If you have read our article “Basic Types of Charts in Technical Analysis”, now it’s time to unlock the secret with technical analysis indicators. Let’s dive in!

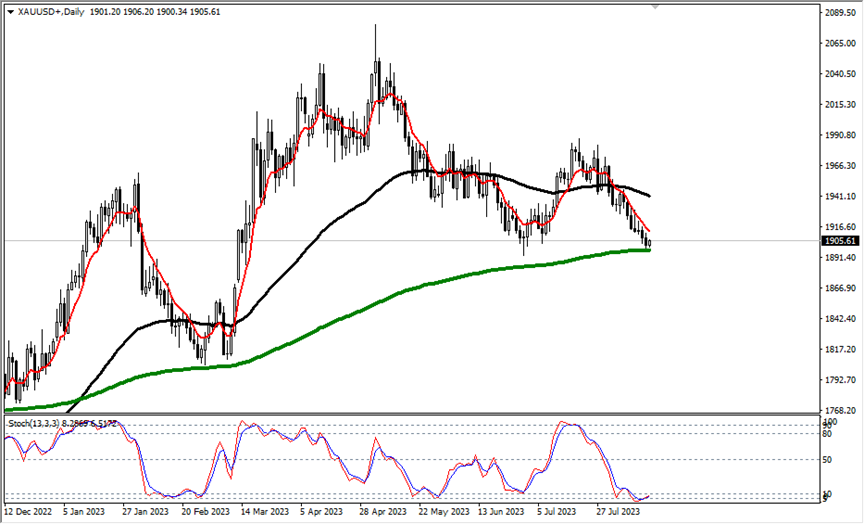

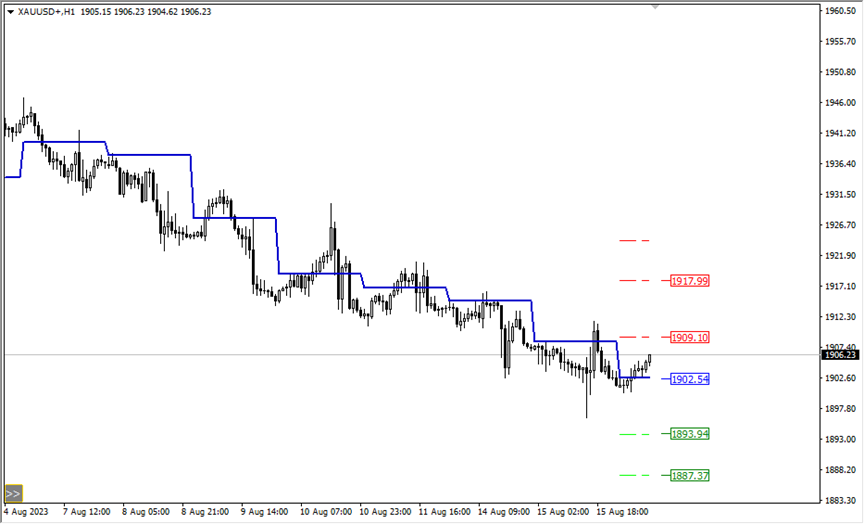

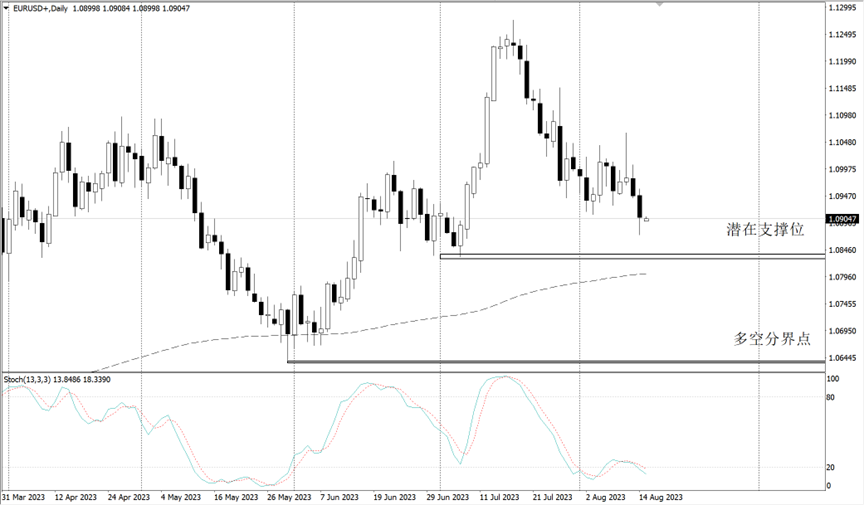

- Moving Averages:

Moving averages calculate the average price of a currency pair or any other asset over a specific period, such as 10 days or 50 days, to reveal the trend. By plotting these averages on a chart, you can easily spot if prices are going up or down. They help you identify potential buy or sell signals to make trading decisions like a pro!

- Relative Strength Index (RSI):

RSI helps you measure the strength and momentum in the markets. This oscillator ranges from 0 to 100. When it goes above 70, it suggests the asset might be overbought. On the contrary, when it drops below 30, it indicates the asset might be oversold.

- Bollinger Bands:

Bollinger bands are like dynamic rubber bands hugging the price chart. They consist of a moving average line in the middle, with two bands above and below, representing standard deviations from the average. When the price moves close to the bands, it could mean a surge in volatility. Bollinger Bands are perfect for identifying potential price breakouts or reversals so that you won’t miss those exciting trading moments!

Summary

You can combine these indicators to build your trading superpower! For example, you might use moving averages to spot trends, RSI to identify overbought or oversold conditions, and Bollinger Bands to confirm potential breakouts. The possibilities are endless, and by blending different indicators, you can develop your own unique trading strategy.