Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWhat Are US Treasuries? How to Buy? Master Logic in 2025

In the global financial market, understanding “What are US Treasuries?” is crucial for investors. US Treasury securities, commonly known as US Treasuries, are bonds issued by the US Department of the Treasury and backed by the full faith and credit of the US government. Due to their high safety and liquidity, US Treasuries are regarded as cornerstone assets of the global financial system, widely used for asset allocation, hedging, and monetary policy operations.

Basic Definition and Types of US Treasuries

1. What Are US Treasuries?

US Treasuries are national government bonds issued by the US government to raise fiscal funds, backed by sovereign credit, and regarded as one of the safest fixed-income assets globally. The funds are used for infrastructure, social welfare, defense spending, and other purposes, raised through a regular auction mechanism. As of March 2025, the total US Treasury outstanding reached $36.6 trillion, with about 40% issued during the 2020-2021 pandemic period at low interest rates (0.5%-1.5%).

2. Five Major Types of US Treasuries

US Treasuries mainly include the following types:

| Type | English Name | Investment Term | Interest Payment Method | Key Features and Uses |

| Short-term Treasury Bills | Treasury Bills (T-Bills) | ≤ 1 year | Zero-coupon, issued at discount | Suitable for short-term fund management, highly liquid, very low risk |

| Medium-term Treasury Notes | Treasury Notes (T-Notes) | 2 to 10 years | Fixed interest paid semiannually | Medium-term investment option, stable returns, price sensitive to interest rates |

| Long-term Treasury Bonds | Treasury Bonds (T-Bonds) | 20 to 30 years | Fixed interest paid semiannually | Suitable for long-term allocation, stable interest income, highly affected by interest rate changes |

| Inflation-Protected Securities | Treasury Inflation-Protected Securities (TIPS) | 5, 10, or 30 years | Interest paid semiannually, principal adjusted by CPI | Inflation hedge, protects real purchasing power, suitable when inflation risk rises |

| Floating Rate Notes | Floating Rate Notes (FRNs) | 2 years | Interest rate adjusted quarterly | Follows market interest rate fluctuations, suitable to counter short-term rate hikes, relatively stable returns |

These bonds are fully backed by the “full faith and credit” of the US government, with extremely low default risk, thus regarded as the benchmark risk-free assets.

Core Characteristics of US Treasuries

US Treasuries possess the following features in the global financial system

1. Safety and Hedging Attributes

Backed by US sovereign credit, US Treasuries have never defaulted historically. Even facing the 2025 debt maturity peak (nearly $3 trillion), the market expects the Federal Reserve to stabilize liquidity through bond purchases and other tools, avoiding default risk.

2. Highly Liquid Market

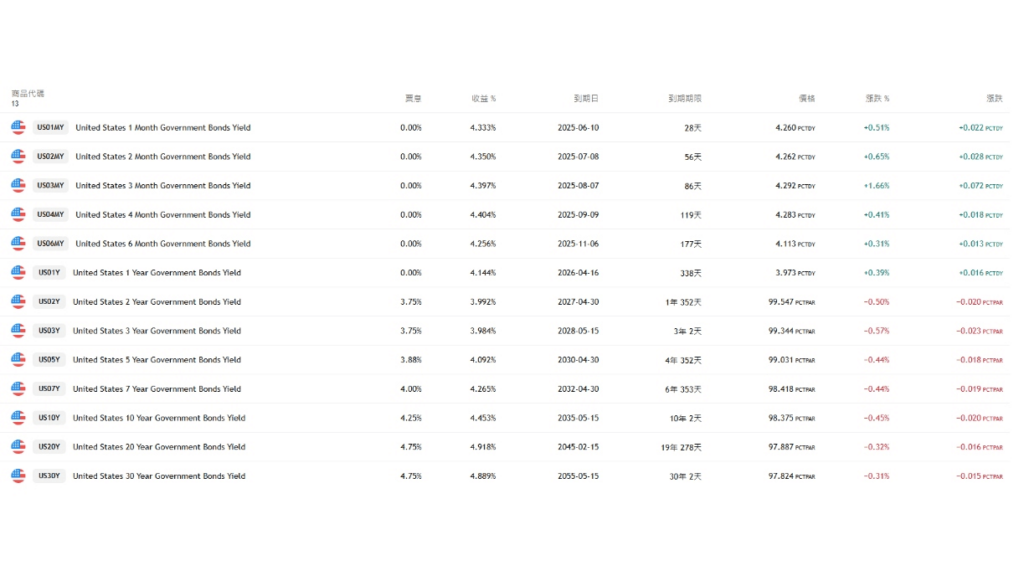

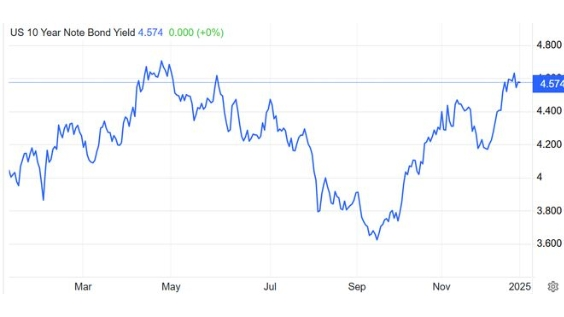

In 2024, the average daily trading volume of US Treasuries reached $900 billion, with an active secondary market allowing investors to buy and sell anytime. In April 2025, the 10-year Treasury yield briefly exceeded 4.85%, reflecting market depth and efficient price discovery.

3. Stable Yields and Diverse Options

For example, the 30-year Treasury yield reached 4.873% in April 2025, marking the largest weekly increase in 38 years. Meanwhile, instruments like TIPS and FRNs provide inflation protection and interest rate flexibility, continuing to attract conservative investors.

4. International Status of US Dollar Assets

The US dollar accounted for 57.8% of global foreign exchange reserves by the end of 2024. As the core of the dollar system, US Treasuries remain the preferred choice for international trade settlements and central bank reserves.

US Treasury Market Operation Mechanism

1. Issuance and Trading Process

The US Department of the Treasury auctions bonds monthly, using “competitive” (institutional investors) and “non-competitive” (retail investors) bidding methods. In 2025, to address debt maturity pressures, the issuance proportion of short-term bonds increased to 85%, intensifying market volatility.

2. Key Participants

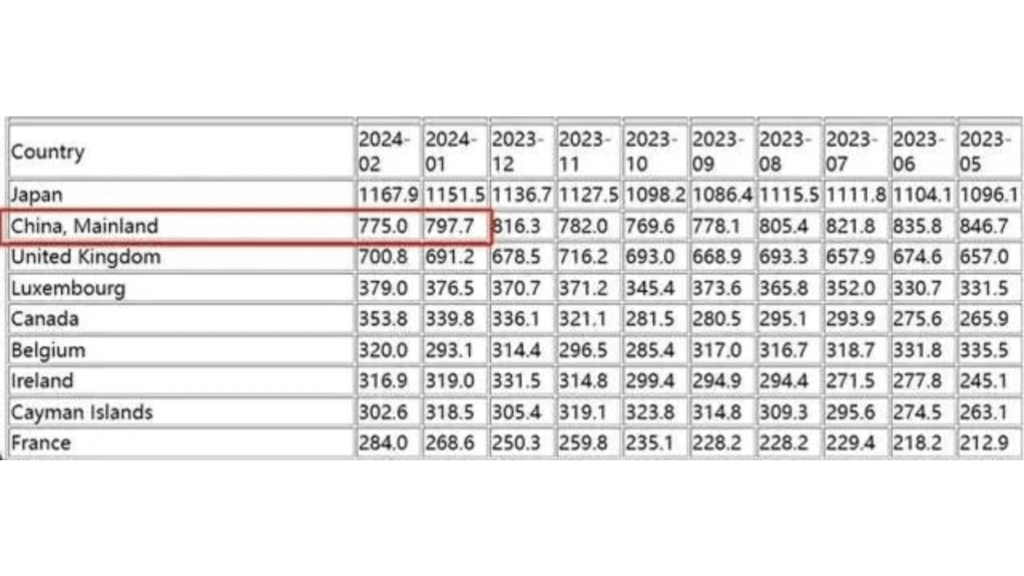

- Foreign investors: hold 24% of US Treasuries (about $8.5 trillion), with China and Japan continuously reducing holdings while private capital increases positions to arbitrage high yields.

- The Federal Reserve: holds 20% of US Treasuries and stabilizes prices through open market operations when necessary.

3. Interest Rate Policy Linkage

In 2025, amid low probability of Federal Reserve rate cuts and inflation battles, the 10-year US Treasury yield fluctuates between 4.4% and 5%, reflecting policy uncertainty.

Advantages of Investing in US Treasuries

Investing in US Treasuries offers the following advantages:

Hedge Demand:

With escalating global geopolitical conflicts, US Treasuries serve as a safe haven, exemplified by the simultaneous rise of gold and US Treasuries in April 2025.

Good Liquidity:

The market is active, and investors can easily buy and sell through ETFs without currency conversion.

Stable Income:

Coupon payments are unaffected by stock market volatility, making them suitable for long-term funds like pensions.

Tax Benefits:

Interest income is exempt from state and local income taxes.

Risks of Investing in US Treasuries

Although US Treasuries carry relatively low risk, the following risks should still be noted:

Interest Rate Risk:

When market interest rates rise, prices of fixed-rate bonds held may fall. If the Federal Reserve delays rate cuts, long-term bond prices could decline; in 2024, the TLT ETF dropped by 11%.

Inflation Risk:

If inflation rises, real yields may be eroded. Under aggressive tariff policies, if US inflation returns to 3% in 2025, real yields could turn negative.

Currency Risk:

For non-US dollar investors, exchange rate fluctuations may impact investment returns.

Policy Risk:

The Trump administration’s expansion of tariffs and fiscal deficits increases debt servicing costs, estimated at $1.3 trillion annually, intensifying repayment pressure.

Reinvestment Risk:

Interest income reinvestment may face lower reinvestment rates.

Impact of US Treasuries on the Global Economy

1. Capital Flow Indicator

Rising US Treasury yields attract international capital back to the US. In April 2025, emerging market bond ETFs saw a net outflow of $4 billion, increasing capital outflow pressure.

2. US Dollar Exchange Rate and Trade Linkage

If the US Dollar Index falls below 100, it may weaken Asia’s export competitiveness, but high yields help sustain dollar demand.

3. Global Interest Rate Benchmark

The 10-year US Treasury yield is regarded as the “anchor of asset pricing,” with its fluctuations directly affecting corporate financing costs and stock market valuations

2025 US Treasury Market Latest Developments

1. Current Environment Analysis

- Debt Maturity Peak: Approximately $3 trillion of low-interest bonds mature in 2025, requiring refinancing at 4%-5% rates, increasing annual interest expenses by $250 billion.

- Federal Reserve Policy Dynamics: The market expects a low probability of rate cuts in 2025, with inflation potentially limiting easing measures.

2. Market Forecast

Morgan Stanley predicts the 10-year US Treasury yield will drop to 3.75% by mid-2025, while Wells Fargo forecasts it will rise to 4.5%-5.0% by year-end. US tariff policies and expanding fiscal deficits may push long-term rates higher.

Taiwan’s US Treasury Holdings

Data shows that as of February this year, Taiwan held US Treasuries worth $294.8 billion, mainly by life insurance companies and the central bank.

However, under the pressure of Trump’s tariff war, the TWD/USD exchange rate appreciated by 10% within one month in May 2025, marking the largest single-month gain since 1988. This exposes Taiwanese life insurers holding large unhedged dollar assets to currency loss risk.

How to Invest in US Treasuries through Ultima Markets

As a forex and CFD broker, Ultima Markets offers diversified US Treasury investment channels:

- Open an Account: Register on the Ultima Markets official website and complete KYC verification.

- Deposit Funds: Supports multiple deposit methods including credit card and bank transfer.

- Choose a Trading Platform: Trade using MetaTrader 5, WebTrader, or the Ultima Markets App.

- Find Treasury Products: Search for “T-Bond” or “Treasury” on the platform to view contract specifications.

- Place Orders: Set trade size, take profit, stop loss, and submit your order.

- Monitor and Withdraw: Check your positions anytime and withdraw profits to your bank account.

Through Ultima Markets, investors can flexibly participate in the US Treasury market and diversify their asset allocation.

Conclusion

As the “king of safe-haven assets,” US Treasuries offer stable returns and capital preservation amid increased market volatility in 2025. Despite short-term risks from interest rates and policies, investors can effectively hedge inflation and currency fluctuations by diversifying with various instruments (such as long-term bond ETFs and TIPS), building a resilient global asset portfolio.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.