Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomAI、HPC與電動車浪潮推動PCB需求,被譽為「電子產品之母」的PCB與科技發展緊密相連。本文透過PCB概念股推薦,解析產業鏈並精選龍頭與潛力股,助投資人掌握科技投資良機。

PCB產業鏈:從上游到下游的PCB概念股推薦

要了解PCB概念股的投資價值,首先必須掌握其產業鏈的構成。PCB產業主要分為上游的原料供應、中游的製造加工,以及下游的終端應用,每個環節都有其代表性的龍頭企業。

上游:關鍵材料供應商

- 銅箔基板 (CCL):PCB的核心原料,其品質直接影響電路板的性能。代表公司有台光電 (2383)、聯茂 (6213)及台燿 (6274)。

- 其他材料:包含銅箔、玻纖布、環氧樹脂等,也是構成PCB不可或缺的部分。

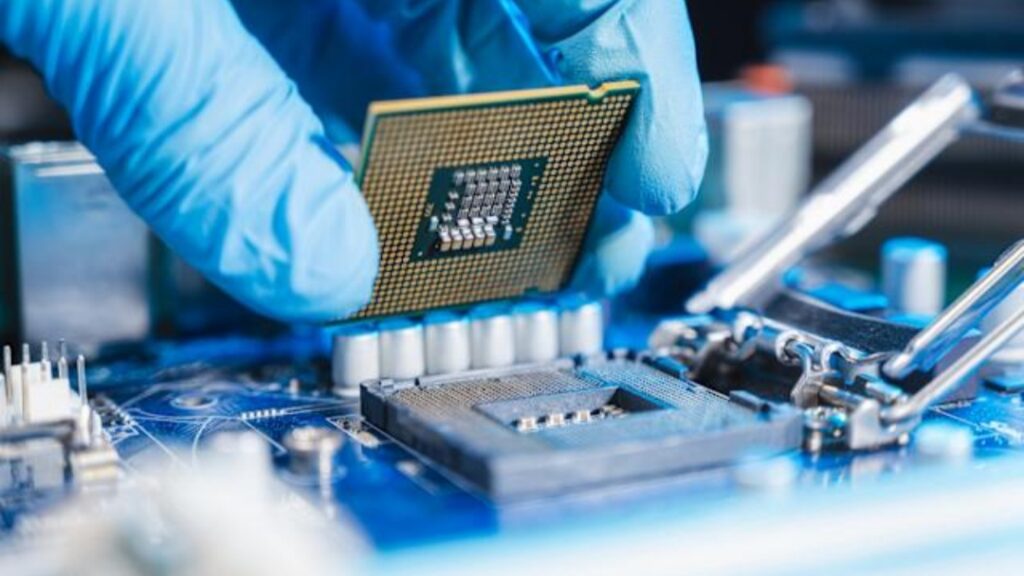

中游:製造與加工核心

- IC載板:技術門檻與毛利最高的領域,特別是ABF載板,是AI晶片、高階CPU/GPU的命脈。代表公司為欣興 (3037)、臻鼎-KY (4958)、南電 (8046)。

- 硬板 (Rigid PCB):廣泛應用於AI伺服器、網通設備、汽車電子等領域。代表公司有金像電 (2368)、健鼎 (3044)。

- 軟板 (Flexible PCB):主要用於手機、穿戴裝置等輕薄短小的消費性電子產品。

下游:終端應用市場

下游應用是驅動PCB產業成長的核心引擎,目前最主要的動能來自:

- AI伺服器與雲端資料中心

- 電動車與先進駕駛輔助系統(ADAS)

- 高階智慧型手機、筆電等消費電子規格升級

精選5大PCB潛力概念股分析

綜合產業趨勢與公司競爭力,以下是幾檔值得留意的PCB概念股。在實際投入資金前,不妨先透過模擬賬戶練習,熟悉市場波動;當您準備好時,再進入真實市場。

欣興 (3037) – IC載板龍頭

- 投資亮點:全球領先的ABF載板供應商,直接受惠於NVIDIA、AMD等AI晶片巨頭的強勁需求。

- 關注焦點:高階產能擴充進度、資本支出後的毛利率變化。

金像電 (2368) – AI伺服器板專家

- 投資亮點:AI伺服器板主要供應商,搭上雲端服務商(CSP)擴建資料中心的順風車。

- 關注焦點:高層數伺服器板的出貨佔比與新平台滲透率。

臻鼎-KY (4958) – 全方位佈局巨擘

- 投資亮點:全球PCB市佔率第一,產品線完整,客戶結構多元,能抵禦單一產業的景氣波動。

- 關注焦點:在高階IC載板與汽車電子的佈局成效。

健鼎 (3044) – 營運穩健模範生

- 投資亮點:產品應用分散,涵蓋汽車、伺服器、DRAM模組等,營運極為穩健。

- 關注焦點:汽車電子與伺服器應用的成長動能是否持續。

台光電 (2383) – 上游材料領先者

- 投資亮點:全球無鹵素CCL的領導者,在AI伺服器等高階材料市場擁有高市佔率。

- 關注焦點:高階AI材料的認證進度與實際出貨情況。

投資PCB概念股前應注意的4大風險

儘管前景看好,但在做出投資決策前,仍需評估潛在風險:

- 景氣循環風險:電子產業需求與全球總體經濟高度相關,經濟衰退將衝擊需求。

- 資本支出壓力:高階製程(如IC載板)需投入巨額資金,龐大的折舊費用可能侵蝕獲利。

- 技術疊代風險:科技日新月異,若公司未能跟上新技術發展,可能被市場淘汰。

- 客戶集中風險:過度依賴單一客戶(如蘋果),可能因訂單波動而影響營運穩定性。

結論

AI與電動車是推動PCB產業的核心動能,高階AI伺服器與IC載板相關公司具最大成長潛力。本份PCB概念股推薦清單提供市場概覽,投資人應依風險承受度配置,並透過獨立研究與追蹤財報,把握產業機會。

FAQ

Q1:PCB概念股成長的核心動能是什麼?

A1:AI伺服器、雲端資料中心與電動車需求推動PCB快速成長。

Q2:投資PCB概念股需注意哪些風險?

A2:景氣循環、資本支出壓力、技術迭代及客戶集中風險。

免責聲明:本內容僅作為參考資訊,不能視為任何形式的金融、投資或專業建議。文中觀點不代表 Ultima Markets 或作者對任何特定投資產品、策略或交易的推薦。請勿僅依據本資料作出投資決策,必要時請諮詢獨立專業顧問。