Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomCentral Banks Signal Diverging Paths Amid Inflation Slowdown

Global financial markets turned their attention to Sintra on Monday as key central bank leaders — including Fed Chair Jerome Powell, ECB President Christine Lagarde, BoE Governor Andrew Bailey, and BoJ Governor Kazuo Ueda — shared their latest policy perspectives during the ECB’s annual Central Bank Forum in Portugal.

While all four acknowledged the progress in taming inflation, the forum exposed clear divergences in the pace and confidence of potential rate cuts, reinforcing that the path to policy normalization remains uneven across regions.

Fed’s Powell & ECB’s Lagarde: “Data-Dependent” Path Forward

U.S. Federal Reserve Chair Jerome Powell struck a cautious but slightly dovish tone, noting that while inflation is trending in the right direction, the Fed still needs to see “more good data” to gain confidence that inflation is sustainably heading back to the 2% target.

“We are making progress, but not declaring victory,” said Powell, keeping the door open for a possible rate cut as soon as September, if upcoming jobs and inflation data continue to show improvement.

Similarly, ECB President Christine Lagarde reaffirmed the central bank’s data-dependent approach, stating that while goods inflation has eased, services inflation remains sticky. She emphasized that there is “no predefined path” for rate cuts and that policy will remain flexible and conditional on future data.

Markets are still assessing whether the ECB will deliver another cut by September. Lagarde’s remarks suggest that a cut remains possible, but only if price pressures continue to ease further in the months ahead.

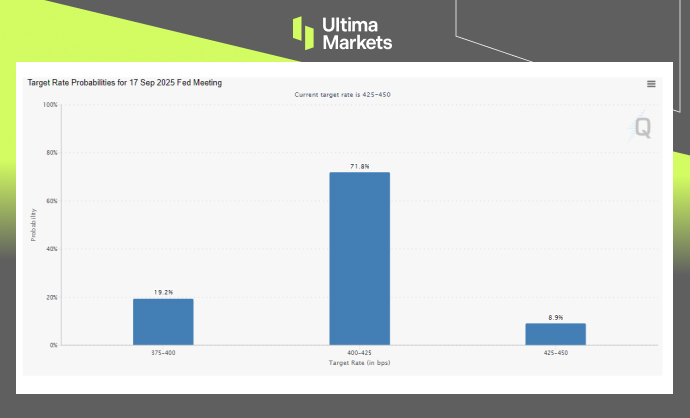

Meanwhile, the probabilities for Fed cut in September holds at 71.8%, according to CME FedWatch.

September Fed Cut Probabilities | Source: CME Fedwatch

BoE’s Bailey: “No Green Light Yet”

Bank of England Governor Andrew Bailey maintained a cautious and hawkish stance, stating that while UK inflation has declined sharply, persistent wage growth and service sector inflation remain a concern.

“We are not yet at a point where we can safely say inflation is back under control,” Bailey said.

His tone disappointed markets hoping for a summer rate cut. GBP firmed slightly after his comments, as expectations for a BoE rate cut shifted further into Q4.

BoJ’s Ueda: “Too Early for Aggressive Tightening”

Bank of Japan Governor Kazuo Ueda highlighted Japan’s continued progress in wage growth, but suggested the BoJ would move slowly on normalizing policy, citing the need for more consistent evidence of sustained inflation above 2%.

“We are still watching for signs that inflation is truly embedded,” Ueda said.

The yen weakened slightly after his comments, as markets interpreted the stance as dovish, reinforcing that Japan remains the global outlier in monetary policy.

Setting the Stage for FX Market Shifts

While the overall tone from major central bank leaders remained largely unchanged from their previous meetings, policy paths now appear to be diverging, laying the groundwork for potential shifts in FX dynamics.

Although immediate market reaction was muted, traders are now turning their focus to what comes next. In general:

- U.S. Dollar remains under pressure amid ongoing fiscal concerns and trade uncertainty. Weakness could extend further if this week’s U.S. labor data disappoints.

- Japanese Yen continues to trade heavy as the Bank of Japan stays dovish, but with the Yen hovering near major technical support, any shift in tone or yields could trigger volatility.

- Euro and Pound remain volatile as both the ECB and BoE balance easing inflation trends with sticky wage pressures, creating uncertainty around the pace of further policy easing.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server