Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

TSM October Revenue Explode, Surpassing NT$15 Trillion Value

TSM Achieved a Record-high Revenue Last Month

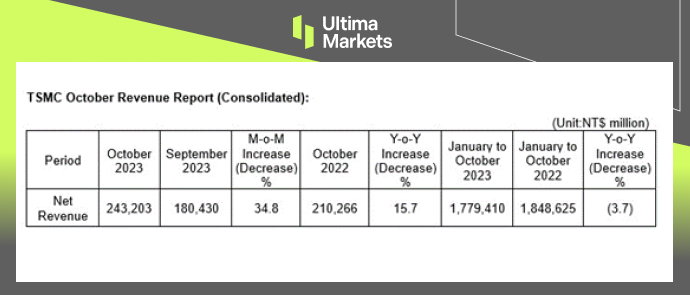

On November 10, Taiwan Semiconductor Manufacturing Company (TSM.US) announced that its October revenue was a record-breaking US$7.53 billion (NT$243.2 billion), representing a notable 34.8% increase from September and a 15.7% raise from the same period last year.

(TSMC Consolidated October Revenue)

Unveiling the TSM’s Revenue Numbers

TSMC’s cumulative revenue for the first 10 months of 2023 stood at an impressive US$55.6 billion, showcasing a modest 3.7% decline from the corresponding period in 2022.

The company’s resilience in navigating the challenges posed by weaker global demand in certain sectors, particularly consumer electronics, is evident in these numbers.

The surge in demand for TSMC’s cutting-edge 3nm technology played a pivotal role in its ADR surging more than 6% following the earnings release.

TSM’s Leadership Insight

C. C. Wei, TSMC’s CEO, expressed unwavering optimism regarding the chip market during a recent statement. He anticipates that the company will soon overcome the challenges of a prolonged sluggishness, primarily attributed to the lingering effects of the COVID-19 pandemic.

The surge in the AI industry, driven by an increased need for chips used in training large language models, has significantly contributed to TSMC’s positive outlook.

TSM’s Technological Prowess

TSMC’s third-quarter revenue surge was underpinned by its advanced technology, with the 3nm, 5nm, and 7nm processes collectively accounting for an impressive 59% of the company’s total revenue.

Looking ahead, TSMC is set to push the boundaries further by mass-producing an even more advanced 2nm process in 2025. This ambitious move is poised to solidify TSMC’s position as a trailblazer in high-end technology development.

TSM’s Future Projections

As we look toward the future, TSMC’s fourth-quarter revenue for 2023 is anticipated to range between US$18.8 billion and US$19.6 billion, with an estimated midpoint of US$19.2 billion (approximately NT$614.4 billion at the current exchange rate of NT$32 per US$1).

This represents an impressive approximately 11.1% increase on a quarterly basis. Despite the expectation of a slight dip in revenue in November and December compared to the stellar October figures, TSMC remains confident in achieving its financial forecast target.

The company estimates that the revenue in the remaining two months will average around US$5.84 billion.

Bottom Line

In conclusion, TSMC’s stellar performance in October is a testament to its resilience, technological prowess, and strategic vision.

The company’s commitment to advancing semiconductor technology, coupled with its optimistic outlook despite global challenges, positions TSMC as a formidable leader in the high-end technology landscape.

As TSMC continues to push the boundaries of innovation, the industry watches eagerly to witness the unfolding chapters of its success story.

Perché fare trading su metalli e materie prime con Ultima Markets?

Ultima Markets offre il più competitivo ambiente di costi e scambi per le materie prime più diffuse in tutto il mondo.

Inizia a fare tradingMonitoraggio del mercato in movimento

I mercati sono sensibili ai cambiamenti della domanda e dell'offerta

Attraente per gli investitori interessati solo alla speculazione sui prezzi

Liquidità ampia e diversificata senza commissioni nascoste

Nessun Dealing Desk e nessuna riquotazione

Esecuzione rapida tramite il server Equinix NY4