Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

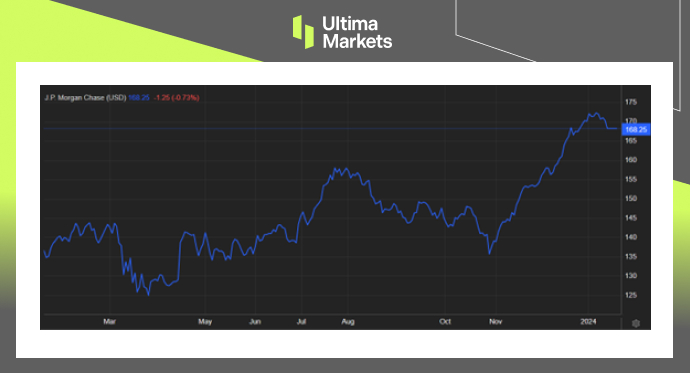

JPMorgan Q4 Earnings Drop, But Yearly Earnings Hit New High

JPMorgan’s Financial Overview: A Deep Dive into Quarterly Profits and Annual Records

JPMorgan Chase (JPM.US), the United States’ largest bank, recently released its fourth-quarter financial report, providing insights into its performance and setting the stage for a detailed analysis of its yearly achievements.

JPMorgan Quarterly Earnings and Net Income

In the fourth quarter of 2023, JPMorgan reported earnings per share of $3.04, accompanied by a revenue of $38.6 billion. Despite the decline in quarterly profits to $9.3 billion, a 15% decrease from the previous year’s $11 billion, the bank’s overall financial health remains robust.

JPMorgan Annual Profit and Growth

JPMorgan’s CEO, Jamie Dimon, emphasized the bank’s remarkable full-year performance, with annual earnings reaching a record $49.6 billion. The acquisition of First Republic contributed significantly, generating $4.1 billion in profit and solidifying JPMorgan’s position as a financial powerhouse.

Impact of FDIC Special Assessment

JPMorgan disclosed a unique challenge in the form of a special assessment from the FDIC, resulting in a $2.9 billion cost and a reduction of 74 cents in earnings per share. The bank clarified that excluding this adjustment, earnings would have been $3.97 per share.

Market Performance and Future Outlook

The bank’s growth, reminiscent of its post-2008 crisis expansion, positions JPMorgan as a key player in the industry. Its strategic move in acquiring First Republic strengthens its foothold amid challenges faced by regional banks.

JPMorgan Chase continues to navigate the financial landscape, exceeding expectations in areas such as net interest income and credit quality, as highlighted by CEO Jamie Dimon.

(JPMorgan Chase Stock Performance Yearly Chart)

Frequently Asked Questions

Q: Where can I find JPMorgan’s official quarterly earnings report?

A: You can access JPMorgan’s official quarterly earnings report directly from their investor relations page.

Q: What contributed to JPMorgan’s decline in quarterly profits?

A: The decline in quarterly profits is attributed to a special assessment from the FDIC, resulting in a $2.9 billion cost.

Q: How did JPMorgan perform in terms of yearly net income?

A: JPMorgan achieved a remarkable yearly net income of $49.6 billion, setting a new record.

Bottom Line

JPMorgan Chase’s financial journey in 2023 reflects both challenges and triumphs. As it navigates the complex financial landscape, the bank’s strategic decisions and robust performance showcase its resilience and strategic prowess.

Vì sao chọn giao dịch Kim loại & Hàng hóa với Ultima Markets?

Ultima Markets cung cấp điều kiện giao dịch và chi phí cạnh tranh hàng đầu cho các mặt hàng phổ biến trên toàn thế giới.

Bắt đầu giao dịchTheo dõi thị trường mọi lúc mọi nơi

Thị trường dễ bị ảnh hưởng bởi những thay đổi về cung và cầu

Hấp dẫn với các nhà đầu tư chỉ quan tâm đến đầu cơ giá

Thanh khoản sâu và đa dạng, không có phí ẩn

Không qua môi giới tạo lập thị trương, không báo giá lại

Khớp lệnh nhanh chóng thông qua máy chủ Equinix NY4