Please note that this website is not intended for EU residents. If you are located in the EU and wish to open an account with an EU investment firm and protected by EU laws, you will be redirected to Huaprime EU Ltd, a company licensed and regulated by the Cyprus Securities and Exchange Commission with licence no. 426/23.

29 September 2021

Ultima Markets Holiday Trading Hours Adjustment Notice

Dear Client,

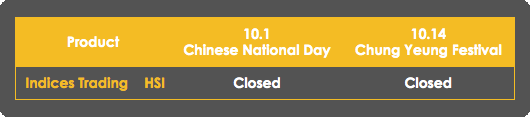

Due to the impact of holidays, the trading hours of some products will also be changed and after the holiday, as follows:

Details:

If you have any questions or require assistance, please do not hesitate to contact [email protected].

Kind regards,

Ultima Markets

28 September 2021

Ultima Markets SPI200 Trading Hours Adjustment Notice

Dear Client,

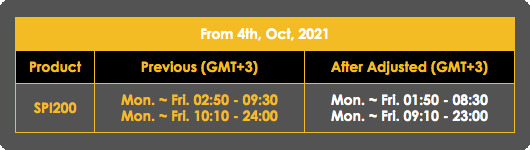

Daylight Savings Time in Australia begins in October 3th, 2021. SPI200 will change the trading time in MT4 system as follow.

Details:

Note: Please refer to the time shown in the MT4 product specifications.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

Kind regards,

Ultima Markets

23 September 2021

Ultima Markets Index Dividend Adjustment Notice

Dear Client,

Ultima Markets is one of the world’s leading brokers, with multi-country regulation, and offers its clients a wide range of financial trading products, including currency pairs, precious metals, energy, indices and stocks, among more than 200 trading products.

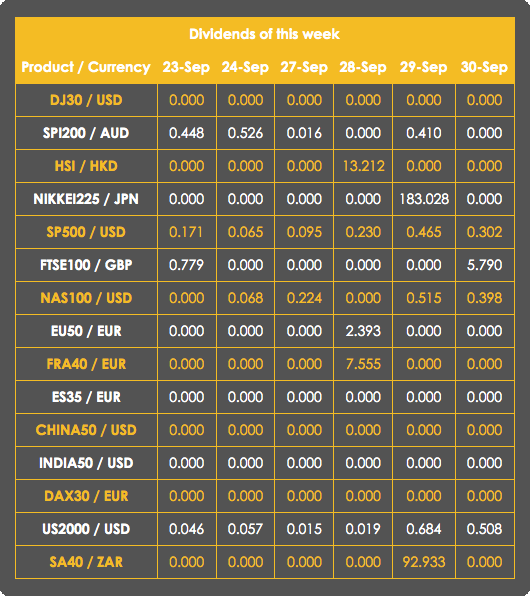

When the client is trading in Contracts for Difference (CFDs) on spot stock indices, if a component of the underlying stock index pays a dividend/dividend (payout) to its shareholders, your trading account will be adjusted ex-dividend at 00:00 server time on the same day and the corresponding gain or expense will occur depending on the position you holding and will be reflected in the account history.

Details

Note: The above data is expressed in the base currency of each index, the actual execution data may be subject to change, please refer to the MT4 software.

Please note that when the stock indexes go ex-dividend, the Dividend will be adjusted separately in the form of a capital recovery/deduction. You can check in your account history that the funds are adjusted with the following comment “Div & Index Name & Net Lot Size”, which is the dividend adjustment, where the long positions lot size is calculated as “positive” and the short positions lot size is calculated as “negative”, and the sum of the two is the “Net Lot Size”.

An example is as follows.

If you trade 5 lots long positions of NAS100, you can see the “Div & NAS100 & 5” adjustment in the account history in the form of balance; conversely, if you trade 5 lots short positions of NAS100, you can see the “Div & NAS100 & -5” payout adjustment in the account history in the form of balance.

If you are concerned about the impact of dividend payments on your account funds, we recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

Kind regards,

Ultima Markets

16 September 2021

Ultima Markets Index Dividend Adjustment Notice

Dear Client,

Ultima Markets is one of the world’s leading brokers, with multi-country regulation, and offers its clients a wide range of financial trading products, including currency pairs, precious metals, energy, indices and stocks, among more than 200 trading products.

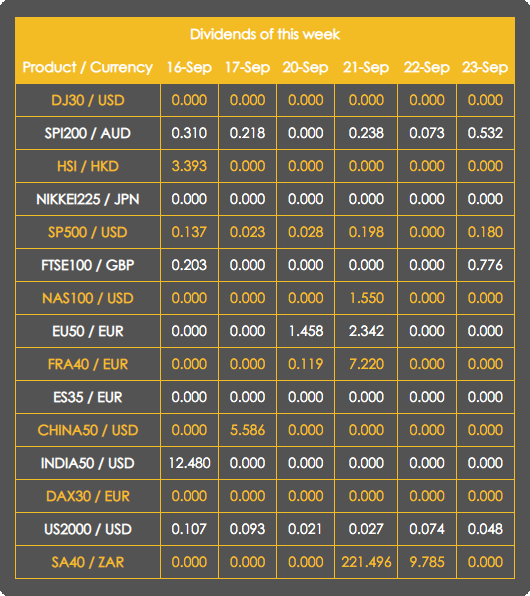

When the client is trading in Contracts for Difference (CFDs) on spot stock indices, if a component of the underlying stock index pays a dividend/dividend (payout) to its shareholders, your trading account will be adjusted ex-dividend at 00:00 server time on the same day and the corresponding gain or expense will occur depending on the position you holding and will be reflected in the account history.

Details

Note: The above data is expressed in the base currency of each index, the actual execution data may be subject to change, please refer to the MT4 software.

Please note that when the stock indexes go ex-dividend, the Dividend will be adjusted separately in the form of a capital recovery/deduction. You can check in your account history that the funds are adjusted with the following comment “Div & Index Name & Net Lot Size”, which is the dividend adjustment, where the long positions lot size is calculated as “positive” and the short positions lot size is calculated as “negative”, and the sum of the two is the “Net Lot Size”.

An example is as follows.

If you trade 5 lots long positions of NAS100, you can see the “Div & NAS100 & 5” adjustment in the account history in the form of balance; conversely, if you trade 5 lots short positions of NAS100, you can see the “Div & NAS100 & -5” payout adjustment in the account history in the form of balance.

If you are concerned about the impact of dividend payments on your account funds, we recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

Kind regards,

Ultima Markets

14 September 2021

Ultima Markets DAX30 Components Adjustment Notice

Dear Client,

Ultima Markets dedicates to providing the best trading environment and the widest range of products.

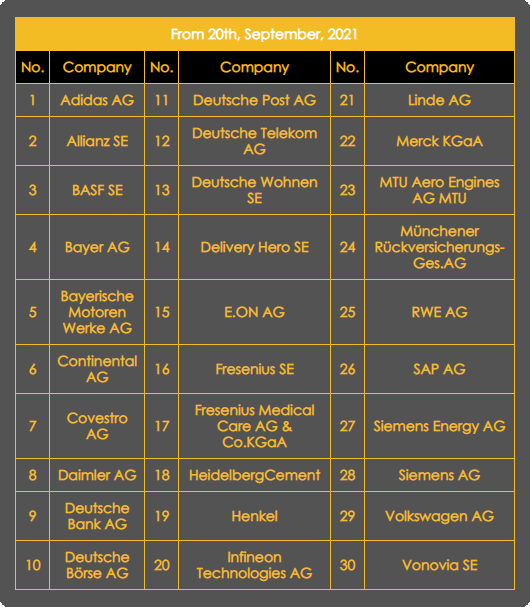

It’s our pleasure to announce that German index, the DAX30, will increase the number of stocks which make up the blue chip DAX30 index from 30 to 40, enhancing the competitiveness of German Index DAX30.

The rebalancing of the index is scheduled to take place by 20th, September, 2021.

Purpose:

The DAX30 (German: Der Dax, Deutscher Aktienindex), an important German Index) is a stock market index consisting of the 30 major German blue chip multinational corporations. The DAX30 represents the economy of German, and it is also called “Frankfurt Index” as all the corps are trading on the Frankfurt Stock Exchange.

The DAX30 is a major indicator, along with FTSE100 and FRA40.

Since November 2020, the Deutsche Börse has introduced a stricter criterion on the index constituents. The required conditions include: “Financial Report” and “Profitability”. It aims to promote the German economy and provide more liquidity, by expanding blue chips and executing harsh standard.

The list of ten blue chips are as follows:

Airbus SE

Zalando SE

Siemens Healthineer AG

Symrise AG

HelloFresh SE

Sartorius AG Vz

Porsche Automobil Holding

Brenntag SE

Puma SE

Qiagen N.V.

For investors, the adjustment can provide more liquidity to the markets, and improve the economy of German. Ultima Markets will not change the name of the DAX30 or have any impacts on the index. However, the clients should be aware of the change in the investment markets affected by the reweighting.

The list of current components are as follows:

Kindly remind you that it is important to have sufficient fund if you have the DAX30 positions. There is possible risk for the adjustment after the markets opening on Monday.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

Kind regards,

Ultima Markets

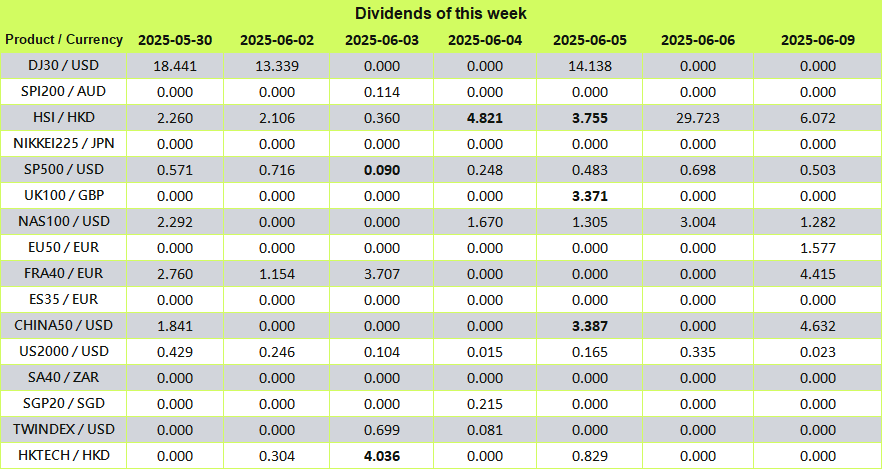

Ultima Markets Index Dividend Adjustment Notice

Filters:

No Results

Please try a different search term.

• The above data are expressed in the base currency of each index.

• According to market practice, the actual execution data may change, please refer to MT4 software for details.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact [email protected]