Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

U.S. Core PCE Dips, Rate Cuts Imminent

U.S. Core PCE Prices Dip: Implications for Rate Cuts

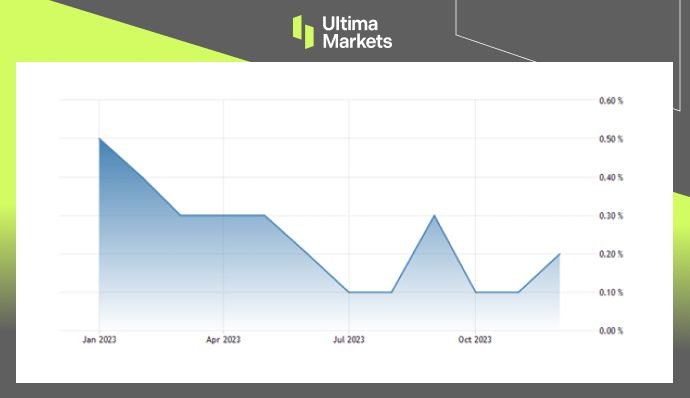

In December 2023, the core PCE prices in the United States, which do not take into account food and energy, saw an increase of 0.2% compared to the previous month, marching in step with projected market predictions. This was a small uptick from November’s increase of 0.1%. Looking at year-on-year trends, the core PCE prices recorded a 2.9% rise from the previous year, falling slightly short of the 3% increase that market predictions had set, rendering it the lowest such reading since February 2021.

Turning our attention to the overall national PCE, a broader scope that includes both energy and food costs, it is observed that the prices increased by 0.2% in comparison to the previous month, and 2.6% when compared to the previous year, aligning squarely with market expectations. An examination of prices for goods indicates a less than 0.1% rise from the preceding year, 2022, while the prices for services steadfastly remained high, standing at 3.9%.

(US Core PCE Price Index,The Bureau of Economic Analysis)

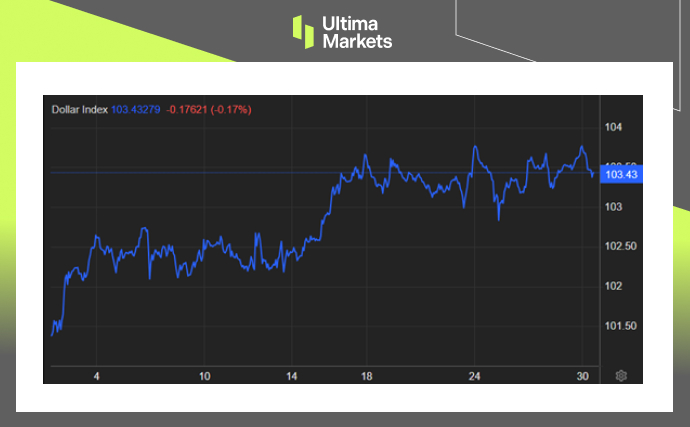

The Dollar holds steadily after PCE data. The dollar index has surged to 103.7, its peak since mid-December, as investors await the Federal Reserve’s upcoming monetary policy decision this Wednesday. Although it’s expected for interest rates to remain steady, particular attention will be paid to any hints around the projected timing and rate of potential interest rate reductions this year. The current odds for a 25 basis point rate cut in March are approximately 49 percent, while identical reductions in May have a 50 percent likelihood. The dollar experienced its highest buying activity in relation to the euro, as investors increased their speculation that the European Central Bank will decrease loan rates as soon as April. Furthermore, the U.S. currency bolstered its position against the British pound in anticipation of the Bank of England’s monetary policy declaration this Thursday.

(Dollar Index Monthly Chart)

Frequently Asked Questions

1. What is Core PCE?

Core PCE refers to Personal Consumption Expenditures excluding volatile items like food and energy.

2. How does Core PCE affect monetary policy?

Core PCE data influences the Federal Reserve’s decisions on interest rates and other monetary policy measures.

3. Why is Core PCE important for investors?

Investors monitor Core PCE as it provides insights into inflationary trends and potential shifts in monetary policy, which can impact financial markets.

ทําไมต้องซื้อขายโลหะมีค่าและสินค้าโภคภัณฑ์กับ Ultima Markets?

Ultima Markets ให้บริการด้วยต้นทุนที่เหมาะสมแข่งขันได้ในสภาพแวดล้อมการซื้อขายที่ดีที่สุดสำหรับสินค้าที่เป็นที่นิยมแพร่หลายทั่วโลก

เริ่มการซื้อขายตรวจสอบความเป็นไปของตลาด

ตลาดมีความอ่อนไหวต่อการเปลี่ยนแปลงของอุปสงค์และอุปทาน

ดึงดูดนักลงทุนที่สนใจเฉพาะการเก็งกําไรราคา

สภาพคล่องที่สูงและหลากหลายโดยไม่มีค่าธรรมเนียมแอบแฝง

ไม่มี dealing desk และไม่มี requotes

การดําเนินการที่รวดเร็วผ่านเซิร์ฟเวอร์ Equinix NY4