Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Sep’23 Economic Growth Soars for US Retail and Manufacturing

U.S. Retail Sales Thrived in September 2023

As we delve into the latest economic data for September 2023, it becomes evident that the U.S. retail and manufacturing sectors are experiencing notable developments.

This comprehensive report highlights the key statistics and trends that are shaping these critical segments of the American economy.

Consumer Spending Takes the Lead

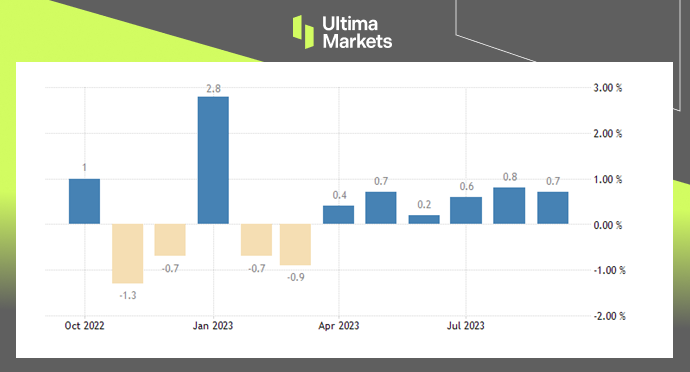

In September, U.S. retail sales increased by a solid 0.7%, building on the previous month’s 0.8% rise. This is good news, especially given the challenges posed by high prices and borrowing costs. Consumers continued to show confidence by spending more than expected, defying economic uncertainties.

Leading Categories

Several categories saw remarkable growth:

- Miscellaneous store retailers: Up by 3%

- Non-store retailers: A solid increase of 1.1%

- Motor vehicles and parts dealers: An impressive 1% growth

- Gasoline stations: 0.9% increase

It’s important to note that these figures don’t account for inflation, making these results even more noteworthy.

(Retail Sales, United States Department of Commerce)

Diverse Sectors Register Growth

In addition to the standout categories, other sectors also did well:

- Food services and drinking places: 0.9% rise

- Health and personal care stores: An 0.8% increase

- Food and beverage stores: 0.4% growth

- General merchandise stores: Also up by 0.4%

However, some sectors experienced declines:

- Electronics and appliances: Decreased by 0.8%

- Clothing stores: A drop of 0.8%

- Building material and garden equipment stores: A slight dip of 0.2%

Even when we exclude automobile sales, gasoline, building materials, and food services, retail sales still rose by a solid 0.6%. These results are a testament to consumer resilience in the face of economic challenges.

Strong U.S. Manufacturing Output Growth

Manufacturing Shines

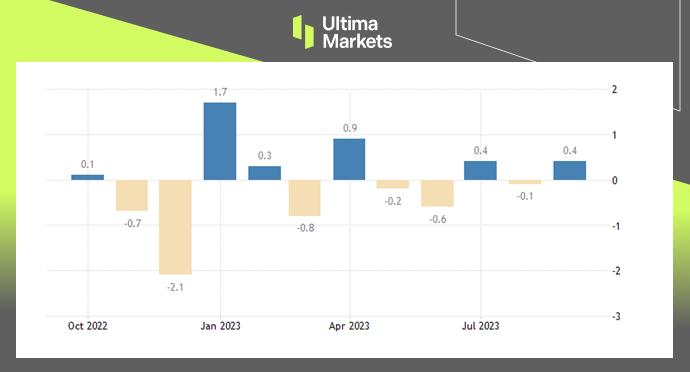

In September, production in U.S. factories increased more than expected, even though there were strikes in the automobile industry that limited the production of motor vehicles. This is additional proof that the economy finished the third quarter with strength.

Positive Manufacturing Data

The Federal Reserve reported a 0.4% increase in manufacturing output last month. In contrast, the data for August was revised downwards, showing a 0.1% decrease in factory production, instead of the previously reported 0.1% increase. Economists surveyed by Reuters had predicted a 0.1% uptick in factory output.

Year-on-Year Analysis

Looking at the year-on-year basis, production saw a 0.8% decline in September, with no change in the third quarter. Durable goods manufacturing output increased at an annualized rate of 2.3%, but this was offset by a 2.4% decline in nondurable manufacturing.

(Manufacturing Production MoM, FED)

Summary

In summary, the data for September 2023 highlights a resilient U.S. retail sector and a manufacturing industry that’s bouncing back from challenges. Consumers are spending with confidence despite rising prices, and manufacturers are adapting positively.

Staying informed and agile in these sectors is essential for businesses and investors looking to seize the opportunities presented by these trends.

Perché fare trading su metalli e materie prime con Ultima Markets?

Ultima Markets offre il più competitivo ambiente di costi e scambi per le materie prime più diffuse in tutto il mondo.

Inizia a fare tradingMonitoraggio del mercato in movimento

I mercati sono sensibili ai cambiamenti della domanda e dell'offerta

Attraente per gli investitori interessati solo alla speculazione sui prezzi

Liquidità ampia e diversificata senza commissioni nascoste

Nessun Dealing Desk e nessuna riquotazione

Esecuzione rapida tramite il server Equinix NY4