Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Data Revealing the Solid U.S. Economy Before Fed Meeting

Unveiling the Robust U.S. Economic Landscape Ahead of the Federal Reserve Meeting

The Bureau of Labor Statistics released three statistical reports on September 14:

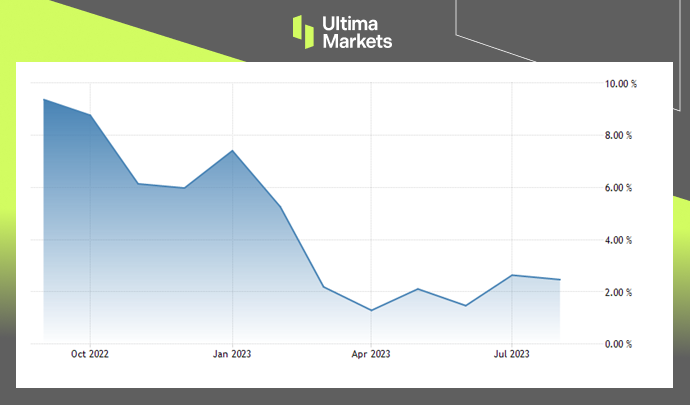

1. Retail sales

U.S. retail sales in August increased by 0.1% on a monthly basis higher than market expectations, and the annual growth rate increased from 2.6% to 2.5%. Retail sales in August were mainly driven by the sharp increase in gas station sales mom from 0.1% to 5.2%, reflecting the rebound in oil prices.

Other categories also generally showed positive growth, with more significant increases including automobiles and parts from -0.4% to 0.3%, electronics Supplies -1.1%→0.7%, and dining out and catering 0.8%→0.3% showed a slowdown.

Overall, retail sales in August were partly due to the recovery in gasoline prices, but retail sales excluding automobiles and gasoline were also higher than market expectations. (0.2% vs. 0.1%), the control group dropped from 0.7% to 0.1%, which was still better than the market expectation of -0.1%, highlighting that the US consumer market is still strong.

(Retail Sales data, BLS)

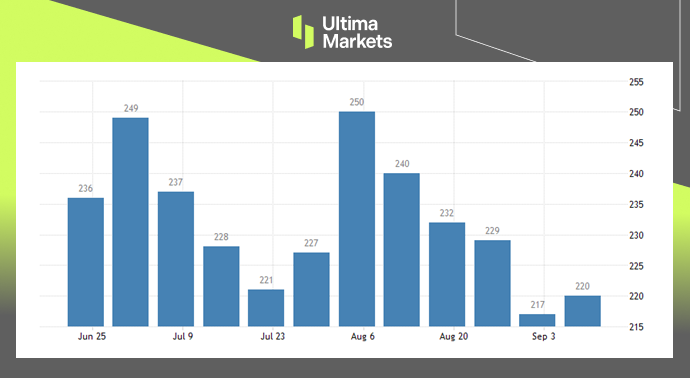

2. Initial jobless claims

Last week, the number of initial claims for unemployment benefits increased by 3,000 from 217,000 to 220,000, lower than the expected 225,000.

The number of continuing claims for unemployment benefits in the previous week increased by 4,000 from 1.684 million to 1.688 million, which was lower than the market estimate of 1.69 million people, showing that the job market is cooling more slowly than expected.

(Initial Jobless Claims, BLS)

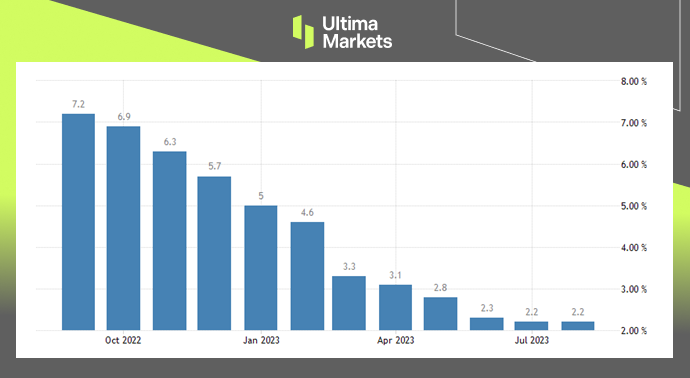

3. PPI (Producer Price Index)

The August producer price index (PPI) increased by 1.6% year-on-year, higher than market expectations of 1.2% and the previous value of 0.8%, growing for the second consecutive month.

Excluding volatile food and energy prices, the August core PPI rose by 2.2% YoY, in line with market expectations and lower than the previous value of 2.4%.

The growth of PPI in August was mainly driven by rising energy and transportation costs.

(Core PPI, BLS)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Perché fare trading su metalli e materie prime con Ultima Markets?

Ultima Markets offre il più competitivo ambiente di costi e scambi per le materie prime più diffuse in tutto il mondo.

Inizia a fare tradingMonitoraggio del mercato in movimento

I mercati sono sensibili ai cambiamenti della domanda e dell'offerta

Attraente per gli investitori interessati solo alla speculazione sui prezzi

Liquidità ampia e diversificata senza commissioni nascoste

Nessun Dealing Desk e nessuna riquotazione

Esecuzione rapida tramite il server Equinix NY4