Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomFinancial Market Participants

There are several types of participants in the financial markets. They can be:

- Retail investors and traders

- Professional investors and traders

- Corporates

- Financial institutions

- Governments

- Central banks

Each participant in the financial markets has specific interests. While some, like central banks, tend to influence the economy through their participation, others, like retail traders, only seek to gain from the price movements of financial products.

Traders vs Investors

Two types of participants influence most financial markets: traders and investors. People often mix up the characteristics of these two participants, but they differ significantly.

Trader: A trader is very active in the financial market and tends to gain quickly from the price movement of financial instruments. Traders are active in every market, but mainly in the ones with volatility. Also, traders often prefer to trade leveraged derivatives that can amplify the return on their available capital (but leveraged trading also amplifies the losses if the market moves in the opposite direction). They take both long and short positions on the markets, wherever they are available.

Investors: Investors generally take long-term positions in the financial markets. They often purchase stocks or units of funds and hold them for months or years. This type of participant usually invests based on long-term fundamental market factors.

Types of Financial Markets

There are two types of markets to trade any financial instruments:

Centralised exchanges

Exchanges are centralised markets where financial instruments change hands. Originating from ancient physical markets, modern exchanges are electronic. These centralised exchanges take buy and sell orders and match orders based on the order book.

A prominent example of a centralised exchange is stock markets.

Over-the-counter (OTC) markets

OTC markets are decentralised venues where participants theoretically trade financial instruments directly with each other. These markets generally offer trading services for securities, derivatives, currencies, and commodities.

The global forex trading market is the prominent OTC financial market. Contracts for differences (CFDs) are also OTC instruments.

Different Financial Markets

We can classify the overall financial markets into many categories based on the asset class. Some asset classes trade on the same markets, while others have different markets. Each market type serves specific financial needs and contributes to economic growth and stability.

The key financial markets globally are:

Stock markets

Investors generally trade shares of companies or financial instruments in stock markets. These markets primarily serve as secondary markets where investors buy and sell shares, and companies raise capital from investors. Almost every country with a functional economy has at least one stock market, while major ones have multiple.

Some of the well-known stock markets are:

- Nasdaq (The United States)

- New York Stock Exchange (The United States)

- London Stock Exchange (The United Kingdom)

- Tokyo Stock Exchange (Japan)

- Hong Kong Stock Exchange (Hong Kong)

These stock markets facilitate trading company shares, indices, exchange-traded funds (ETFs), and other financial instruments.

Bond markets

Governments and corporations issue bonds as debt securities, and investors trade these instruments in bond markets. Investors purchase bonds, effectively lending money in exchange for periodic interest payments and the return of the principal amount at maturity. The bond market is a key area for fixed-income investment.

Investors primarily trade bonds on the OTC markets, where the entry barrier often favours institutional investments. However, there are many bond markets where retail investors can also participate.

Forex market

The foreign exchange, or forex, market is the largest financial market globally by size (according to the latest BIS data, the global forex market handles nearly $7.5 trillion worth of currency trading daily).

Forex trade is crucial as it facilitates international trade between countries and cross-country investments. Speculative traders (institutional and retail) can trade currency pairs to earn from their movement. Speculative traders never take delivery of the physical currency.

Forex transactions also happen on OTC markets, as no centralised exchange handles trades. However, many forex brokers connect to Electronic Communication Networks (ECNs) to provide liquidity and fast order execution.

Commodity market

Commodity markets involve trading economic goods like gold, silver, crude oil, and agricultural produce. Derivatives of commodities are traded in financial markets, where speculative trading on commodity prices is done.

Two popular commodities markets are:

- Chicago Mercantile Exchange (The United States)

- London Metal Exchange (The United Kingdom)

Derivatives market

Derivatives are financial contracts that track the price of underlying assets. They are traded in derivatives markets. Many derivatives include futures, options, swaps, CFDs, and more.

Traders trade derivatives on both centralised and OTC markets. They mainly trade futures and options on centralised exchanges, while CFDs are traded on OTC markets.

Some top global derivatives exchanges are:

- Chicago Mercantile Exchange (The United States)

- Intercontinental Exchange (The United States)

- Eurex (Germany)

- London Metal Exchange (The United Kingdom)

Money markets

Money markets focus on short-term borrowing and lending, typically involving instruments with one year or less maturities. These markets are crucial for managing liquidity and include instruments like Treasury bills and certificates of deposit.

The primary participants in the money markets are central banks, commercial banks, governments, corporations, financial institutions, institutional investors, etc. However, such markets are generally not for retail investors (although retail investors can participate in money markets through indirect investment opportunities).

Cryptocurrency markets

The cryptocurrency market is the newest financial market, a little over a decade old. These markets allow traders and investors to buy and sell cryptocurrencies, also called digital assets.

Crypto markets are both centralised and decentralised. While centralised markets act more like stock exchanges and brokers combined, decentralised markets prioritise the decentralised nature of the cryptocurrencies and do not maintain any centralised order book.

Interestingly, many cryptocurrency ETFs are listed on stock exchanges, while mainstream derivatives markets also facilitate trading crypto options and futures. There are also dedicated crypto-specific derivatives exchanges.

What drives financial markets?

A specific set of factors influences each financial market. The key factors driving stock markets differ from events influencing forex rates.

However, the common principle of supply and demand drives all markets. If a financial asset is abundant in the market, its price might decrease. On the other hand, if more market participants show interest in buying a financial asset, creating a demand, the price will go up.

The key factors influencing the financial markets are:

Stock markets

- Corporate performance: Earnings reports, revenue growth, and profitability.

- Economic indicators: GDP growth, unemployment rates, and consumer confidence.

- Interest rates: Changes in interest rates impact the cost of borrowing and investor preferences.

- Market sentiment: Investor confidence and reactions to geopolitical events.

- Government policies: Tax reforms, regulations, and fiscal policies.

Bond markets

- Interest rates: Directly impact bond yields and prices.

- Credit ratings: Issuer’s creditworthiness influences investor demand.

- Inflation expectations: High inflation reduces the real returns on bonds.

- Monetary policy: Central bank actions such as quantitative easing or tightening.

Forex markets

- Economic data: Trade balances, inflation rates, and employment figures.

- Interest rate differentials: Variations in rates between countries affect currency values.

- Political stability: Stable governments attract foreign investments.

- Global trade trends: Demand for exports and imports influences currency strength.

Commodity markets

- Supply and demand dynamics: Production levels and consumption patterns.

- Geopolitical events: Conflicts or policies affecting resource-rich regions.

- Weather conditions: Impact on agricultural commodities.

- Economic growth: Drives demand for energy and industrial metals.

Derivatives markets

- Underlying asset performance: The value of the underlying asset affects derivatives.

- Market volatility: Higher volatility often increases derivative trading activity.

- Interest rates: Influence the pricing of derivatives.

Money markets

- Central bank policies: Influence short-term interest rates.

- Liquidity needs: Demand for cash and short-term funding.

- Economic stability: Confidence in the economy affects lending and borrowing.

Cryptocurrency markets

- Adoption and regulation: Increased use cases and supportive regulations boost demand.

- Market sentiment: News on technological advancements or hacks.

- Macroeconomic trends: Inflation or currency devaluation drives interest in cryptocurrencies.

Bearish vs Bullish Markets

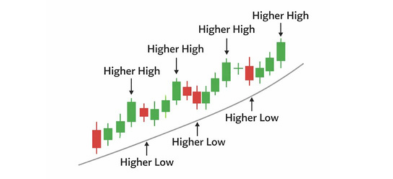

Bear or bull are two words that define the condition of any financial market. A bear market means prices fall, whereas a bull market indicates rising prices. These generally represent the market’s momentum.

- A bullish market: When bulls dominate the markets, investors usually spend more money buying financial instruments. A bull market indicates the rising value of the markets, meaning investors will gain from investing in the markets. A bullish market brings optimism to investors.

- A bearish market: Unlike a bull market, a bearish market indicates selling pressure. The prices of financial instruments go down with the dominance of bears in the markets. While investors sell their holdings in bearish markets, traders can take short positions.

Although people generally associate bullish and bearish sentiments with stock markets, these sentiments also impact forex.

As traders trade currencies in pairs, the bullish sentiment of one currency, driven by a country’s economic conditions and policies, opens up trading opportunities against another. On the other hand, the bearish sentiment of one currency over the other also opens up trading opportunities. In either case, traders can either take long or short positions.

Financial Market Regulations

Regulations play a crucial role in financial markets. Regulators ensure the stability, transparency, and fairness of markets. One or more regulators oversee almost every financial market. However, the degrees of regulation depend on the type of market, the participants, geography, and associated risks.

Regulations are most stringent when financial instruments are offered to retail traders, who are considered the most vulnerable. Many regulators in some jurisdictions even restrict offering financial products to retail investors.

The derivatives products, like the CFDs, are the most regulated when it comes to retail trading. Regulators in many regions limit the leverage offered to retail CFD traders, mandate certain disclosures, and restrict the marketing of these products. Some jurisdictions even ban CFDs outright to retail traders.

Some of the key regulators regulating CFDs are:

- The Financial Conduct Authority (The United Kingdom)

- Cyprus Securities and Exchange Commission (Cyprus)

- Australian Securities and Investments Commission (Australia)

- The Federal Financial Supervisory Authority or BaFin (Germany)

- Financial Markets Authority (FMA)

Countries like the United States and Belgium effectively ban CFDs. Hong Kong also de facto bans them, as the jurisdiction’s gambling law prohibits the distribution of such derivatives unless regulated by the regulator, which only allows the trading of exchange-traded CFDs.

How to Get Started in the Financial Markets

The first step to start trading or investing in the financial markets is to educate yourself about the intricacies of this sector. As a retail trader, you must know how financial markets operate, how different products are classified, leverage and margin trading, and the risks involved.

Then, a trader needs to open an account with a regulated broker. If the broker supports multiple markets, traders can trade in forex, cash equities, derivatives, bonds, and cryptocurrencies from a single platform.

Things to consider when opening an account with a broker:

- Where the broker is regulated

- The products offered by the broker

- The leverage limit offered by the broker

- Ease of deposit and withdrawal of funds

- Available market analysis tools

With the proper knowledge, tools, and a trusted broker, you can navigate the complexities of financial markets confidently and work towards achieving your financial goals.

Trade with Ultima Markets

Ultima Markets is a fully licensed broker and a multi-asset trading platform offering access to 250+ CFD financial instruments, including Forex, Commodities, Indices and Shares. We guarantee tight spreads and fast execution. Until now, we have served clients from 172 countries and regions with our trustworthy services and well-built trading systems.

Ultima Markets has achieved remarkable recognition in 2024, winning prestigious awards such as the Best Affiliates Brokerage, Best Fund Safety in Global Forex Awards, and the Best APAC CFD broker in Traders Fair 2024 Hong Kong. As the first CFD broker to join the United Nations Global Compact, Ultima Markets underscores its commitment to sustainability and the mission to advance ethical financial services and contribute to a sustainable future.

Ultima Markets is a member of The Financial Commission, an international independent body responsible for resolving disputes in the Forex and CFD markets.

All clients of Ultima Markets are protected under insurance coverage provided by Willis Towers Watson (WTW), a global insurance brokerage established in 1828, with claims eligibility up to US$1,000,000 per account.

Open an account with Ultima Markets to start your index CFDs trading journey.