The UK’s Mounting Debt Crisis

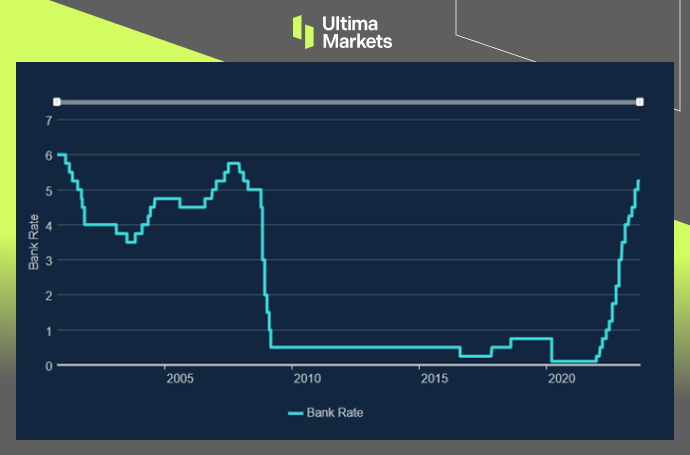

UK government debt has soared more than 40% since the Covid-19 outbreak in March 2020, reaching nearly 2.6 trillion pounds ($3.3 trillion), the highest level since the early 2020s and about the same as the country’s annual gross domestic product.

Inflation-Linked Debt: A Troubling Reality

Although some developed countries, for example, the US has debts as a high percentage in its GDP, the UK is unique in this case because 1/4 of its government debt is “index-linked to inflation”.

As prices surged in the UK over the past 18 months, so have government repayments of interest on inflation-linked bonds.

The Burden of High Inflation

In the latest fiscal year, high inflation resulted in the highest debt ratio in 40 years, weighing on the country’s finances as it grapples with weak economic growth and an election looming pressure.

The credit ratings company Fitch said, “Britain has a higher debt-repay as a share of government revenue than any other advanced economy.”

The Looming Specter of Credit Downgrade

Britain’s growing debt burden puts it in a precarious position. A downgrade of the country’s credit rating could further raise borrowing costs, although the impact is likely to be limited.

Earlier this month, Fitch canceled the U.S.’s AAA rating, one of the reasons was the increase in the U.S. debt ratio.

Fitch ‘s current rating outlook on the UK is negative, which means the risk of the country’s rating being downgraded to A from the current AA- rating increases.

Future Outlook: Waiting for Rating Agencies’ Verdict

The UK’s financial landscape is poised for a significant transformation. Moody’s and S&P are set to release their assessments of the nation’s credit rating on October 20th, with Fitch following suit on December 1st.

These impending evaluations will play a pivotal role in shaping the UK’s financial future.

(UK ratings, Fitch)

Conclusion

In conclusion, the UK’s escalating government debt crisis demands immediate attention. As this hierarchical presentation illustrates, the mounting debt, coupled with inflation-linked complications, has profound implications.

The nation’s credit rating, currently at risk, hinges on the impending assessments by rating agencies. Staying informed and prepared for potential developments in the UK’s financial stability is of utmost importance.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.