Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

US Stock Market’s Recent Surge Thanks To Cool Labor Market

The Bright Outlook for US Stocks: A Market Analysis

In November 2023, the US stock market witnessed a significant upswing, reinforcing expectations of an end to the era of rate hikes.

The Dow Jones index soared by more than 560 points on November 2nd, marking its most remarkable daily gain since June. Simultaneously, the S&P recorded a 1.89% surge, its most substantial single-day increase since April. The Nasdaq also celebrated a robust performance, closing 2.36% higher, its best showing since July.

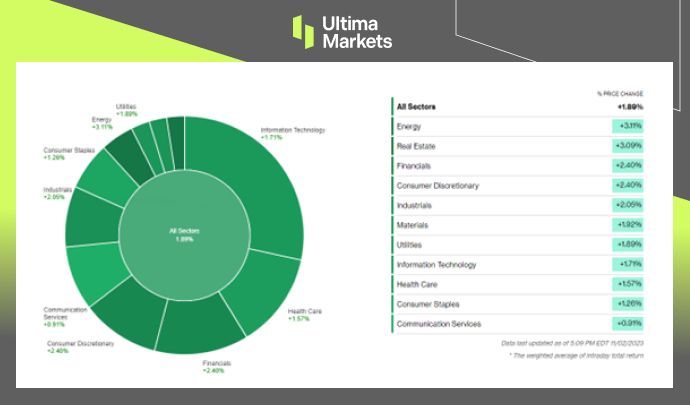

This impressive market rally was underpinned by gains in the energy and real estate sectors, both of which secured advances exceeding 3.0%. These substantial gains contributed to all eleven S&P sectors concluding the session on a positive note.

US Stocks Saw Strong Buying Across Sectors

The momentum behind these stock market surges is closely tied to growing expectations regarding the Federal Reserve’s future monetary policy.

As this sentiment gains traction, investors and market participants are becoming increasingly confident that the central bank is nearing the completion of its rate-hiking efforts.

Additionally, the benchmark US 10-year yield fell to its lowest level in three weeks, reaching 4.65%. This decline further signifies the market’s anticipation of a more accommodative monetary stance

Robust Sector Performance

One of the most notable aspects of this remarkable stock market rally is the broad-based nature of the gains. Notably, the energy and real estate sectors exhibited exceptional strength, each securing advances exceeding 3.0%.

These gains underscore the market’s confidence in the economic outlook and support the view that the recovery remains firmly on track.

(Sector Performance, Bloomberg)

Signs of a Weakening Job Market

While the stock market flourishes, the job market faces challenges, which require close scrutiny:

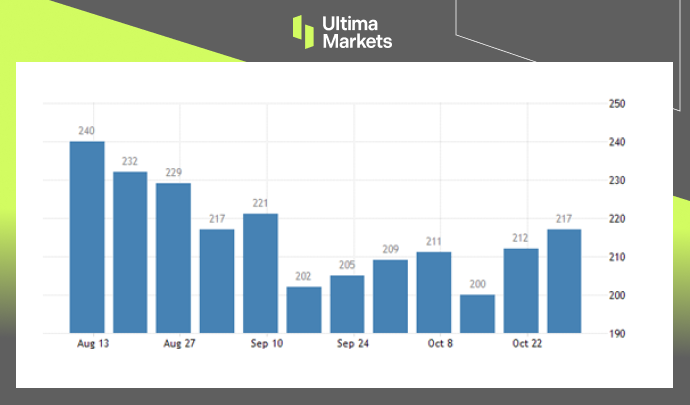

- Unemployment Claims: The number of Americans applying for unemployment benefits increased to 217,000, surpassing market estimates. This indicates that unemployed individuals are encountering difficulties in finding employment.

- Continuing Jobless Claims: Continuing claims rose to 1,818,000, exceeding market expectations. These figures align with signals from the Federal Reserve, suggesting that labor market conditions are softening.

- Nonfarm Payrolls: All eyes are now on the upcoming nonfarm payrolls report, with economists predicting an increase of 180,000 jobs in October, following a substantial gain in September. This report will provide crucial insights into the job market’s health.

(Initial Jobless Claims, United States Department of Labor)

Bottom Line

In conclusion, the US stock market’s recent surge is a significant development with far-reaching implications. As the market regains strength, it underlines the growing confidence in a more accommodative monetary policy by the Federal Reserve.

However, it’s vital to balance this optimism with the challenges in the job market, as signs of weakness in unemployment claims and continuing claims signal potential hurdles in the economic recovery.

The interplay between these factors will undoubtedly shape the trajectory of the US economy in the months to come.

Warum mit Ultima Markets Metalle und Rohstoffe handeln?

Ultima Markets bietet das wettbewerbsfähigste Kosten- und Börsenumfeld für gängige Rohstoffe weltweit.

Mit dem handel beginnenÜberwachung des Marktes von unterwegs

Märkte sind anfällig für Veränderungen in Angebot und Nachfrage

Attraktiv für Anleger, die nur an Preisspekulationen interessiert sind

Umfangreiche und vielfältige Liquidität ohne versteckte Gebühren

Kein Dealing Desk und keine Requotes

Schnelle Ausführung über den Equinix NY4-Server