Fed Powell Testifies: No Rush for Rate Cuts!

Federal Reserve Chair Jerome Powell delivered another cautious tone during his testimony before Congress on Tuesday, reiterating that the central bank is in no rush to cut interest rates. Despite increasing market expectations for policy easing, Powell emphasized that the Fed remains firmly committed to a data-dependent approach.

Tariffs and Inflation Concerns

Powell reiterated that the Fed remains firmly data-dependent and will wait for clearer signs that inflation is sustainably returning to its 2% target before adjusting rates.

In particular, Powell warned that recent tariff increases could fuel upward pressure on inflation in the coming months. He noted that while the U.S. labor market remains strong and economic growth resilient, global uncertainties—including trade policy and geopolitical tensions—still pose uncertainty risk to inflationary pressures.

Powell also pushed back on calls to cut rates in response to political pressure. “I do not want to point to a particular meeting. I don’t think we need to be in any rush”, Powell stated on the Congress.

Market Reaction: Focus on September Cuts

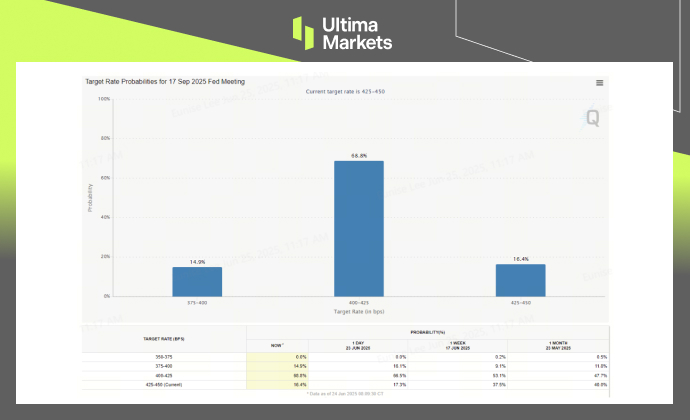

Following Powell’s remarks, markets scaled back expectations for a July rate cut. Fed Funds Futures now show an 81.4% probability of no change in July, increased sharply from earlier weeks. However, expectations for a 25 basis point cut in September rose to 68.8%, up from 53.1% just a week ago, suggesting investors see easing still on the table—but at a slower pace.

Fed Target Rate Probabilities for September | Source: CME FedWatch

The U.S. Dollar further extend downside but broadly held steady, while Treasury yields edged slightly lower as markets digested Powell’s cautious tone.

Eyes on Friday’s PCE Inflation

Markets will be closely watching Friday’s release of the Fed’s preferred inflation gauge—PCE Price Index. A softer-than-expected reading would likely boost expectations for a September rate cut and another cut in later this year, reinforcing Powell’s data-centric approach and potentially giving the Fed greater flexibility.

Until then, Powell’s testimony has effectively recalibrated the market’s timeline for Fed action. With inflation risks tied to tariffs still looming, and no urgent need for immediate policy shifts, the central bank appears well-positioned to wait and see.

US Dollar Under Pressure Amid Lack of Fresh Catalysts

The US Dollar extended its decline on Tuesday, weighed down by continued strength in the Euro and Japanese Yen as investors moved away from the greenback amid lingering uncertainty.

USDX, 4-H Chart Analysis | Source: Ultima Market MT5

From a technical perspective, the Dollar Index (USDX) remains in a bearish posture, struggling to reclaim the key 99–100 resistance zone.

Without any fresh catalysts to support a rebound—such as stronger economic data or a shift in whether monetary or Trump policy—the dollar is likely to stay under pressure in the near term.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server