股票怎麼看漲跌?新手必學5大分析技巧+實戰工具

「股票怎麼看漲跌?」 這是每個投資新手最迫切想知道的問題。在台股、美股、港股等市場中,股價的波動牽動著每位投資人的心跳。根據調查,掌握技術分析的投資者,平均報酬率比盲目交易者高出35%。然而,新手常因誤判漲跌訊號導致虧損,本文將從技術分析、基本面解讀到市場心理,一步步教你建立完整的判斷邏輯,讓你用專業方法掌握買賣時機!

為什麼看懂股票漲跌是投資賺錢的關鍵?

多數人常陷入「追高殺低」的困境,根本原因在於缺乏系統化的分析框架。例如:

- 短期波動:台積電(2330)可能因季報表現單日漲跌3%

- 長期趨勢:AI產業鏈受全球需求推動,相關個股年漲幅超過50%

要避免被市場牽著鼻子走,必須結合數據工具與分析方法。選擇靠譜專業的經紀商,掌握實用圖表與即時行情,幫你快速判讀多空訊號,減少盲目下單的風險。

股票價格的基本概念:看懂數字背後的意義

在學習股票怎麼看漲跌前,先掌握5大基礎價格:

- 1.開盤價:當日第一筆成交價,反映隔夜市場情緒

- 2.收盤價:最後一筆成交價,決定隔日漲跌幅基準

- 3.高點/低點:當日股價波動範圍,判斷多空力道

- 4.漲跌幅計算公式:

(當前價 – 前日收盤價) ÷ 前日收盤價 × 100%

範例:台積電(2330)前日收780元,今日收800元 → 漲幅56%

Ultima Markets小提醒:使用平台內建的【交易計算器】,輸入價格自動換算潛在損益,避免手動計算錯誤。

- 5.成交量與成交額

- 成交量:當天買賣股票的總數量。

- 成交額:成交量與成交價格的總和。

- 成交量影響:成交量大,表示市場活躍,股價可能波動較大。

股票漲跌的底層邏輯:供需決定價格

股票漲跌怎麼形成的?投資者需要分析多種影響股價的因素。

1. 股價如何形成?

股票漲跌來自「買方」與「賣方」的角力:

- 買單>賣單,價格上漲:當投資人普遍看好某股票時,買盤增加,推動價格上升。(例如:外資大舉買超台股權值股)

- 賣單>買單,價格下跌:市場信心不足時,賣壓增加,導致股價下跌。(例如:地緣政治風險引發散戶拋售)

不同市場規則也會影響波動幅度:

- 台股:普通股漲跌幅10%、創新板股票20%

- 美股:無漲跌幅限制,可能單日暴漲暴跌

2. 影響股價的4大核心因素

| 因素類型 | 具體案例 |

| 總體經濟 | GDP、CPI、利率政策影響市場走勢。

例:央行升息導致金融股下跌 |

| 產業趨勢 | 產業發展前景與市場需求對公司股價影響重大。

例:電動車補助政策推動相關供應鏈 |

| 公司營運 | 查看公司營收、淨利、每股盈餘(EPS)。

例:鴻海(2317)毛利率提升激勵股價 |

| 市場情緒 | 投資人信心、股市熱度影響股票買賣意願。

例:散戶論壇熱議帶動元宇宙概念股 |

技術分析:用圖表與指標預測股票漲跌

透過研究股票價格、交易量等歷史市場數據,運用統計和圖形分析技術,預測未來價格走勢,協助投資者制定買賣策略。主要方法包括K線圖、移動平均線、相對強弱指數(RSI)、指數平滑異同移動平均線(MACD)等。這些工具透過視覺化和數據計算,揭示市場趨勢和潛在的買賣信號。

1. K線形態實戰教學

K線圖,又稱蠟燭圖,是技術分析中常用的圖表類型。每根K線包含開盤價、收盤價、最高價和最低價,透過不同顏色和形狀,反映價格變動情況。投資者可透過K線圖識別市場趨勢,如上升趨勢、下降趨勢或橫盤整理。趨勢線則是連接價格高點或低點的直線,用於確認支撐和阻力位,判斷價格可能的變動方向。

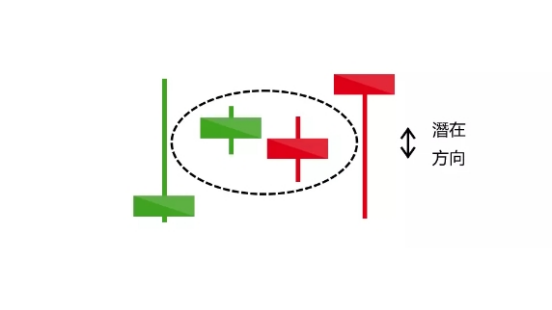

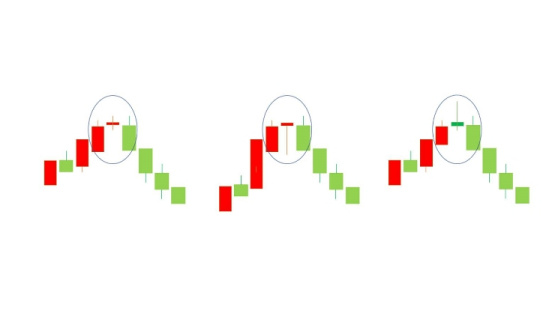

- 十字線:出現在高點可能預示反轉(搭配多時段K線對比)

- 晨星/夜星:三天組合形態判斷多空轉折

- 突破頸線:W底/M頭形態確認趨勢方向

2. 3大技術指標應用技巧

- 移動平均線(MA):

移動平均線是將一定期間內的收盤價進行平均,形成平滑的曲線,用於顯示價格趨勢。常見的移動平均線包括短期(如5日、10日)、中期(如20日、50日)和長期(如100日、200日)均線。當短期均線上穿長期均線時,形成「黃金交叉」,可能預示買入信號;反之,短期均線下穿長期均線,形成「死亡交叉」,可能預示賣出信號。移動平均線適合判斷市場趨勢,當價格突破MA時,往往預示著市場轉折。

- 黃金交叉(5日線突破20日線)= 短線買入訊號

- 死亡交叉(5日線跌破60日線)= 趨勢轉弱警訊

tips:Ultima Markets支持一鍵添加均線,自訂週期快速驗證

- MACD指標:

MACD由快線(DIF)、慢線(DEA)和柱狀圖組成,用於判斷價格趨勢和動能。當DIF上穿DEA時,形成「黃金交叉」,可能預示買入信號;反之,DIF下穿DEA時,形成「死亡交叉」,可能預示賣出信號。柱狀圖則反映兩線之間的差距,顯示趨勢強度。結合使用能夠更加準確地捕捉市場短期波動與突破點。

- 柱狀體由負轉正 → 多頭力道增強

- 頂背離(股價新高但MACD下滑)= 潛在賣出機會

- RSI相對強弱指標:

RSI是一種衡量價格變動速度和變化的技術指標,數值範圍在0到100之間。一般而言,RSI高於70被視為超買,可能出現價格回調;低於30被視為超賣,可能出現價格反彈。投資者可透過RSI判斷市場是否處於極端狀態,輔助買賣決策。

- RSI>70 → 超買區,考慮獲利了結

- RSI<30 → 超賣區,尋找反彈契機

3. 量價關係的關鍵訊號

- 價漲量增:趨勢健康(例如:聯發科(2454)法說會後帶量上攻)

- 價跌量縮:賣壓減輕,可能止跌

- 異常爆量:主力進出痕跡(使用主力資金流向工具監控)

基本面分析:挖掘股票內在價值

1. 財報數據解讀重點

分析公司的財務報表,如損益表、資產負債表和現金流量表,可以了解公司的盈利能力和財務健康狀況。關鍵指標包括每股盈餘(EPS)、本益比(P/E)和股東權益報酬率(ROE)等。

- 本益比(PE):台股平均PE約15倍,科技股可接受較高估值

- ROE股東權益報酬率:>15%顯示公司獲利能力強(如台達電2308)

- 自由現金流:正現金流企業抗跌性高

2. 產業週期與政策影響

宏觀經濟指標,如GDP增長率、通膨率和利率,會影響整體市場表現。此外,行業的發展趨勢和競爭狀況也會對個別公司的業績產生影響。

- 成長期:半導體設備需求爆發(如京鼎3413)

- 衰退期:傳統製造業面臨庫存調整

- 政策紅利:政府綠能補助帶動風電族群

tips:Ultima Markets經濟日曆整合全球財經數據,提前預判行情波動!

市場情緒:隱形卻關鍵的漲跌推手

新聞事件和市場傳聞可能引發投資者的情緒波動,進而影響股價。例如,重大政策變動、公司併購消息或全球經濟事件都可能導致市場劇烈波動。因此,投資者應密切關注相關資訊,並保持理性判斷。

1. 情緒量化工具

- VIX恐慌指數:>40表示市場過度恐慌,可能觸底反彈

- 融資餘額:台股融資使用率>60%需警戒過熱

2. 新聞事件操作心法

- 利多出盡:公司併購消息公布後反而下跌

- 利空築底:財報不如預期但股價不破前低

風險管理:看錯漲跌時的應對策略

在了解股票漲跌概念及技巧後,制定適合的投資策略和風險管理計劃至關重要。投資者應根據自身風險承受能力,選擇長期投資或短期交易策略。此外,設定止盈止損點,並嚴格執行,有助於控制潛在損失。分散投資於不同產業和資產類別,也是降低風險的有效方法。

1. 停損停利設定原則

- 固定比例法:虧損達7%立即出場

- 波動調整法:根據ATR指標動態設定

2. 倉位控管心法

- 333法則:單一標的<30%、單日交易<30%資金、保留30%現金

- 金字塔加碼:趨勢確認後分批買入

tips:Ultima Markets一鍵設定移動停損,自動鎖住盈利、控制風險!

實戰案例:綜合分析台股與美股漲跌

案例1:台積電(2330)技術面反轉訊號

以2024年台灣股市為例,受益於人工智慧相關硬體需求的增長,台積電(TSMC)股價在該年上漲了81%,創下自1999年以來的最佳年度表現。 這顯示出在技術分析與基本面分析相結合的情況下,投資者可以捕捉到市場的上漲機會。

案例2:輝達(NVDA)財報行情操作

- 事前分析:AI晶片需求成長、PE低於同業

- 數據驗證:營收年增率>50%、毛利率提升

- 結果:財報公布後股價單日上漲8%

股票市場合理運用工具的必要性:善用科技戰勝人性弱點

在投資股票時,獲取即時且專業的市場分析對於制定明智的交易決策至關重要。Ultima Markets深知投資者的需求,特別整合了Trading Central的頂級分析工具,為客戶提供專業的技術分析和交易策略建議。透過Trading Central的技術觀點,投資者可以獲得清晰的趨勢線、關鍵價格水準和技術狀況,輕鬆解讀市場走勢,並即時採取行動。

1.Trading Central智能分析工具

- 數據整合效率:同時監控台股、美股、外匯行情,避免錯失跨市場連動機會

- 決策客觀性:用技術指標訊號過濾情緒化交易(例如:RSI超買時自動提醒減倉)

- 策略回溯驗證:透過歷史數據測試「均線交叉」「MACD背離」等方法的勝率

2.專家顧問(EA)功能

MetaTrader 4(MT4)交易平台支援專家顧問(EA)功能,允許投資者運用自動交易機器人,打造個人化的自動交易策略。這不僅提升了交易效率,還使投資者能夠在市場波動中迅速反應,捕捉交易機會。

Ultima Markets提供免費技術指標庫與頂端進階功能,點擊註冊即可解鎖全系統工具!

結論:3步驟提升股票漲跌判斷力

- 1.建立分析框架:技術面(40%)+基本面(40%)+情緒面(20%)

- 2.善用智能工具:Ultima Markets提供超過50種技術指標與財務數據庫

- 3.模擬驗證策略:開通Ultima Markets模擬帳戶,零成本測試交易計劃

立即行動!

點擊註冊【Ultima Markets】帳戶,免費使用:

✅ 即時台股、美股行情

✅ 專業K線圖表與技術指標

✅ 經濟日曆與新聞影響分析

✅ 模擬交易練習環境

掌握股票漲跌的關鍵,從現在開始打造你的投資優勢!