Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website拆解日經平均指數,日股投資要看懂的關鍵指標與2025年走勢

在亞洲主要股市中,日經平均指數(Nikkei 225)長期扮演著日本經濟健康與企業競爭力的晴雨表。隨著 2024 年日股創下歷史新高,今年的市場展望更引發全球投資人的高度關注。本文將深入解析日經平均指數的構成、歷史走勢、投資方式,以及 2025 年的最新市場預測,協助您掌握日本股市的脈動。

什麼是日經平均指數?

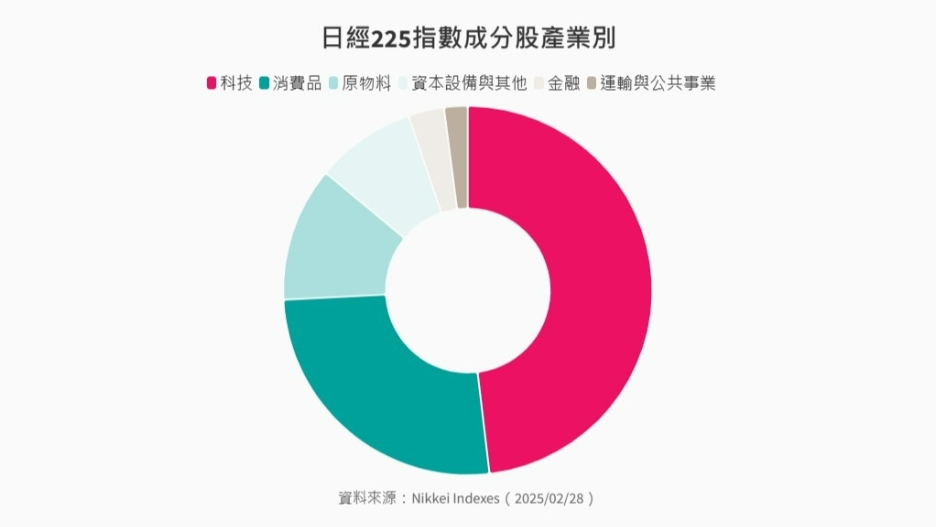

日經平均指數,又稱日經 225、Nikkei 225,是由日本經濟新聞社推出的股價指數,涵蓋東京證券交易所中 225 家具代表性的上市公司。這些成分股涵蓋製造、科技、金融、消費等多元產業,比如像豐田汽車和索尼這樣的傳統企業,以及迅銷集團(UNIQLO品牌)和軟銀集團這樣的新興企業,都在該指數中佔有重要地位,從而反映出日本整體經濟的表現。自 1950 年初次計算起,日經 225 便成為衡量日本股市表現的重要指標。與市值加權的東證指數(TOPIX)不同,日經平均指數採用價格加權方式計算,意味著股價較高的公司對指數波動影響更大。

日經平均指數計算公式

日經平均股價指數 = Σ成份股調整股價(225只)/ 除數

調整股價 = 股票市價(日元) x 股價換算係數

日經 225 VS 東證TOPIX 指數比較

| 指數名稱 | 日經平均指數(Nikkei 225) | 東證指數(TOPIX) |

| 編制機構 | 日本經濟新聞社 | 東京證券交易所 |

| 成分股樣本 | 東京證券交易所 Prime 市場中的 225 家代表性企業 | 以東京證交所Prime市場為主 |

| 成分股數量 | 225 | 約 1,716 |

| 指數特點 | 聚焦大型企業,價格加權導致高價股影響較大 | 涵蓋廣泛,市值加權反映整體市場表現 |

| 計算方式 | 價格加權平均 | 自由流通市值加權 |

| 調整頻率 | 每半年一次(四月和十月) | 年度調整 |

| 成立日期 | 1950 年 9 月 7 日 | 1969 年 7 月 1 日 |

日經平均指數的歷史走勢與影響因子

2024 年,日經平均指數上漲約 19%,收於 39,894.54 點,並創下自 1980 年代泡沫經濟以來42,426.77點的歷史新高。這一波漲勢主要受惠於企業獲利成長、日圓貶值、外資流入,以及日本企業治理改革的推動。

影響日經平均指數的主要因素包括:

- 日本央行政策:例如收益率曲線控制(YCC)政策的調整,對市場流動性與投資信心有直接影響。

- 日圓匯率波動:日圓升值或貶值會影響出口企業的盈利能力,進而影響股價。

- 全球經濟情勢:美國經濟數據、中美貿易關係等國際因素也會影響日經平均指數的走勢。

- 企業財報與科技巨頭表現:如 Sony、Toyota 等大型企業的業績表現對指數有顯著影響。

台灣投資人如何參與日經平均指數市場?

對於台灣投資人而言,參與日經平均指數市場的方式主要有以下兩種:

1. 透過 ETF 投資

投資人可透過在台灣上市的 ETF,間接投資日經平均指數。此外,亦可透過海外券商購買日本上市的 ETF。

2. 差價合約(CFD)交易

CFD 交易允許投資人以槓桿方式進行日經平均指數的多空操作,無需實際持有資產,適合短期或波段操作的投資者。例如,Ultima Markets 提供日經 225 的 CFD 交易,支援 MT4/MT5 平台,槓桿最高可達 1:2000,交易成本低,並提供中文客服與策略支援。

在 Ultima Markets 交易日經平均指數的優勢

隨著全球投資者對日本股市的關注日益增加,選擇一個可靠且功能全面的交易平台至關重要。Ultima Markets 作為一家受多重監管的國際經紀商,為投資者提供了多樣化的交易工具和優質的服務,特別是在交易日經平均指數方面,展現出多項獨特優勢。

1. 多重監管與資金安全保障

Ultima Markets 受多個國際金融監管機構監管,包括賽普勒斯證券交易委員會(CySEC)、澳洲證券與投資委員會(ASIC)及模里西斯金融服務委員會(FSC),確保平台運營的合法性與透明度。此外,客戶資金被存放於獨立的信託賬戶,並與公司營運資金完全隔離,降低資金被挪用的風險。平台還與全球知名保險公司合作,為客戶提供最高達 100 萬美元的額外保險保障,進一步提升資金安全性。

2. 低交易成本與高效執行

Ultima Markets 提供具競爭力的交易成本,ECN 賬戶的佣金僅為每手 5 美元,低於市場平均水平。平台採用先進的交易技術,確保訂單快速執行,並提供低延遲的交易環境,特別適合進行日內交易和高頻交易的投資者。

3. 靈活的槓桿與多樣化的交易產品

Ultima Markets 為投資者提供靈活的槓桿選擇,最高可達 1:2000,使投資者能夠根據自身風險承受能力進行調整。除了日經平均指數外,平台還提供超過 250 種 CFD 金融工具,涵蓋外匯、商品、其他指數和股票,滿足投資者多元化的投資需求。

4. 使用者友好的操作介面與專業支援

Ultima Markets 提供直觀易用的交易平台,支援 MT4 和 MT5,適合不同層級的投資者使用。平台提供 24 小時中文客服,協助解決交易過程中的各種問題,並提供豐富的教育資源,包括免費課程、網路研討會和專家教學,幫助投資者提升交易技能。

5. 積極的企業社會責任與可持續發展承諾

Ultima Markets 是首家加入聯合國全球契約組織(United Nations Global Compact)的 CFD 經紀商,展現其對可持續發展的承諾。平台致力於推動道德金融服務,助力構建可持續未來,這一舉措在業界獲得高度認可。

日經平均指數交易策略分享

在交易日經平均指數時,投資人可考慮以下策略:

技術分析策略

- 支撐與阻力位:識別關鍵價格區間,制定進出場策略。

- K 線型態分析:觀察趨勢反轉或延續的信號。

- 技術指標應用:如 MACD、RSI 等,判斷市場超買或超賣狀態。

基本面策略

- 關注日本央行政策:如利率決策、貨幣政策調整等,對市場有重大影響。

- 追蹤企業財報:大型企業的業績表現可影響整體市場情緒。

- 全球經濟數據:如美國非農就業數據、中國經濟指標等,對市場有間接影響。

風險提示與交易建議

在進行日經平均指數交易時,投資人應注意以下風險:

- 槓桿風險:高槓桿雖可放大收益,但同時也會放大損失,需謹慎使用。

- 市場波動性:突發事件或政策變動可能導致市場劇烈波動。

- 資金管理:設定止損點,控制單筆交易風險,避免重大損失。

建議投資人在進行實盤交易前,先使用模擬帳戶進行策略測試,熟悉市場運作與交易平台。

2025 年日經平均指數展望

根據多家機構的預測,2025 年日經平均指數有望再創新高。

- 路透社調查:預測日經平均指數將在 2025 年底達到 42,500 點,主要受惠於企業改革、低利率環境與吸引人的估值 。

- 花旗銀行分析:預測日經平均指數將在 2025 年底達到 46,000 點,儘管上半年可能面臨日圓升值與美國關稅等挑戰,但企業盈利增長與內需改善將推動市場上行 。

- Monex Group 分析師 Jesper Koll:預測日經平均指數可能在 2025 年底達到 55,000 點,認為日本股市仍有 37% 的上漲空間 。

整體而言,2025 年日經平均指數的上漲動能來自於企業改革深化、經濟復甦、外資流入與市場吸引力等多重因素。然而,投資人仍需關注日本央行貨幣政策變動、全球經濟與地緣政治風險等潛在挑戰。

結語

日經平均指數作為亞洲主要股市指標之一,對於投資組合多元化具有重要意義。隨著日本企業改革持續推進與經濟結構轉型,日經平均指數展現出強勁的上漲潛力。對於投資人而言,透過 ETF 或 CFD 等方式參與日經平均指數投資,可望把握日本股市的成長機會。建議投資人持續關注市場動態,審慎評估風險,制定適合自身風險承受度的投資策略。建議在進行實盤操作前,先利用模擬帳戶進行測試,熟悉市場運作與交易平台,將有助於實現資產配置的多元化與長期增值。

免責聲明:本內容僅作為參考資訊,不能視為任何形式的金融、投資或專業建議。文中觀點不代表 Ultima Markets 或作者對任何特定投資產品、策略或交易的推薦。請勿僅依據本資料作出投資決策,必要時請諮詢獨立專業顧問。