Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom為什麼有些公司財報看似獲利卻倒閉?為什麼薪資不低的人依舊是月光族?答案往往在於現金流意思。它不僅是企業的生存命脈,也是個人財務健康的基石。

現金流意思是什麼?

現金流(Cash Flow)指特定期間內現金流入與流出的淨額。可將財務狀況想像成水庫:收入是水源,支出是閘門,而現金流反映水位的實際變化。

現金流 vs. 利潤

許多人混淆現金流與利潤。利潤依「權責發生制」認列,即使錢未到帳也算進收入;而現金流依「收付制」,必須真實收付才計算。差異如下:

- 現金流:反映支付能力、短期生存力。

- 利潤:反映經營績效、長期獲利能力。

一家公司可能有利潤,但會因現金流斷裂而破產。

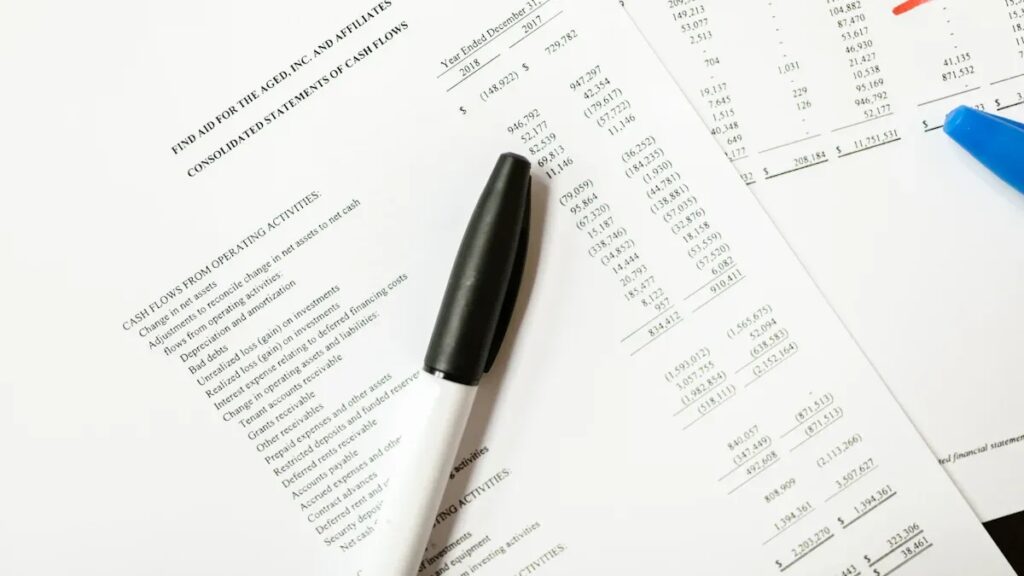

企業現金流量表三大活動

在企業財報中,現金流量表是判斷健康狀況的核心,分為三類:

- 營業現金流:來自本業,若長期為正,代表業務穩健。

- 投資現金流:與資產購買、出售相關,負數通常表示擴張投資。

- 融資現金流:公司與股東、債權人之間的資金往來,如借款或支付股利。

個人理財的現金流意思

「現金為王 (Cash is King)」同樣適用於個人理財。

- 告別月光族:流入大於流出才能累積資產。

- 抵禦風險:現金儲備能面對失業、疾病等危機。

- 實現財務自由:關鍵在於建立被動收入現金流,覆蓋日常開銷。

打造健康的個人正向現金流

理解現金流意思後,更重要的是行動:

1. 記錄與分析

透過記帳了解金錢流向,找出不必要開銷。

2. 開源與節流

制定預算、區分必要與欲望支出,同時尋找增加收入方式,如提升技能、投資理財。新手可先用模擬帳戶練習,再投入真實市場。

3. 建立緊急預備金

準備 3~6 個月生活費,確保突發狀況下現金流不斷裂。

結論

現金流比利潤更能真實反映財務狀況。從今天起檢視並優化現金流,將是邁向財務穩固與成功的重要一步。

常見問題(FAQ)

Q1:現金流與利潤差在哪?

現金流看「實際收付」,關乎短期生存;利潤看「帳面交易」,關乎長期績效。

Q2:負的現金流一定不好嗎?

不一定。若是投資現金流為負,可能是擴張;但營業現金流長期為負則危險。

Q3:如何計算每月現金流?

公式:收入-支出=淨現金流。

Q4:什麼是被動收入現金流?

如股利、租金、版稅等,不需投入大量時間即可持續產生的收入,是財務自由關鍵。

免責聲明:本內容僅作為參考資訊,不能視為任何形式的金融、投資或專業建議。文中觀點不代表 Ultima Markets 或作者對任何特定投資產品、策略或交易的推薦。請勿僅依據本資料作出投資決策,必要時請諮詢獨立專業顧問。