Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomCara Mengoptimalkan Expert Advisors (EA) di MetaTrader 5 (MT5)

Expert Advisor (EA) adalah sistem perdagangan otomatis yang dirancang untuk mengeksekusi perdagangan berdasarkan aturan yang telah diprogram sebelumnya. EA beroperasi di platform MetaTrader 5 (MT5), menghilangkan kebutuhan akan intervensi manual dengan menganalisis kondisi pasar dan menempatkan perdagangan secara otomatis.

Trader menggunakan EA untuk memastikan presisi, efisiensi, dan disiplin strategi trading mereka.

Pentingnya Optimasi dalam Perdagangan Algoritmik

Meskipun EA dapat mengeksekusi perdagangan secara efektif, kinerjanya sangat tergantung pada seberapa baik konfigurasinya. Kondisi pasar berubah seiring waktu, yang berarti EA yang bekerja dengan baik di masa lalu mungkin tidak tetap menguntungkan.

Pengoptimalan adalah proses penyempurnaan parameter EA untuk beradaptasi dengan kondisi pasar yang berbeda, meningkatkan profitabilitas dan stabilitasnya.

Tanpa pengoptimalan, EA dapat:

- Tampil baik dalam kondisi tertentu tetapi gagal dalam kondisi lain.

- Terlalu cocok dengan data masa lalu, yang menyebabkan kinerja real-time yang buruk.

- Struggle to manage risk effectively due to poorly calibrated parameters.

Ikhtisar Penguji Strategi MT5

MT5 menyediakan alat Penguji Strategi yang kuat, yang memungkinkan pedagang untuk melakukan backtest dan mengoptimalkan EA mereka. Alat ini mensimulasikan perdagangan berdasarkan data historis untuk menentukan bagaimana kinerja EA dalam kondisi yang berbeda.

Fitur utama dari MT5 Strategy Tester meliputi:

- Backtesting:Menjalankan EA terhadap data historis untuk menilai kinerja.

- Pengoptimalan: Menemukan kombinasi parameter terbaik untuk profitabilitas maksimum.

- Pemrosesan Multi-Threaded: Menggunakan beberapa inti CPU untuk mempercepat proses pengujian.

- Optimasi Algoritma Genetik: Metode cerdas yang memilih pengaturan terbaik tanpa menguji setiap kemungkinan kombinasi.

- Forward Testing: Memastikan bahwa pengaturan yang dioptimalkan tetap efektif dalam kondisi pasar yang tidak terlihat.

Dengan memahami pentingnya pengoptimalan EA dan cara kerja Penguji Strategi MT5, pedagang dapat menyempurnakan strategi otomatis mereka untuk mencapai kinerja yang lebih baik dan beradaptasi dengan pasar yang berubah.

Apa Arti Pengoptimalan di MT5?

Pengoptimalan di MT5 mengacu pada penyesuaian sistematis parameter Expert Advisor (EA) untuk meningkatkan kinerja. Tujuannya adalah untuk mengidentifikasi pengaturan terbaik yang memaksimalkan profitabilitas, mengurangi penarikan, dan meningkatkan konsistensi perdagangan.

Penguji Strategi MT5 memungkinkan pedagang untuk menjalankan beberapa backtest menggunakan kombinasi parameter input yang berbeda, mengevaluasi kinerja EA dalam kondisi pasar historis. Dengan demikian, pedagang dapat menemukan pengaturan optimal yang selaras dengan tujuan perdagangan mereka.

Meskipun backtesting dan pengoptimalan sangat penting untuk pengembangan EA, keduanya melayani tujuan yang berbeda:

| Fitur | Backtesting | Pengoptimalan |

| Tujuan | Menguji performa EA menggunakan serangkaian parameter tetap. | Menemukan kombinasi parameter terbaik untuk kinerja optimal. |

| Eksekusi | Menjalankan satu pengujian berdasarkan data sebelumnya. | Menjalankan beberapa pengujian dengan pengaturan parameter yang berbeda. |

| Waktu yang Dibutuhkan

|

Relatif cepat, karena hanya satu tes yang dilakukan. | Bisa memakan waktu, terutama dengan himpunan data besar. |

| Hasil | Menyediakan laporan kinerja dengan statistik utama. | Mengidentifikasi kumpulan parameter terbaik berdasarkan kriteria yang dipilih. |

Manfaat Mengoptimalkan EA

Mengoptimalkan EA sangat penting untuk meningkatkan efisiensi perdagangannya dan menyesuaikannya dengan berbagai kondisi pasar. Beberapa manfaat utama meliputi:

- Profitabilitas yang Ditingkatkan: Trader dapat meningkatkan profitabilitas EA dengan menyempurnakan pengaturan seperti ukuran lot, stop loss, dan level take profit.

- Manajemen Risiko yang Lebih Baik: Pengoptimalan membantu menyesuaikan parameter risiko untuk mengurangi penarikan dan melindungi modal.

- Kemampuan beradaptasi terhadap Perubahan Pasar: Pasar berkembang, dan EA yang dioptimalkan dapat menyesuaikan diri dengan tingkat volatilitas, tren, dan pola aksi harga yang berbeda.

- Kecepatan Eksekusi yang Ditingkatkan: Pengaturan yang efisien meningkatkan waktu eksekusi, mengurangi selip dan penundaan pesanan.

- Pencegahan Overfitting: Pengoptimalan yang tepat memastikan EA berkinerja baik dalam kondisi pasar masa lalu dan masa depan daripada terlalu disetel dengan data historis.

Mempersiapkan Optimalisasi

Persiapan yang tepat sangat penting sebelum menjalankan pengoptimalan di MetaTrader 5 (MT5). Pengaturan yang dipersiapkan dengan baik memastikan hasil yang andal dan mencegah jebakan umum seperti overfitting. Trader harus memilih EA yang tepat, menyiapkan data historis, memilih pasangan dan kerangka waktu perdagangan terbaik, dan mengonfigurasi parameter EA untuk pengoptimalan.

Memilih EA yang Tepat

Tidak semua Expert Advisors (EA) dirancang untuk pengoptimalan. Beberapa mungkin memiliki parameter hard-code yang tidak dapat disesuaikan, sementara yang lain mungkin memerlukan input manual untuk kondisi tertentu. Sebelum mengoptimalkan, Anda harus memastikan:

- EA memungkinkan modifikasi parameter.

- Ini memiliki stop-loss, take-profit, ukuran lot, dan input terkait strategi yang dapat disesuaikan.

- Ini dirancang untuk bekerja dalam kondisi pasar yang berbeda, bukan hanya satu skenario.

- Ini mendukung pengujian ulang dan pengoptimalan historis.

Jika EA tidak memiliki fleksibilitas, pengoptimalan tidak akan efektif.

Menyiapkan Data Historis

Keakuratan pengoptimalan tergantung pada kualitas data harga historis. Jika data tidak lengkap atau berkualitas rendah, hasil pengoptimalan mungkin tidak mencerminkan kondisi pasar yang sebenarnya.

Langkah-langkah untuk menyiapkan data historis berkualitas tinggi:

1.Unduh data pasar yang benar:

- Buka MT5 → buka Lihat → pilih simbol.

- Unduh data historis untuk instrumen perdagangan yang ingin Anda optimalkan.

2.Pastikan rentang data yang cukup panjang:

- Gunakan setidaknya 2-5 tahun data historis untuk hasil yang kuat.

- Semakin lama periodenya, semakin baik EA beradaptasi dengan kondisi pasar yang berbeda.

3.Periksa Akurasi Data & Kesenjangan :

- Cari titik data yang hilang atau pergerakan harga yang tidak teratur.

- Gunakan data centang, jika tersedia, untuk simulasi yang paling tepat.

SUnduh data historis dari opsi Simbol di MT5

Memilih Pasangan Perdagangan dan Kerangka Waktu yang Sesuai

Efektivitas EA tergantung pada pasangan mata uang atau aset yang diperdagangkan dan jangka waktu di mana ia beroperasi.

Memilih Pasangan Mata Uang atau Aset

- Jika EA dirancang untuk instrumen tertentu (misalnya, EUR/USD, NAS100, atau Emas), optimalkan untuk pasangan tersebut.

- Jika EA adalah strategi multi-aset, uji di berbagai instrumen untuk mengidentifikasi yang berkinerja terbaik.

- Hindari mengoptimalkan pasangan eksotis kecuali EA dirancang khusus untuk mereka karena spread tinggi dan likuiditas rendah.

Memilih Jangka Waktu yang Tepat

Pemilihan kerangka waktu tergantung pada gaya perdagangan EA:

| Gaya Trading | Jangka waktu yang direkomendasikan |

| Scalping | M1, M5, M15 |

| Intraday | M15, M30, H1 |

| Swing Trading | H4, D1 |

| Long-Term | D1, W1 |

Jika tidak yakin tentang kerangka waktu, mulailah dengan H1 lalu perbaiki berdasarkan hasil.

Mengonfigurasi Parameter EA Awal

Sebelum pengoptimalan, tentukan pengaturan EA mana yang akan dioptimalkan dan mana yang harus diperbaiki.

Jenis Parameter untuk Dioptimalkan

- Ketentuan Masuk & Keluar: Menyempurnakan rata-rata bergerak, ambang batas RSI, persilangan MACD, dll.

- Tingkat Stop Loss & Take Profit: Sesuaikan SL/TP untuk meningkatkan rasio risiko-imbalan.

- Ukuran Lot & Manajemen Uang: Uji lot tetap vs. ukuran posisi dinamis.

- Aturan Trailing Stop & Break-Even Rules: Tingkatkan manajemen risiko.

Mengatur Rentang Parameter

Pengoptimalan memerlukan penentuan nilai minimum, maksimum, dan langkah untuk setiap parameter.

| Parameter | Nilai Min | Nilai Maks | Kenaikan |

| Take Profit (TP) | 20 pips | 100 pips | 5 pips |

| Stop Loss (SL) | 10 pips | 50 pips | 5 pips |

| Lot Size | 0.1 | 1.0 | 0.1 |

| Moving Average Period | 10 | 100 | 5 |

Traders must use logical ranges—too many values slow down optimisation, while too few reduce accuracy.

Menggunakan Penguji Strategi MT5 untuk Pengoptimalan

Penguji Strategi MT5 adalah alat yang ampuh untuk mengoptimalkan Expert Advisors (EA). Ini memungkinkan pedagang untuk menguji beberapa kombinasi parameter, mensimulasikan kondisi pasar nyata, dan menentukan pengaturan yang paling efektif.

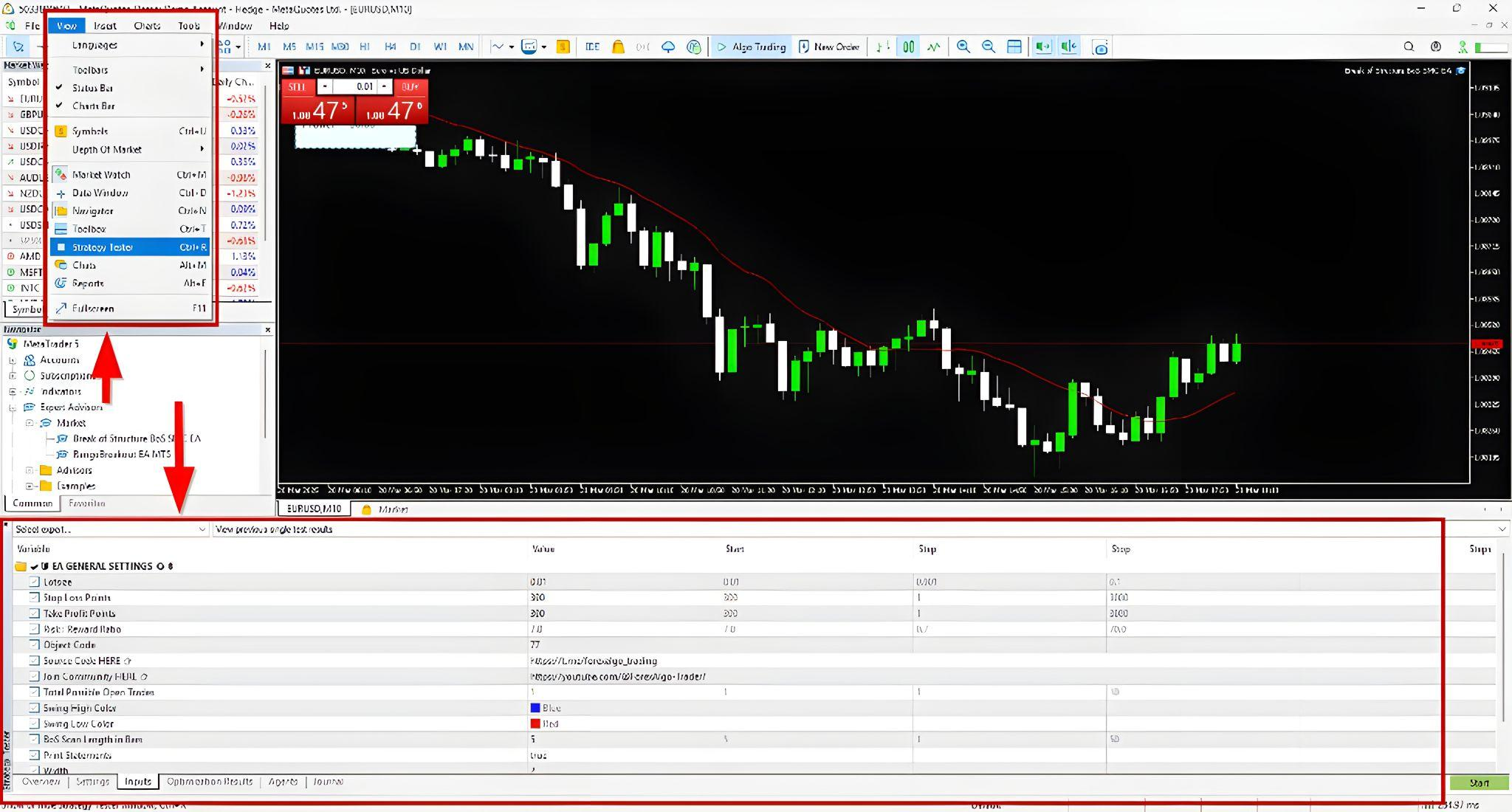

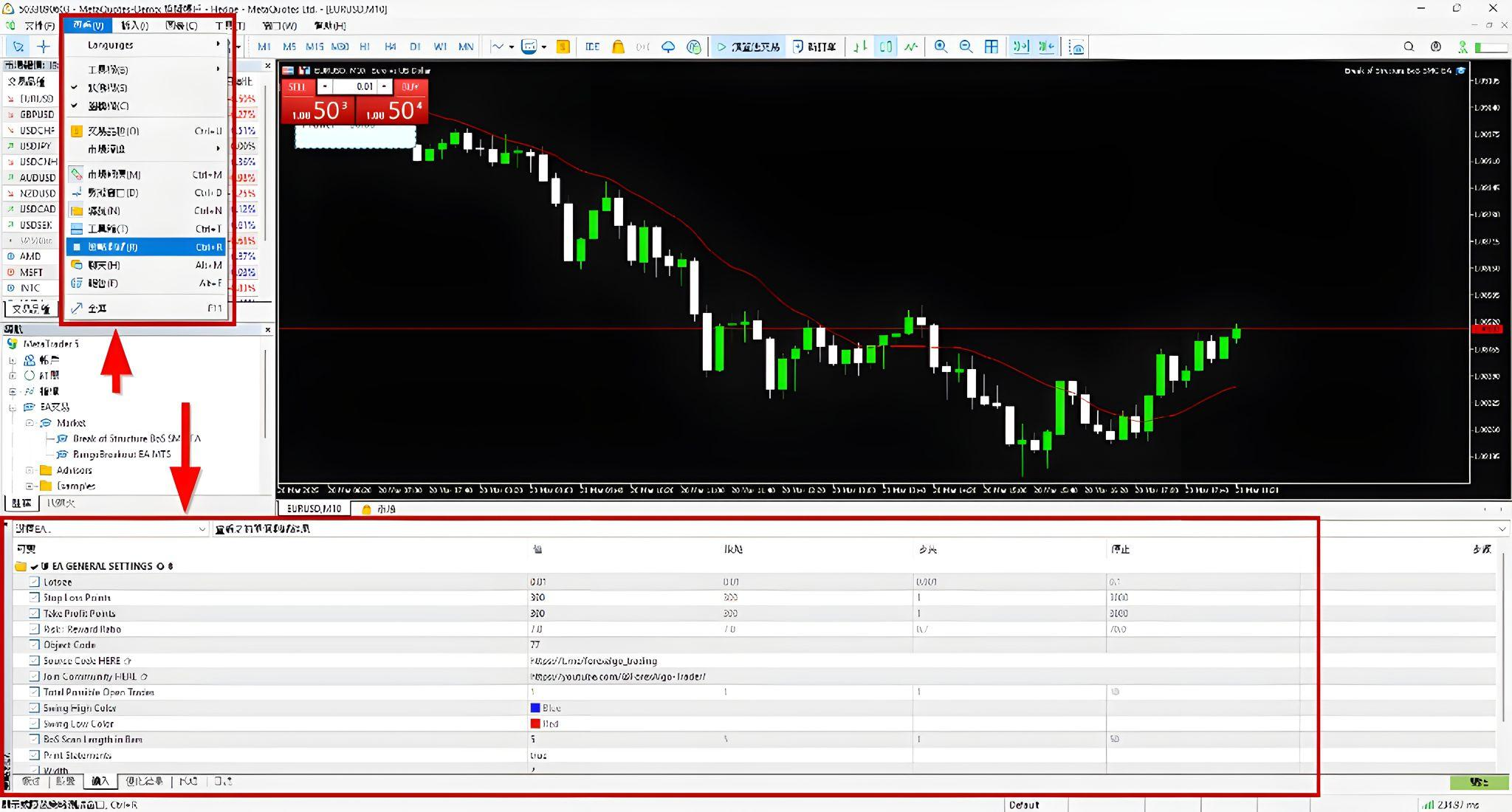

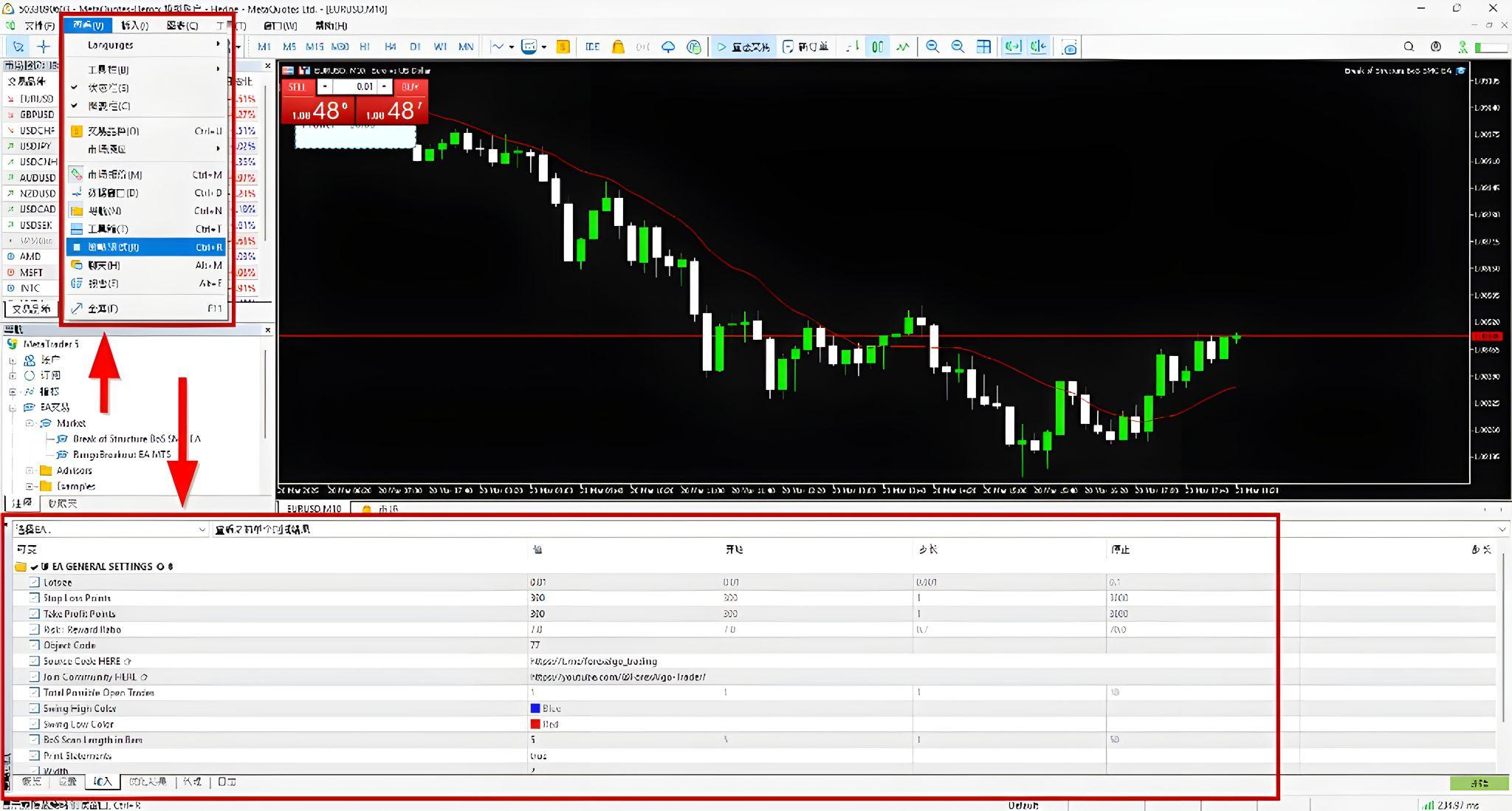

Menavigasi Antarmuka Penguji Strategi

Untuk mengakses Penguji Strategi MT5:

- Buka MT5.

- Pilih View → Strategy Tester (atau ketik Ctrl + R).

- Panel Penguji Strategi akan muncul di bagian bawah layar.

Antarmuka terdiri dari beberapa bagian:

| Bagian | Fungsi |

| Pemilihan EA | Pilih EA yang akan dioptimalkan. |

| Simbol & Jendela Waktu | Pilih pasangan mata uang & jendela waktu pengujian. |

| Pemilihan Model | Pilih bagaimana data harga disimulasikan (centang, OHLC, dll.). |

| Mode Pengoptimalan | Pilih apakah akan menggunakan algoritma lengkap atau genetik. |

| Pengaturan Parameter | Tentukan input mana yang akan dioptimalkan dan jangkauannya. |

| Pengaturan Eksekusi | Tetapkan jumlah deposit, leverage, dan kondisi spread. |

| Tab Hasil | Lihat performa kombinasi parameter yang berbeda. |

Opsi Penguji Strategi di MT5 (EN)

Opsi Penguji Strategi di MT5 (TC)

Opsi Penguji Strategi di MT5 (SC)

Memilih Mode Optimasi yang Tepat

MT5 menawarkan dua mode pengoptimalan utama:

1.Optimasi Lambat (Penuh): Ini menguji semua kemungkinan kombinasi parameter input dan memberikan hasil yang paling akurat tetapi memakan waktu. Sangat cocok untuk rentang parameter kecil atau ketika akurasi tinggi diperlukan.

2.Optimasi Algoritma Genetik (GA) Cepat: Ini menggunakan teknik pembelajaran mesin untuk menemukan pengaturan terbaik, memprioritaskan kombinasi parameter berkinerja tinggi, dan menghilangkan yang lebih lemah. Ini jauh lebih cepat daripada pengoptimalan penuh dan ideal untuk rentang parameter yang besar.

Disarankan agar Algoritma Genetik digunakan terlebih dahulu untuk mengidentifikasi pengaturan yang menjanjikan, kemudian disempurnakan dengan Pengoptimalan Penuh.

Menentukan Parameter Input untuk Pengoptimalan

Untuk mengoptimalkan EA, tentukan parameter mana yang harus diubah dan tetapkan rentangnya:

- Klik Input di Penguji Strategi.

- Centang kotak di samping setiap parameter yang ingin Anda optimalkan.

- Atur nilai Min, Max, dan Step untuk setiap parameter.

Memilih Model Pengujian Terbaik

MT5 menyediakan model pengujian yang berbeda untuk pengoptimalan. Pilihannya tergantung pada kecepatan vs. akurasi.

| Model Pengujian | Kecepatan | Akurasi | Kasus Penggunaan Terbaik |

| Setiap Tick | Cepat | Tinggi | Scalping & strategi yang tepat |

| 1-Menit OHLC | Sedang | Sedang | Swing & intraday trading |

| Harga Buka Saja | Cepat | Rendah | Pengujian cepat awal |

Untuk scalping EA, gunakan “Setiap Tick”; untuk kecepatan dan akurasi yang seimbang, gunakan “OHLC 1 Menit”.

Menyesuaikan Spread, Slippage, dan Kondisi Trading

Untuk pengoptimalan yang realistis, pastikan kondisi pasar mencerminkan skenario perdagangan nyata.

1.Pengaturan Spread: Saat mengoptimalkan, Anda dapat menggunakan spread tetap atau variabel. Anda juga dapat mengatur spread realistis atau menggunakan kecepatan saat ini untuk simulasi pasar nyata.

2.Pengaturan Slippage: Ini memperhitungkan penundaan eksekusi pesanan. Anda harus menetapkan nilai yang wajar (misalnya, 2-3 pips untuk pasar yang bergejolak).

3.Setoran Awal & Leverage: Anda harus menetapkan jumlah setoran dan leverage yang realistis (misalnya, $10.000 dengan 1:100).

Menganalisis Hasil Pengoptimalan

Setelah proses pengoptimalan Expert Advisor (EA) di MetaTrader 5 (MT5) selesai, langkah selanjutnya adalah menganalisis hasil untuk memastikan parameter yang dipilih menawarkan keseimbangan profitabilitas, stabilitas, dan pengendalian risiko.

Memahami Metrik Pengoptimalan

MT5 menyediakan beberapa metrik utama di tab Hasil Pengoptimalan. Masing-masing metrik ini membantu mengevaluasi kinerja EA secara keseluruhan.

| Metrik | Keterangan | Nilai Ideal |

| Laba Bersih | Total laba setelah kerugian | Lebih tinggi lebih baik, tetapi bukan satu-satunya indikator |

| Penurunan Nilai Portofolio (%) | Penurunan maksimum saldo/ekuitas | Di bawah 20% untuk risiko rendah |

| Faktor Keuntungan (PF) | Rasio laba kotor terhadap kerugian kotor | PF > 1.5 bagus, >2.0 sangat baik |

| Tingkat Kemenangan (%) | Persentase perdagangan yang menguntungkan | 40-60% dapat diterima jika R: R tinggi |

| Hasil yang Diharapkan | Keuntungan rata-rata per perdagangan | Lebih tinggi lebih baik |

| Rasio Sharpe | Pengembalian yang disesuaikan dengan risiko | Di atas 0,5 dapat diterima, di atas 1,0 sangat baik |

| Faktor Pemulihan | Laba bersih ÷ penarikan maks | Di atas 3.0 kuat |

| Faktor Stabilitas | Mengukur konsistensi | Semakin dekat ke 1.0, semakin baik |

Mengidentifikasi Pengaturan Berkinerja Terbaik

Setelah menjalankan pengoptimalan, MT5 memberi peringkat kombinasi parameter berdasarkan laba bersih secara default. Namun, secara membabi buta memilih hasil yang paling menguntungkan bisa berisiko.

- Mengurutkan hasil berdasarkan Faktor Keuntungan (PF): Pengaturan dengan PF tinggi lebih berkelanjutan daripada pengaturan dengan keuntungan ekstrem tetapi PF rendah.

- Periksa kolom Penarikan: Jika dua pengaturan memiliki keuntungan yang sama tetapi satu memiliki penarikan yang jauh lebih rendah, pilih opsi yang lebih aman.

- Lihat Faktor Pemulihan:Ini memberi tahu Anda seberapa efisien EA pulih dari kerugian.

- Memastikan Kurva Ekuitas yang Lancar:Hindari hasil dengan fluktuasi tajam.

- Menguji pengaturan di Pengujian Maju:Terapkan ke akun demo sebelum perdagangan langsung.

Mendeteksi Overfitting

Overfitting terjadi ketika EA dioptimalkan terlalu khusus untuk data masa lalu, membuatnya berkinerja baik dalam backtest tetapi gagal dalam perdagangan langsung.

Tanda-tanda overfitting:

- Faktor keuntungan yang luar biasa tinggi (misalnya, PF di atas 5,0).

- Tingkat kemenangan ekstrem (di atas 80% dalam backtest).

- Laba bersih tinggi yang tidak realistis.

- Penurunan kinerja yang sangat besar saat diuji pada kerangka waktu atau aset yang berbeda.

Cara untuk mencegah pemasangan berlebihan:

- Gunakan Uji Walk-Forward: Periksa apakah EA bekerja pada kondisi pasar yang tidak terlihat.

- Uji pada Kondisi Pasar yang Berbeda: Pastikan EA berkinerja baik di pasar yang sedang tren, berkisar dan fluktuatif.

- Hindari Pengoptimalan Parameter yang Berlebihan:Lebih banyak parameter dioptimalkan = risiko pemasangan kurva yang lebih tinggi.

Menganalisis Kurva Ekuitas & Grafik Kinerja

MT5 menyediakan data grafis di tab Hasil dan Grafik, membantu Anda menilai stabilitas EA secara visual.

| Jenis Kurva Ekuitas | Interpretasi |

| Pertumbuhan ke atas yang lancar | Kinerja ideal, konsistensi yang baik. |

| Kenaikan lambat dengan penurunan sesekali | Acceptable, but check drawdown. |

| Paku curam, tabrakan dalam | EA yang terlalu dipasang atau berisiko tinggi. |

| Kemiringan datar atau ke bawah | Tidak menguntungkan, perlu penyesuaian. |

Membandingkan Eksekusi Pengoptimalan yang Berbeda

Untuk mendapatkan pengaturan EA terbaik, bandingkan tes pengoptimalan yang berbeda. Untuk membandingkan berbagai tes pengoptimalan secara efektif, trader harus:

- Jalankan pengujian pada kondisi pasar yang berbeda: Periksa apakah EA berkinerja baik di tahun yang berbeda.

- Uji beberapa kerangka waktu: EA yang baik harus bekerja pada H1, H4, dan D1, bukan hanya satu kerangka waktu tertentu.

- Bandingkan di berbagai broker: Beberapa pengaturan mungkin berfungsi lebih baik di akun ECN dibandingkan akun standar.

- Periksa kinerja di berbagai kelas aset: Jika EA dirancang untuk forex, lihat apakah itu berfungsi pada indeks atau komoditas.

Setelah menganalisis hasilnya, langkah terakhir adalah menerapkan EA yang dioptimalkan dalam perdagangan langsung sambil mempertahankan kontrol risiko yang tepat.

Berdagang dengan Ultima Markets

Ultima Markets adalah broker berlisensi penuh dan platform perdagangan multi-aset yang menawarkan akses ke 250+ instrumen keuangan CFD, termasuk Forex, Komoditas, Indeks, dan Saham. Kami

menjamin spread yang ketat dan eksekusi cepat. Hingga saat ini, kami telah melayani klien dari 172

negara dan wilayah dengan layanan tepercaya kami dan sistem perdagangan yang dibangun dengan baik.

Ultima Markets telah mencapai pengakuan luar biasa pada tahun 2024, memenangkan penghargaan bergengsi seperti Pialang Afiliasi Terbaik, Keamanan Dana Terbaik di Global Forex Awards, dan

broker CFD APAC Terbaik di Traders Fair 2024 Hong Kong. Sebagai broker CFD pertama yang bergabung

United Nations Global Compact, Ultima Markets menggarisbawahi komitmennya untuk

keberlanjutan dan misi untuk memajukan layanan keuangan etis dan berkontribusi pada

masa depan yang berkelanjutan.

Ultima Markets adalah anggota The Financial Commission, sebuah perusahaan independen internasional

badan yang bertanggung jawab untuk menyelesaikan perselisihan di pasar Forex dan CFD.

Semua klien Ultima Markets dilindungi oleh pertanggungan asuransi yang disediakan oleh Willis

Towers Watson (WTW), pialang asuransi global yang didirikan pada tahun 1828, dengan klaim

kelayakan hingga US$1.000.000 per akun.

Buka Akun dengan Ultima Markets untuk memulai perjalanan perdagangan CFD indeks Anda.

Penafian: Informasi yang disampaikan di sini disediakan semata-mata untuk tujuan informasi dan tidak merupakan, serta tidak dapat dianggap sebagai, nasihat keuangan, investasi, hukum, atau nasihat profesional lainnya dalam bentuk apa pun. Setiap pernyataan atau pendapat yang tercantum dalam dokumen ini tidak dapat dianggap sebagai rekomendasi atau saran dari Ultima Markets atau pihak manapun terkait dengan produk investasi, strategi, atau transaksi tertentu. Pembaca dihimbau untuk tidak semata-mata bergantung pada isi dokumen ini dalam mengambil keputusan investasi, dan disarankan untuk berkonsultasi dengan penasihat keuangan independen yang kompeten.