Ultima Markets App

Trade Anytime, Anywhere

Japan’s economic growth is in the shadow while semiconductor slows

Japan’s Semiconductor Slowdown: Impact on the Economy

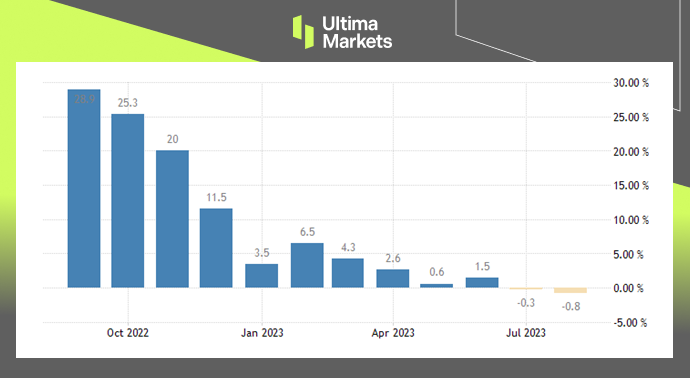

Japan’s Ministry of Finance released import and export data for August, which showed weak demand from China and semiconductor equipment.

The export value fell 0.8% from the same month last year to 7,994.3 billion yen due to reduced exports of semiconductor machinery (-36.3%), organic chemicals (-19.1%), and fossil fuels (-63.7%). It fell into contraction for the second consecutive month.

(Exports YoY, Mo F Japan)

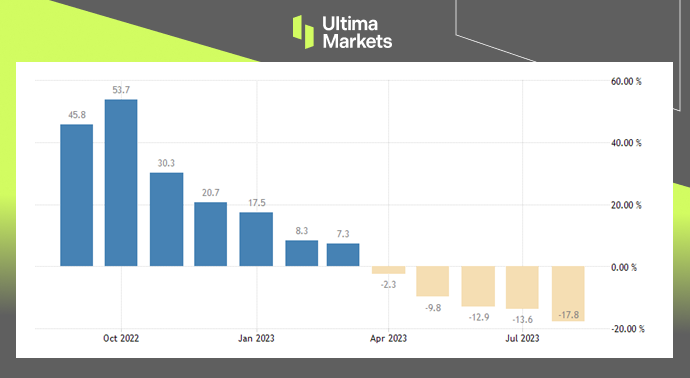

Import Challenges

Japan’s imports fell 17.8% year-on-year to 8,924.82 billion yen, the fifth month of decline since August 2020 and the largest decrease since August 2020, dragged down by energy costs mainly.

The value of imports decreased due to the import of crude (- 25.5%), liquefied natural gas (-43.0%), and coal (-48.6%).

(Imports YoY, Mo F Japan)

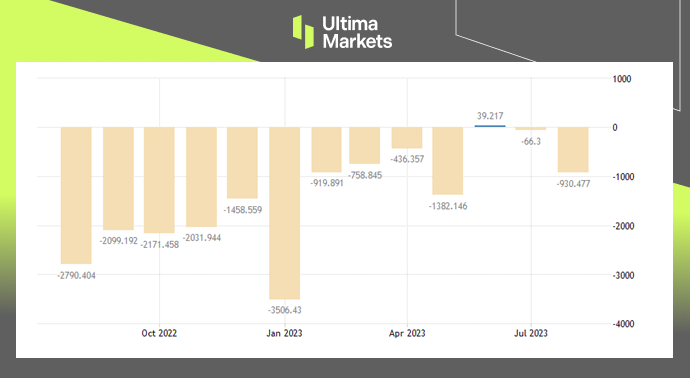

Trade Deficit Dynamics

Japan’s trade deficit decreased sharply to JPY 930.5 billion in August 2023 from JPY 2,790.4 billion in the same month a year earlier, compared with market estimates of a shortfall of JPY 659.1 billion.

Exports fell by 0.8% yoy to JPY 7,994.4 billion, the second straight month of drop, amid weak foreign demand, particularly from China; while imports slumped 17.8% to JPY 8,924.8 billion, the fifth consecutive month of fall and the steepest pace since August 2020, weighed down by energy cost and strong yen.

(Balance of Trade, Mo F Japan)

Implications and Conclusion

In conclusion, Japan’s economic woes are inextricably linked to the semiconductor slowdown and the declining demand from China.

This hierarchical structure conveys the central message efficiently, with supporting details that provide a comprehensive understanding of the economic challenges at hand.

To overcome these challenges and pave the way for future growth and stability, Japan must address the decline in crucial export sectors, navigate import challenges posed by energy costs, and develop strategies to mitigate the trade deficit impact.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Perché fare trading su metalli e materie prime con Ultima Markets?

Ultima Markets offre il più competitivo ambiente di costi e scambi per le materie prime più diffuse in tutto il mondo.

Inizia a fare tradingMonitoraggio del mercato in movimento

I mercati sono sensibili ai cambiamenti della domanda e dell'offerta

Attraente per gli investitori interessati solo alla speculazione sui prezzi

Liquidità ampia e diversificata senza commissioni nascoste

Nessun Dealing Desk e nessuna riquotazione

Esecuzione rapida tramite il server Equinix NY4