Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

在當今的美股市場,AI已經不再只是一個“敘事”,而是實實在在的“利潤引擎”。作爲全球科技界的兩大泰斗,微軟(MSFT)與谷歌(GOOGL)的博弈已進入白熱化階段。投資者最關心的問題在於:誰能更有效地將AI技術轉化爲報表上的淨利潤?

微軟:OpenAI賦能下的“先發制人”

微軟通過對OpenAI的戰略投資,成功實現了從底層架構到應用層的全線領跑。

軟件生態的“AI溢價”

微軟通過Microsoft 365 Copilot將生成式AI深度嵌入Word、Excel及PPT等核心辦公套件,開啓了智能辦公的新紀元。這種創新的訂閱制模式不僅憑藉AI溢價顯著提升了每用戶平均收入(ARPU),更通過技術的高黏性進一步鞏固了其在B端企業級市場的競爭護城河。這種將領先技術快速轉化爲穩定現金流的能力,正是支撐微軟在美股市場享有高估值溢價的核心邏輯。

Azure雲計算的二次增長

受全球企業對生成式AI算力及大模型部署需求的強勁驅動,微軟Azure智能雲業務的增長動能在多個財季中連續突破市場預期,展現出極強的擴張韌性。目前AI相關服務對雲收入的增長貢獻比例正處於快速上升軌道,這一確定性利好大幅增強了資本市場對其未來利潤空間的估值底氣,進而直接拉昇了微軟的遠期市盈率(P/E Ratio)。這種技術領先優勢已成爲支撐股價在高位運行的核心動力,也是投資者佈局美股科技賽道時必須鎖定的關鍵增長指標。

谷歌:防禦戰中的“全面反擊”

儘管在早期被認爲反應遲緩,但谷歌憑藉其深厚的技術底蘊,正通過Gemini重新定義搜索與廣告生態。

搜索革命與廣告效率

谷歌正通過Search Generative Experience(SGE)嘗試將生成的AI體驗深度集成到核心搜索架構中,力求在搜索交互層實現跨代級的體驗升級。儘管大規模模型運營面臨一定的算力成本壓力,但其AI驅動的PMax(Performance Max)廣告工具已通過高度自動化的投放邏輯,顯著提升了廣告主的轉化效率與投資回報率。對於美股投資者而言,谷歌在廣告技術護城河上的AI賦能,正是其在估值博弈中維持長期吸引力的重要底牌。

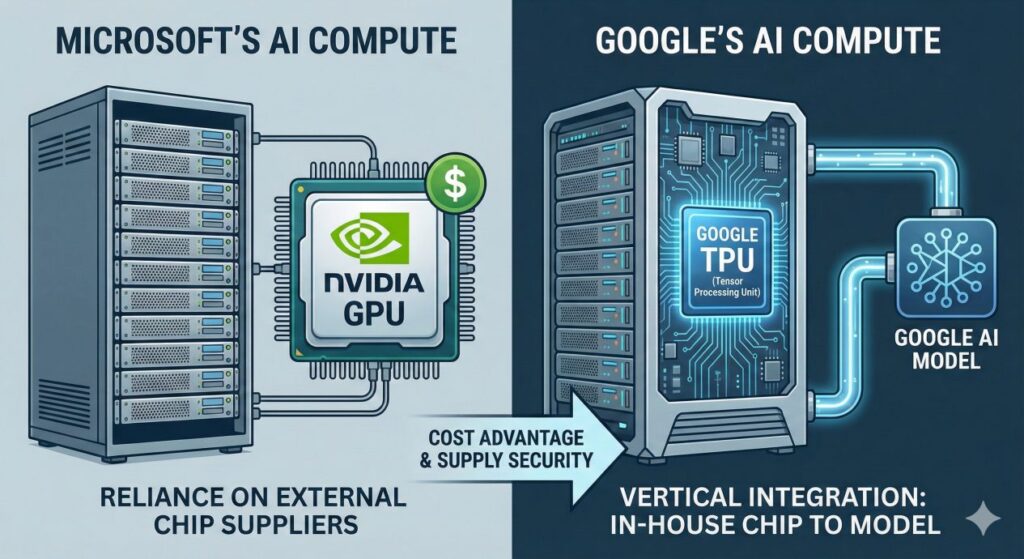

原生硬件與算力優勢

與微軟高度依賴英偉達(NVIDIA)等外部芯片供應商不同,谷歌憑藉其前瞻性的戰略佈局,擁有深耕多年的自主研發芯片TPU(Tensor Processing Units)。這種從底層硬件到模型架構的垂直整合能力,不僅極大緩解了昂貴GPU供應短缺帶來的業務風險,更讓谷歌在長期的AI算力成本競賽中佔據了天然的主動權。

通過自研芯片大幅降低每單位推理與模型訓練的成本,谷歌有望在AI商業化的大規模擴張期展現出更具韌性的毛利表現,這種“軟硬一體化”的硬科技底蘊,不僅是谷歌抵禦算力通脹的堅實護城河,更是其在美股科技巨頭估值博弈中,維持長期盈利能力的關鍵變量。

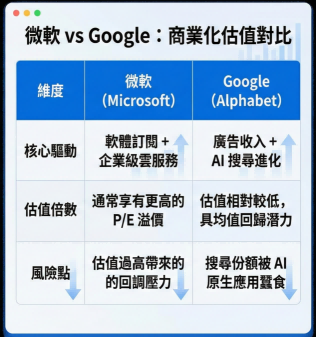

商業化估值對比:誰的“性價比”更高?

從投資邏輯的深度視角來看,微軟與谷歌的估值底層邏輯呈現出顯著差異:微軟(Microsoft)的核心增長引擎在於穩健的軟件訂閱及企業級雲服務,這使其在市場中通常享有更高的P/E溢價,但投資者需防範估值過高可能帶來的回調壓力;相比之下,谷歌(Alphabet)的價值則錨定在廣告收入及AI搜索的進化上,其目前估值水平相對較低,具備更強的均值迴歸潛力,儘管其仍面臨搜索市場份額被AI原生應用蠶食的長遠挑戰。

對於追求穩健增長的投資者來說,微軟的路徑更爲清晰;而對於尋找估值窪地的交易者,谷歌則提供了更具吸引力的買入點。

即刻訪問[Ultima Markets 官方網站],開立您的交易賬戶,獲取深度市場報告與實時報價,開啓您的專業美股交易之旅!

常見問題FAQ

A:可以採用“核心+衛星”策略。即通過Ultima Markets配置主流科技股的差價合約(CFDs)作爲核心持倉,捕捉趨勢利潤;同時利用平臺提供的止損(Stop Loss)和移動止損工具來對衝財報發佈前後的劇烈波動。此外,關注AI板塊的波動率指數,結合Ultima Markets的技術分析工具,可以幫助您在尋找微軟和谷歌的“性價比”買點時,更精準地把握市場節奏。

A:鑑於目前一股微軟股票的價格高達數百美金,對許多資金有限的初學者而言入場門檻較高,而通過Ultima Markets交易差價合約(CFDs)則提供了一個高性價比的解決方案:您無需投入全額資金即可參與市場行情,並能通過支持碎股交易的特性靈活降低起始成本。此外,這種模式賦予了投資者極高的策略靈活性,無論您是看好AI浪潮而選擇“做多”,還是認爲市場過熱計劃“做空”回調,都能在Ultima Markets抓住雙向交易機會,是新手小額起步、快速積累美股實戰經驗的理想選擇。

免責聲明:本內容僅作為參考資訊,不能視為任何形式的金融、投資或專業建議。文中觀點不代表 Ultima Markets 或作者對任何特定投資產品、策略或交易的推薦。請勿僅依據本資料作出投資決策,必要時請諮詢獨立專業顧問。