Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

在金融投資領域,槓桿(Leverage)常被稱爲“雙刃劍”。它能讓交易者以小博大,放大盈利空間,但如果缺乏有效的管理,它也會成倍放大虧損,甚至導致賬戶爆倉。因此,掌握如何管理槓桿風險是每一位在Ultima Markets交易的投資者必須修好的首要課程。

理解槓桿的本質:爲什麼它風險巨大?

槓桿的本質是借貸。當你使用1:100的槓桿(100倍槓桿)時,意味着你只需支付1%的保證金即可控制全額價值的資產。當市場價格波動1%,在沒有槓桿的情況下,你的資產變動也是1%,但在1:100槓桿下,你的資產波動就被放大了100倍,即本金將面臨100%的盈虧波動。

當賬戶淨值跌破規定的最低保證金水平(Margin Level)時,系統爲了防止虧損進一步擴大,會執行強制平倉。這就是槓桿交易獨有的風險。

五大策略教你精準控制槓桿風險

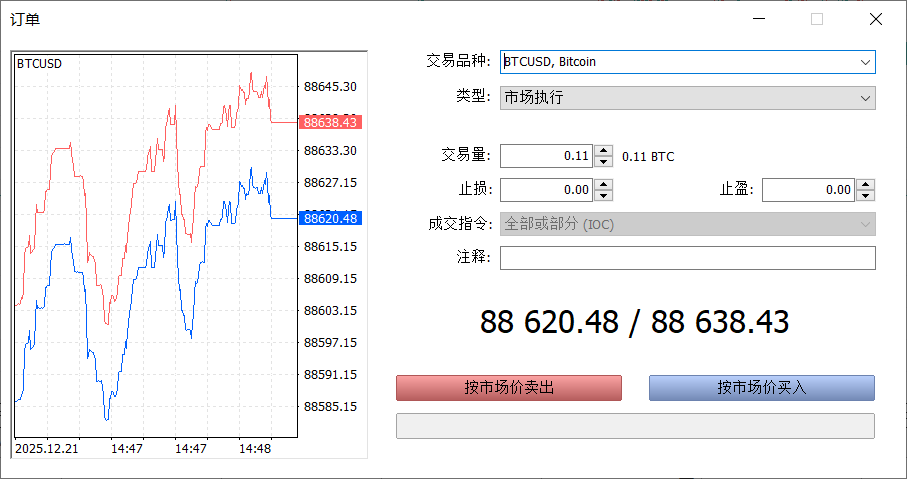

策略1:嚴格設置止損

止損是交易者的最後一道防線。無論你對行情多麼有信心,每一筆訂單都必須預設止損價位。有兩種主流止損方式:普通止損和追蹤止損。

普通止損:在下單那一刻即設定系統止損,絕不寄希望於“主觀平倉”。

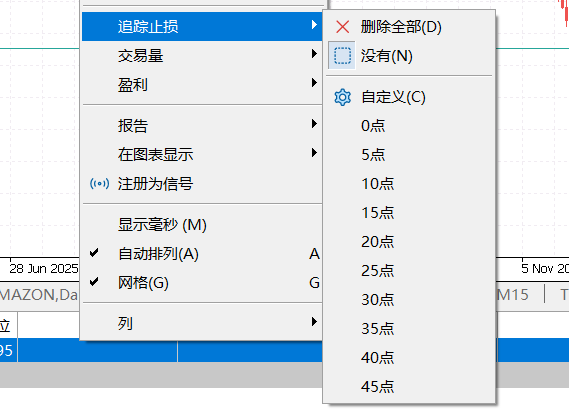

追蹤止損:隨着價格向有利方向移動,逐步調優止損位,鎖定既得利益。

策略2:科學倉位管理

不要寄希望於一筆交易致富,穩健的倉位纔是長久盈利的祕訣。專業的風險控制建議將單筆交易的風險額度限制在賬戶總資金的1%-2%之內。這意味着如果你的賬戶有$10000,單筆止損額度不應超過$200。在Ultima Markets交易時,您可以結合進場價與止損距離,反向推導出應開倉的手數,通過這種科學的計算,即使遭遇連續的小額虧損,您的賬戶依然擁有極強的韌性去迎接下一次行情機會。

策略3:選擇匹配的槓桿比例

槓桿比例應根據資產波動性與個人經驗進行動態調整。雖然平臺提供高倍槓桿,但並不代表必須“用滿”。對於新手,建議從低槓桿起步,待建立成熟系統後再適度放開。特別是操作黃金、原油等高波動品種時,應主動降低實際槓桿。在Ultima Markets,您可以根據策略需求靈活設置槓桿,確保賬戶有足夠的“安全空間”來抵禦市場正常的震盪。

策略4:動態監控保證金水平

實時關注交易終端底部的“可用預付款”,它是賬戶健康的晴雨表。在Ultima Markets的MT4/MT5界面中,需隨時注意保證金水平,交易者應養成定期檢查賬戶狀態的習慣,一旦可用保證金過低,應果斷採取平倉部分頭寸或補足資金的措施,絕不要等到系統強制平倉時才追悔莫及。

策略5:保持冷靜的交易心態

槓桿風險往往源於人性而非技術,心態控制是風險管理的最高境界。許多爆倉案例源於虧損後的“扛單”或盈利後的“報復性重倉”。建議交易者在Ultima Markets的模擬賬戶中先進行壓力測試,建立並嚴格遵守交易計劃。只有在零風險的環境中磨鍊出像機器一樣執行計劃的冷靜心態和超強執行力,才能在真實交易的壓力下,不被槓桿帶來的情緒波動所左右,真正做到知行合一。

準備好開始實戰了嗎? [立即註冊 Ultima Markets 真實帳戶]

常見問發FAQ

A:不完全是。槓桿本身是工具,虧損源於倉位過大和缺乏止損。如果交易者能嚴格執行風險百分比原則,高槓杆反而能大幅提高資金的利用效率。

A:受FCA等嚴格監管的經紀商(如 Ultima Markets)必須遵循透明的執行規則和負餘額保護制度。這意味着在極端行情下,您的風險管理指令(如止損)更能得到公正執行,有效防止非正常滑點帶來的超額虧損。

A:在極少數極端的市場跳空行情下(如週末開盤或重大突發事件),價格可能瞬間越過預設的止損位,產生不可控的成交滑點。因此,單純依賴止損單並不足夠。在進行槓桿交易時,投資者可以通過降低交易手數來保留充足的淨值緩衝,並結合分倉操作將風險分散於不同相關性的資產中。這種多層次的防禦策略能有效對衝單一品種的系統性衝擊,在極端市況下爲您的資金安全築起堅實的“防火牆”。

免責聲明:本內容僅作為參考資訊,不能視為任何形式的金融、投資或專業建議。文中觀點不代表 Ultima Markets 或作者對任何特定投資產品、策略或交易的推薦。請勿僅依據本資料作出投資決策,必要時請諮詢獨立專業顧問。