15 February 2024

Ultima Markets – The Adjustments of Leverage for US Share

From 19th , Feb 2024

|

Product |

Previous Leverage |

Leverage after updating |

|---|---|---|

|

US share CFDs |

20:1 |

33:1 |

• The margin requirements for the above products will decrease with the leverage adjustment. The margin level may be affected; please pay attention to your trading strategy and account risk.

• Due to the inherent uncertainty in the market, please refer to the MT4 software as the primary source for executing trades and monitoring market conditions.

• The holding positions can be kept after the adjustment.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

1 February 2024

Ultima Markets The trading sessions of holiday in Feb

| Holiday | Date | Adjustments (Product / Actions) | |

| LUNAR NEW YEAR | 2024.02.09 | 10:30 Early Close | HK50, HK50ft |

| LUNAR NEW YEAR | 2024.02.12 | Market Closed | HK50, HK50ft, BVSPX |

| LUNAR NEW YEAR | 2024.02.13 | Market Closed | HK50, HK50ft, BVSPX |

| LUNAR NEW YEAR | 2024.02.14 | 18:00 Late Open | BVSPX |

| 21:55 Early Close | |||

| USA Presidents Day | 2024.02.19 | Market Closed | Cotton, OJ, Cocoa, Coffee, Sugar, Soybean,Wheat |

| US shares | |||

| 18:30 Early Close | VIX | ||

| 20:00 Early Close | DJ30, DJ30ft, SP500, SP500ft, NAS100, NAS100ft, US2000, Nikkei225, JPN225ft, TY |

||

| 21:30 Early Close | GOLD, SILVER, COPPER, XPDUSD,XPTUSD | ||

| USOUSD, CL-OIL, NG, GAS | |||

| 23:00 Early Close | UK100, UK100ft, GER40, GER40ft, EU50 | ||

Friendly Reminder

- • The mentioned times are based on DST system time GMT+2.

- • Liquidity providers might adjust the trading sessions base on the dynamic nature of market conditions. The up-to-date execution data should be subject to information on the MetaTrader software/application.

If you have any questions or require assistance, please do not hesitate to contact [email protected]

31 January 2024

Ultima Markets – The Rollover Schedule of Futures in Feb

The Rollover Schedule of Futures in Feb

|

Symbol |

Description |

Rollover Date |

Current Contract |

Next Contract |

|---|---|---|---|---|

VIX |

Volatility |

2024/2/8 |

Feb-24 |

Mar-24 |

CL-OIL |

Crude Oil West Texas Future |

2024/2/15 |

Mar-24 |

Apr-24 |

FRA40ft |

France 40 Index Future |

2024/2/15 |

Feb-24 |

Mar-24 |

FLG |

UK Long Gilt Futures |

2024/2/21 |

Mar-24 |

Jun-24 |

CHINA50ft |

CHINA50 Future |

2024/2/22 |

Feb-24 |

Mar-24 |

UKOUSDft |

Brent Oil Future |

2024/2/23 |

Apr-24 |

May-24 |

HK50ft |

Hong Kong 50 Future |

2024/2/27 |

Feb-24 |

Mar-24 |

TY |

US 10 YR T-Note Futures Decimalised |

2024/2/27 |

Mar-24 |

Jun-24 |

FGBX |

Euro – BUXL Futures |

2024/3/1 |

Mar-24 |

Jun-24 |

FGBS |

Euro – Schatz Futures |

2024/3/1 |

Mar-24 |

Jun-24 |

• Internal transfers will be suspended during the half-hour before and after the rollover.

• Investors are advised to carefully manage their positions or adjust the take-profit and stop-loss settings before the rollover.

• Liquidity providers might adjust the rollover schedules base on the dynamic nature of market conditions. The up-to-date execution data should be subject to information on the MetaTrader software/application.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

3 January 2024

Ultima Markets The trading sessions of holiday in Jan

| Holiday | Date | Adjustments (Product / Actions) | |

| Martin Luther King Jr.Day | 2024.01.15 | Market Closed | Cotton. OJ, Cocoa, Coffee, Sugar, Soybean, Wheat |

| US shares | |||

| 18:30 Early Close | VIX | ||

| 20:00 Early Close | DJ30, DJ30ft, SP500, SP500ft, NAS100, NAS100ft, US2000, Nikkei225, JPN225ft, TY |

||

| 23:00 Early Close | UK100, UK100ft, GER40, GER40ft | ||

| 21:15 Early Close | XPDUSD, XPTUSD | ||

| 21:30 Early Close | GOLD, SILVER | ||

| USOUSD, CL-OIL, NG, GAS, Copper | |||

| Australia Day | 2024.01.25 | 23:00 Early Close | SPI200 |

| Australia Day | 2024.01.26 | Market Closed | USDINR |

| 08:10 Late Open | SPI200 | ||

Friendly Reminder

- • The mentioned times are based on DST system time GMT+2.

- • Liquidity providers might adjust the trading sessions base on the dynamic nature of market conditions. The up-to-date execution data should be subject to information on the MetaTrader software/application.

If you have any questions or require assistance, please do not hesitate to contact [email protected]

28 December 2023

Ultima Markets – The Rollover Schedule of Futures in Jan

The Rollover Schedule of Futures in Jan

|

Symbol |

Description |

Rollover Date |

Current Contract |

Next Contract |

|---|---|---|---|---|

VIX |

Volatility |

2024/1/12 |

Jan-2024 |

Feb-2024 |

CL-OIL |

Crude Oil West Texas Future |

2024/1/17 |

Feb-2024 |

Mar-2024 |

FRA40ft |

France 40 Index Future |

2024/1/18 |

Jan-2024 |

Feb-2024 |

CHINA50ft |

CHINA50 Future |

2024/1/24 |

Jan-2024 |

Feb-2024 |

UKOUSDft |

Brent Oil Future |

2024/1/25 |

Mar-2024 |

Apr-2024 |

HK50ft |

Hong Kong 50 Future |

2024/1/26 |

Jan-2024 |

Feb-2024 |

• Internal transfers will be suspended during the half-hour before and after the rollover.

• Investors are advised to carefully manage their positions or adjust the take-profit and stop-loss settings before the rollover.

• Liquidity providers might adjust the rollover schedules base on the dynamic nature of market conditions. The up-to-date execution data should be subject to information on the MetaTrader software/application.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

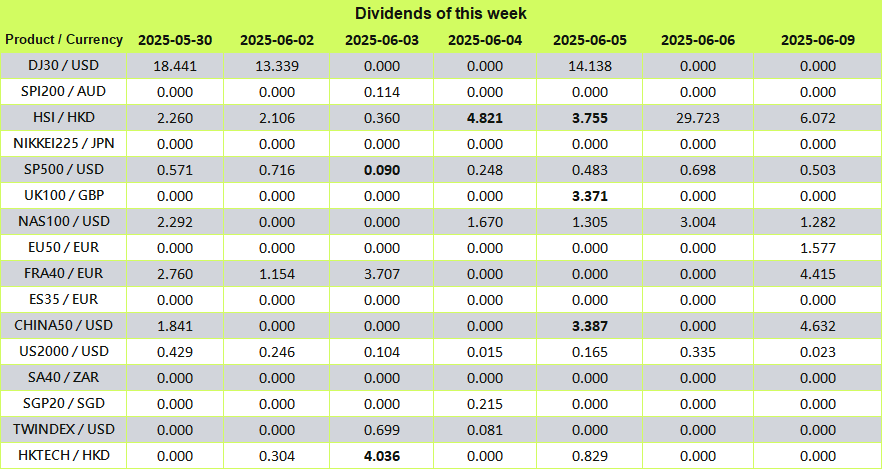

Ultima Markets - Avviso di Adeguamento dell'Indice dei Dividendi

Filtri:

Nessun risultato

Prova un termine di ricerca diverso.

• I dati sopra riportati sono espressi nella valuta base di ciascun indice.

• Secondo la prassi di mercato, i dati di esecuzione effettivi possono variare. Per favore, fare riferimento al software MT4 per i dettagli.

Quando l’indice azionario entra in fase ex-dividendo, il dividendo verrà rettificato sotto forma di movimento di fondi.

Puoi visualizzare il movimento di fondi con la seguente annotazione: “Div & nome indice & lotti netti” nello storico del conto. Si tratta della rettifica del dividendo. I lotti long sono calcolati come “valore positivo” e i lotti short come “valore negativo”. La somma dei due rappresenta i “lotti netti”.

Un esempio è il seguente.

Se operi con più di 5 lotti di DJ30, potrai visualizzare la voce “Div & DJ30 & 5” come rettifica del dividendo nello storico del conto sotto forma di saldo; oppure “Div & DJ30 & -5” per le posizioni short.

Ti consigliamo di valutare attentamente le tue posizioni attuali e considerare se mantenerle aperte durante la notte.

Se hai domande o necessiti assistenza, non esitare a contattarci all’indirizzo [email protected]