the position size into your account currency to determine the required margin.

Risk Management

Currency conversion helps assess how exchange rate fluctuations impact your portfolio, supporting effective risk management.

How to Accurately Convert Currency and Trade via Ultima Markets

1. Multi-Currency Account Support to Eliminate Redundant Conversion Costs

Ultima Markets offers a variety of base currency options—including USD, EUR, AUD, and TWD—allowing traders to flexibly choose the account currency that best suits their funding source and trading habits. With its internal automated currency conversion system, cross-currency transfers are handled seamlessly without manual steps, significantly reducing fees and latency risks.

2. Real-Time Conversion Tools and Live Rate Display

The platform includes a real-time exchange rate module, with all conversions based on live market prices (e.g., EUR/USD, GBP/JPY), and trading P&L automatically updated. Whether you’re trading major pairs or less common cross-currency pairs, margin and leverage calculations remain precise.

3. Fast Execution with Ultra-Low Spreads

In the increasingly competitive forex landscape of 2025, Ultima Markets continues to offer leading low spreads and fast execution. For example, with an ECN account, EUR/USD spreads can be as low as 0.2 pips and commission is only USD 5 per lot. For traders relying on frequent currency conversions and tight-spread strategies, this greatly enhances profit potential.

4. Practice Currency Conversion with a Demo Account

For beginner traders, Ultima Markets offers a demo account with USD 100,000 in virtual funds, enabling hands-on practice with currency conversion and multi-currency trades. It’s an excellent tool for learning the platform, testing strategies, and developing solid risk management fundamentals.

Common Currency Conversion Mistakes and How to Avoid Them

1. Ignoring Spreads and Slippage

Many users rely solely on bank rates or Google’s exchange quotes for currency conversion, overlooking slippage and bid-ask spreads in actual trading. Using real-time rates on platforms like UM yields far more accurate conversion.

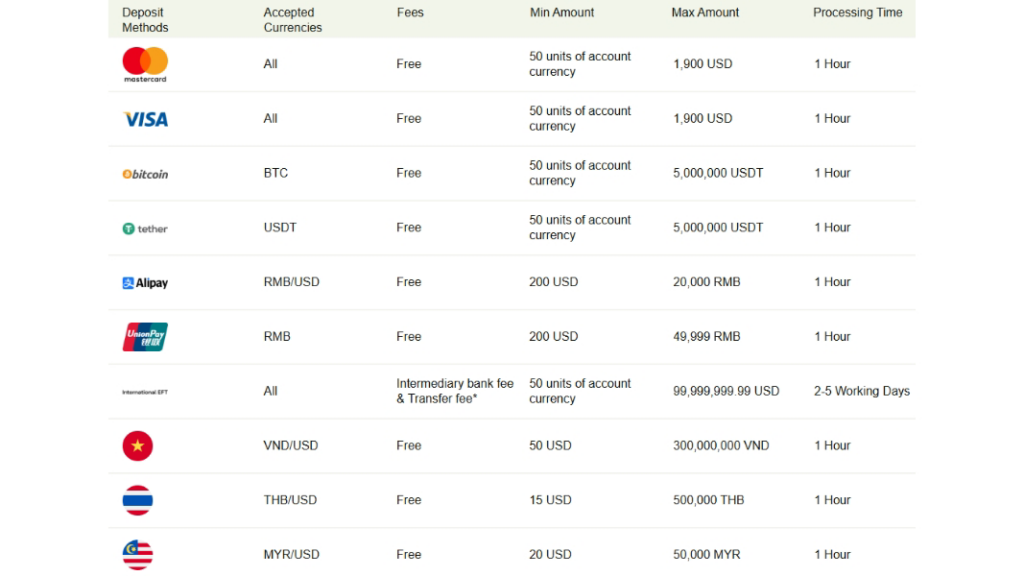

2. Overlooking Fees and Transfer Costs

Deposits and withdrawals via banks without selecting matching currency accounts may incur extra interbank or cross-currency fees. Choosing platforms like Ultima Markets that support multi-currency deposits and auto-detection can minimize such unnecessary losses.

3. Underestimating the Cost Impact of Conversion

In short-term or high-frequency trading, ignoring real-time currency fluctuations can inflate overall costs. Professional traders confirm live exchange rates beforehand and use the UM platform to simulate total trade costs.

2025 Outlook for Currency Trends in Taiwan and Globally

1. Outlook for the New Taiwan Dollar

According to Taiwan’s central bank, the TWD is projected to fluctuate between 31.8 and 32.8 per USD in 2025, driven by weakened export momentum and persistent high U.S. interest rates. This will directly impact the cost of imports, overseas tuition, and capital conversion, further highlighting the vital role of currency conversion in financial planning.

2. US Dollar Trend

The Federal Reserve is expected to maintain its benchmark interest rate between 4.25% and 4.5% throughout 2025 to combat persistent inflation. This policy will likely sustain USD strength, putting downward pressure on most Asian currencies.

3. Chinese Yuan and Japanese Yen

With China implementing economic stimulus and Japan continuing its low interest rate policy, both the Chinese Yuan and Japanese Yen may remain weak in 2025. This presents potential opportunities for Taiwanese investors to engage in Japanese and Chinese stock markets or travel-related currency exchanges.

Conclusion

In today’s rapidly shifting financial environment, currency conversion is no longer just a travel tool—it’s a fundamental skill every consumer, investor, and corporate decision-maker must master. From live rate monitoring and interpretation to profit/loss calculations and risk management, currency conversion is omnipresent.

Choosing a professional trading platform like Ultima Markets—which offers multi-currency accounts, real-time exchange rates, automatic currency conversion, and low spreads with high liquidity—can greatly streamline your currency management process. It also enhances your ability to respond to global financial trends, optimize asset allocation, and improve financial decision-making.

Whether you’re a forex beginner or an advanced trader, precise currency conversion is your essential first step toward success.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.